Stubbornly high inflation and a return to tightening monetary policy by the Reserve Bank of Australia has led to persistent uncertainty in markets over the past year. Superannuation fund returns are expected to be slightly negative over the month, with leading superannuation research house SuperRatings estimating the median balanced option generated a return of -0.2% for May. Despite the uncertain outlook for inflation, we estimate financial year to date returns on a Balanced (60-76) option to be 7.9% as at the end of May. Depending on returns throughout June, super funds are on track to manage a return above inflation for the past 12 months.

The median growth option fell by an estimated -0.3% over May, while the median capital stable option is estimated to decline by -0.2%.

Accumulation returns to May 2023

| Monthly | FYTD | 1 yr | 3 yrs (p.a.) |

5 yrs (p.a.) |

7 yrs (p.a.) |

10 yrs (p.a.) |

|

| SR50 Balanced (60-76) Index | -0.2% | 7.9% | 4.0% | 7.4% | 5.9% | 6.6% | 7.3% |

| SR50 Capital Stable (20-40) Index | -0.2% | 4.4% | 2.6% | 3.2% | 3.2% | 3.7% | 4.5% |

| SR50 Growth (77-90) Index | -0.3% | 9.6% | 5.0% | 9.1% | 6.8% | 7.7% | 8.5% |

Source: SuperRatings estimates

Pension returns saw a similar fall over May with the median balanced pension option estimated to decline by -0.3%. The median growth pension option is also estimated to fall by -0.3%, while the median capital stable pension option fell by an estimated ‑0.2% over the month.

Pension returns to May 2023

| Monthly | FYTD | 1 yr | 3 yrs (p.a.) |

5 yrs (p.a.) |

7 yrs (p.a.) |

10 yrs (p.a.) |

|

| SR50 Balanced (60-76) Index | -0.3% | 8.6% | 4.7% | 8.0% | 6.4% | 7.5% | 8.0% |

| SR50 Capital Stable (20-40) Index | -0.2% | 4.9% | 3.2% | 3.7% | 3.5% | 4.1% | 4.9% |

| SR50 Growth (77-90) Index | -0.3% | 10.6% | 5.5% | 9.7% | 7.6% | 8.6% | 9.2% |

Source: SuperRatings estimates

Executive Director of SuperRatings Kirby Rappell commented, “While May saw a small fall, funds are currently on track to deliver a return in excess of inflation, so funds have kept the value of members money from diminishing in a high inflation environment, which has been no simple task.”

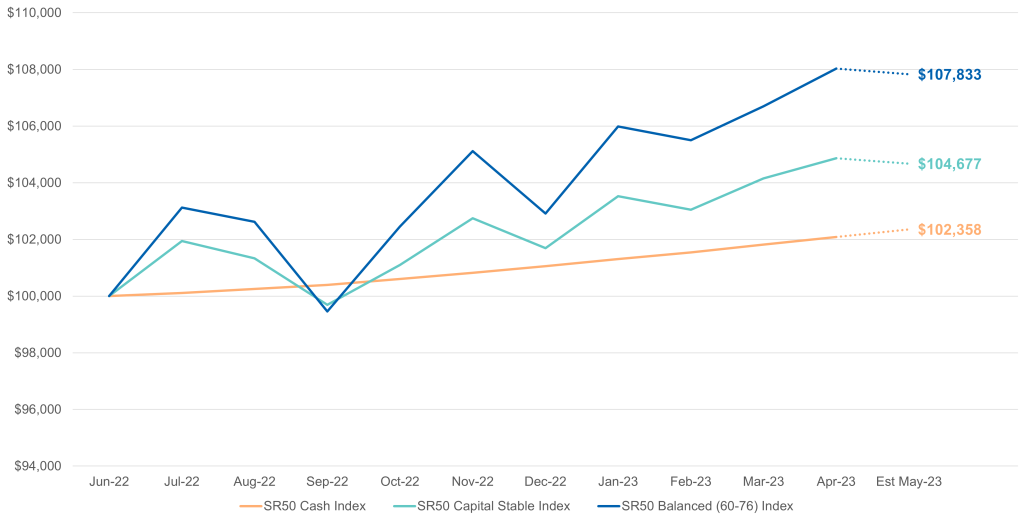

In dollar terms, members with $100,000 invested in the Balanced option at the start of July last year would have an estimated $107,833 in their account at the end of May, not accounting for administration fees or any insurance premiums they may pay. Members investing in the more defensive Capital Stable option would have an estimated $104,677 with smaller ups and downs throughout the year, while members that limited their investments to Cash would have a lower overall balance of $102,358 while seeing small gains each month. This demonstrates that fund’s investment strategies are behaving as expected by trading off between account growth and a smooth return, even in such uncertain times.

“Inflation, and the central bank response to inflation, have been the most influential factors for superannuation performance this financial year and we expect this to continue into FY24. Super fund returns have had a bumpy year with markets facing several shocks over the last 11 months; however, funds continue to navigate the challenges well with most accounts seeing growth over the course of the full year”, Mr Rappell continued.

Release ends

We welcome media enquiries regarding our research or information held in our database. We are also able to provide commentary and customised tables or charts for your use.

For more information contact:

Kirby Rappell

Executive Director

Tel: 1300 826 395

Mob: +61 408 250 725

Kirby.Rappell@superratings.com.au