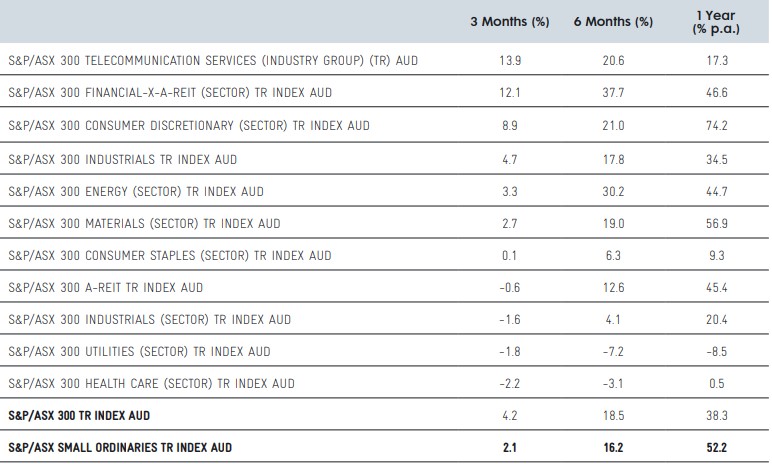

The Australian equity market experienced another positive quarter of performance to the end of March, delivering a 4.1% return as measured by the S&P/ASX 300 Accumulation Index. The recent gains have contributed to a significant 38.3% return over the past 12 months, when the local market touched its cycle lows on 23 of March 2020.

The quarterly return was led by the telecommunications, financials and consumer discretionary sectors, with key companies producing stronger than expected results primarily driven by cost control and margin expansion. The banks reinstated larger dividend payouts and material writebacks of their COVID-related bad debt provisions, signaling to investors increased confidence in their earnings outlook. Long-term bond yields were up 77 basis points in response to stronger economic activity flowing through to a re-pricing of higher inflation expectations. In this environment, banks should benefit with improved earnings growth. Very low levels of community transmission and the rollout of the COVID-19 vaccine program have delivered a boost of optimism for investors, particularly sectors directly linked to the re-opening of the economy, in particular consumer discretionary, industrial and resources. A cautionary note: companies that have benefited from COVID-19 (e.g. Coles and JB Hi-Fi) will have significantly higher comparable sales to meet or exceed in upcoming result periods to maintain their share price gains.

The telecommunication sector gained 13.9% courtesy of merger and acquisition activity with Macquarie Infrastructure Group and Aware Super launching an indicative bid for Vocus, and further details on Telstra’s proposal to restructure its business model. Telstra’s restructure would split the company into four business segments, seeking to realise the value of the company’s infrastructure assets, which the market has responded to positively with some brokers upgrading their target prices.

Resources maintained their positive momentum with the global economic recovery continuing to gather pace. Miners including BHP (+9.6%) were driven by a resilient iron ore price and announcements of larger dividends at their recent February results. Within the Energy sector, Santos (+14.2%) and Oil Search (+10.7%) were also stronger performers as the Brent Crude price increased to US$64 per barrel.

S&P/ASX 300 TR Index three-year rolling returns (% p.a.) to 31 March 2021

SOURCE: LONSEC, FINANCIAL EXPRESS

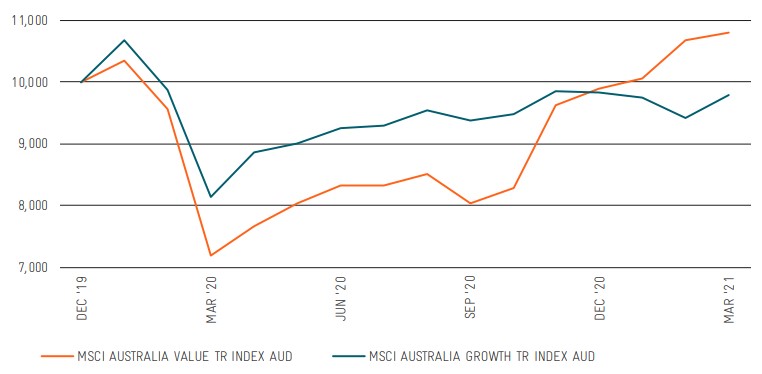

The value rotation has been in full swing since October 2020

SOURCE: ABS

Australian share index performance to 31 March 2021

SOURCE: FINANCIAL EXPRESS

Information Technology was the laggard sector delivering -10% in the March quarter, with several companies not matching their high expectations (e.g. Appen in the recent results period). Investors are pivoting away from COVID beneficiary sectors IT and Healthcare, while shifting investor attention to cyclically exposed stocks and higher bond yields detract from the value of their long-term cash flows.

Value outperformed growth by 9.6% in the March quarter

The rotation out of growth into value sectors continued over the March quarter with the economic recovery starting to materialise with a lower unemployment rate contributing to stronger growth. Unless some unforeseen tail risk event occurs, it is expected that business and consumer confidence will rise, providing a clear indication of ‘normal’ conditions returning in the not-too-distant future.

The small cap segment of the market experienced a softer return outcome in the March quarter compared to its broad-cap counterparts returning 2.1% as measured by the S&P/ASX Small Ordinaries Index, with mixed performances from the small resources index delivering -2.8% and the small industrials index gained 3.3%.

The Australian equity market is trading on a one-year P/E ratio of nearly 20 times, which is circa 30% above the long-term average of 14.5 times and prima facie looks stretched relative to history. However, based on the current environment, with policy and liquidity support underwriting economic activity for the foreseeable future, the market appears to be moderately expensive.

Outlook

Presently, the Australian equity market is profoundly influenced by macro factors surrounding the management of Covid-19, with company specific fundamentals taking some form of a back seat. The unprecedented fiscal and monetary stimulus measures implemented over the past 12 months should continue over the medium term but gradually taper off on the basis that Covid-19 is well contained, and economic re-opening becomes a sustainable state of affairs.

While it is not expected to be smooth sailing, as the economy moves towards a solid recovery phase, the reflation trade is likely to occur with cyclicals benefitting on relative basis over long-duration growth companies.

Issued by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Warning: Past performance is not a reliable indicator of future performance. Any advice is General Advice without considering the objectives, financial situation and needs of any person. Before making a decision read the PDS and consider your financial circumstances or seek personal advice. Disclaimer: Lonsec gives no warranty of accuracy or completeness of information in this document, which is compiled from information from public and third-party sources. Opinions are reasonably held by Lonsec at compilation. Lonsec assumes no obligation to update this document after publication. Except for liability which can’t be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error, inaccuracy, misstatement or omission, or any loss suffered through relying on the document or any information. ©2021 Lonsec. All rights reserved. This report may also contain third party material that is subject to copyright. To the extent that copyright subsists in a third party it remains with the original owner and permission may be required to reuse the material. Any unauthorised reproduction of this information is prohibited.