As markets focus on the persistence of inflation, returns were subdued over the month with leading superannuation research house SuperRatings estimating that the median balanced option generated a return of -0.4% for February.

With the peak in the federal funds rate still uncertain, we expect markets to remain volatile and members should expect further ups and downs in their balances over the coming months. Despite this volatility, we have still seen a modest positive return over the past year.

The median growth option and the median capital stable option also fell by an estimated -0.4% in February, as funds continue to navigate high levels of uncertainty across markets.

Accumulation returns to February 2023

| Monthly | 1 yr | 3 yrs (p.a.) |

5 yrs (p.a.) |

7 yrs (p.a.) |

10 yrs (p.a.) |

|

| SR50 Balanced (60-76) Index | -0.4% | 0.8% | 5.1% | 5.8% | 7.1% | 7.3% |

| SR50 Capital Stable (20-40) Index | -0.4% | -0.2% | 1.9% | 3.1% | 3.9% | 4.4% |

| SR50 Growth (77-90) Index | -0.4% | 1.4% | 6.4% | 6.7% | 8.2% | 8.5% |

Source: SuperRatings estimates

Pension returns faced a similar moderate fall over February, with the median balanced pension option down an estimated -0.5%. The median capital stable pension option is also estimated to have fallen by -0.5% over the month while the median growth pension option is estimated to fall by a slightly smaller -0.4% for the same period.

Pension returns to February 2023

| Monthly | 1 yr | 3 yrs (p.a.) |

5 yrs (p.a.) |

7 yrs (p.a.) |

10 yrs (p.a.) |

|

| SR50 Balanced (60-76) Index | -0.5% | 0.6% | 5.8% | 6.2% | 7.9% | 8.0% |

| SR50 Capital Stable (20-40) Index | -0.5% | 0.0% | 2.1% | 3.4% | 4.3% | 4.8% |

| SR50 Growth (77-90) Index | -0.4% | 1.2% | 6.9% | 7.4% | 9.2% | 9.3% |

Source: SuperRatings estimates

“While super funds are estimated to have had negative returns over February, super fund returns remain much less volatile than equity markets. This demonstrates the benefits of diversification and the ability of funds to weather these markets conditions with competitive outcomes for their members.”, commented Executive Director of SuperRatings, Kirby Rappell.

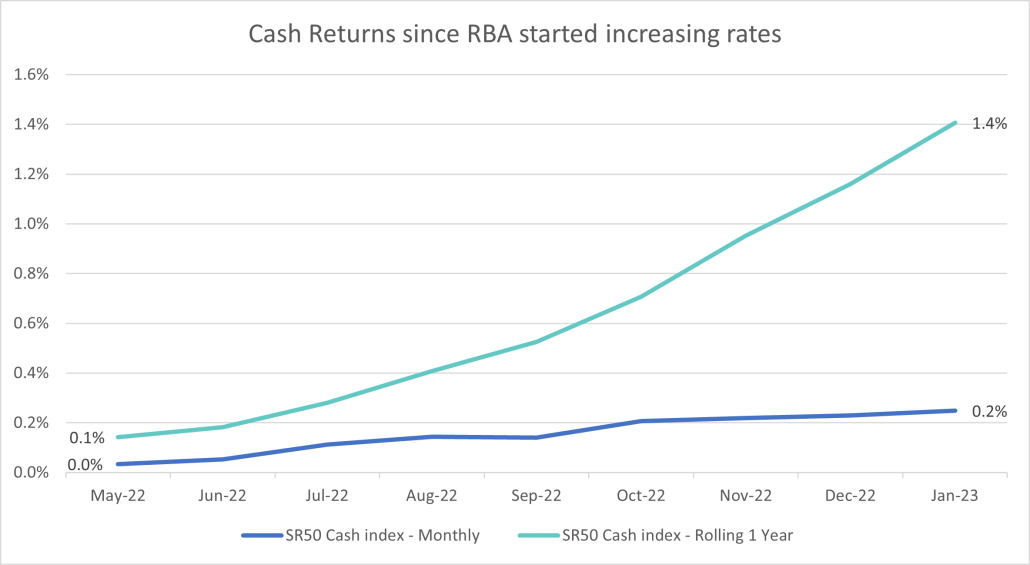

While the response to inflation has been swift, there is a silver lining for those members close to retirement who may have greater reliance on cash returns. Rising interest rates are now flowing back through to member’s cash returns with the SR50 Cash index return rising since May 2022 in line with the RBA cash rate. The chart below displays the monthly and rolling one year return for cash since May 2022.

Cash returns for the month of May 2022 were less than 0.1%, with members seeing an annual return on cash of just 0.2% for the 2022 financial year. This was less than the cash return for January 2023 meaning members would have earned more on their superannuation invested in cash over the month of January than they did for the entire year to June 2022. If we see the current level of cash returns remain, we expect to see outcomes rising quickly towards 4-5%.

“For those members seeking more stability or cash flow to support pension withdrawals, rising cash returns will be a welcome trend; however, cash returns remain materially below the current level of inflation and are unlikely to be of benefit for younger members. We recommend members seek advice from their fund or a trusted adviser before making changes to their investment strategy.” Mr Rappell added.

Release ends

We welcome media enquiries regarding our research or information held in our database. We are also able to provide commentary and customised tables or charts for your use.

For more information contact:

Kirby Rappell

Executive Director

Tel: 1300 826 395

Mob: +61 408 250 725

Kirby.Rappell@superratings.com.au