Super funds have delivered stronger than expected returns with the losses from the start of the financial year now a distant memory, and despite renewed fears around the trajectory of inflation. Leading superannuation research house SuperRatings estimates that the median balanced option returned 0.7% over the month of June, bringing the return for the year to 30 June 2024 up to an estimated 8.8%.

Executive Director of SuperRatings, Kirby Rappell, said “Fund returns have made a strong turnaround since November 2023 to deliver a second year of above average returns. Top performers will be handing members double digit returns for the year, reinforcing superannuation funds’ ability to deliver a competitive outcome for everyday Australians.”

Mr Rappell continued “Technology shares in the US and bank shares in Australia have really driven this year’s outcomes, meaning funds with higher levels of investments in these assets will have done well over the year. While ongoing cost of living pressures are hard to ignore, superannuation continues to support long-term financial outcomes, with most funds managing to keep performance in line with the typical CPI+3.0% investment objective over 10 years.”

The median growth option returned an estimated 0.8% over the month, while capital stable options, which hold more traditionally defensive assets such as cash and bonds, returned 0.6%.

Accumulation returns to 30 June 2024

| Monthly | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a.) | 7 yrs (p.a.) | 10 yrs (p.a.) | |

| SR50 Balanced (60-76) Index | 0.7% | 8.8% | 4.7% | 6.2% | 6.7% | 7.0% |

| SR50 Capital Stable (20-40) Index | 0.6% | 5.6% | 2.5% | 3.3% | 3.8% | 4.3% |

| SR50 Growth (77-90) Index | 0.8% | 10.5% | 5.6% | 7.5% | 8.1% | 8.3% |

Pension returns also ended the financial year strongly, with the median balanced pension option up an estimated 0.9% over June. The median growth option rose by 1.0% while the median capital stable option is estimated to deliver a 0.6% return for the month.

Pension returns to 30 June 2024

| Monthly | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a.) | 7 yrs (p.a.) | 10 yrs (p.a.) | |

| SRP50 Balanced (60-76) Index | 0.9% | 10.0% | 5.2% | 6.9% | 7.5% | 7.9% |

| SRP50 Capital Stable (20-40) Index | 0.6% | 6.2% | 2.8% | 3.7% | 4.3% | 4.9% |

| SRP50 Growth (77-90) Index | 1.0% | 11.7% | 6.0% | 8.2% | 8.8% | 9.1% |

Super Performance Powers Through Market Uncertainty

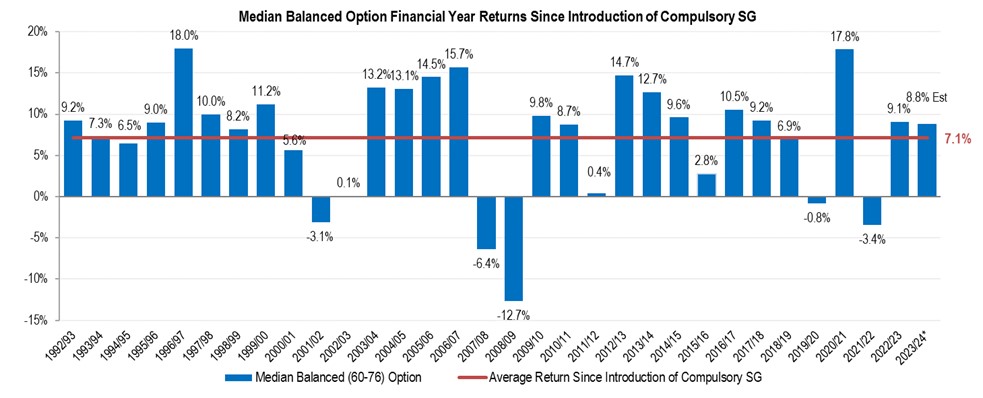

The chart below shows that the average annual return since the inception of the superannuation system is 7.1%, with the typical balanced fund exceeding its long-term return objective of CPI+3.0%.

Similar to last year, international shares were the standout performers for super funds, with the sector estimated to return 17% as developments in artificial intelligence and associated industries led a small number of technology shares in the US to unprecedented highs. The Australian share market also made a strong contribution to super fund returns, with an estimated 11% return for the sector. We expect all major asset classes to contribute positively to fund returns for the year, although the fixed interest and property sectors had a tougher year and are expected to make the smallest contributions.

The small number of shares driving performance resulted in passive investment options, those which track a specific benchmark and often have a higher allocation to shares, outperforming most other strategies over the year. SuperRatings estimates the median passive balanced option will return 11.6% for the year, compared to 8.8% for the SR50 Balanced (60-76) Index, while 5-year performance for passive options is estimated to be 6.0%, compared to the SR50 Balanced (60-76) Index 5-year return of 6.2%.

We continue to emphasise the importance of setting a long-term strategy for your superannuation. Despite the strong performance over the past two years, we suggest members remain alert to market conditions and review their longer-term settings, such as whether they are in the most appropriate investment option for their situation and check their fees when they receive their annual statements.

Mr Rappell commented, “With the share market driving another strong year of returns members may be tempted to seek out higher exposure to these assets. However, risks remain, particularly around the trajectory for inflation in Australia and geopolitical factors such as ongoing wars and the upcoming presidential elections in the US. Members should be prepared to see their balances fluctuate and consider seeking professional advice before making changes. For those who are not approaching or in retirement, keep in mind that current market movements are not likely to be what you are thinking about when you retire 20 or 30 years from now.”

Release ends

We welcome media enquiries regarding our research or information held in our database. We are also able to provide commentary and customised tables or charts for your use.

For more information contact:

Kirby Rappell

Executive Director

Tel: 1300 826 395

Mob: +61 408 250 725

Kirby.Rappell@superratings.com.au