Using alternative investment to address pre- and post-retirement issues

Walter Davis, Alternatives Investment Strategist

Ashley O’Connor, Investment Strategist, Invesco Australia

Introduction

Investing in financial markets requires investors to balance return and risk, short-term and long-term goals, and cyclical and structural factors. To do so effectively, investors must also balance the human emotions of greed and fear. Greed drives investors’ desire to build wealth by seeking investments with attractive return potential, while fear drives investors’ desire to avoid losses by investing in low risk investments.

These two emotions are particularly acute for individual investors who have identified (and become emotionally attached to) a specific goal for their savings, be it retirement, funding a college education or buying a house. In such situations, investors want to ensure they generate attractive returns on their investments so they have sufficient wealth to fund the event, while at the same time avoiding damaging losses that could permanently impair their ability to do so. This issue is even more complicated for investors seeking to provide for a comfortable retirement, given the significant variables involved (such as the unknown duration of retirement and highly variable expenses) and the potentially devastating consequences of failure to achieve the goal.

This challenge is not limited to individual investors. Institutional investors, such as defined contribution pension plans, defined benefit pension plans, insurance companies and government-sponsored retirement plans, all face a similar dilemma. In many cases, these investors have plans that are underfunded and need to generate strong returns to meet future liabilities, while at the same time avoiding losses that would undermine their ability to do so.

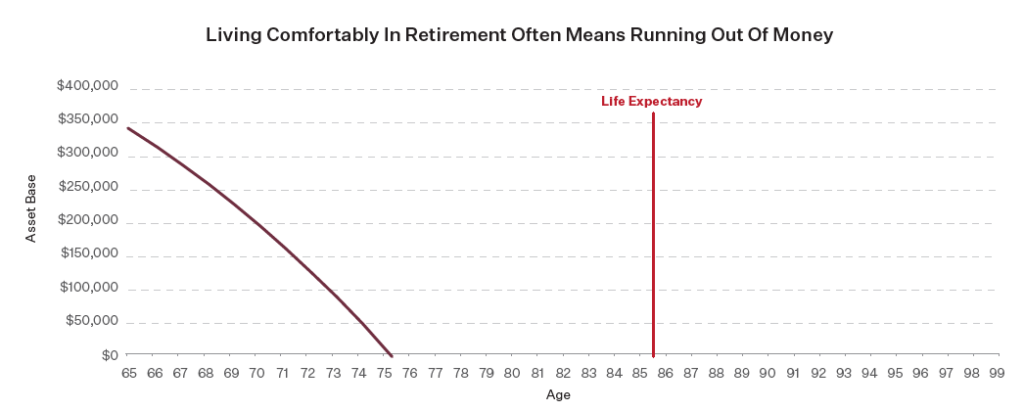

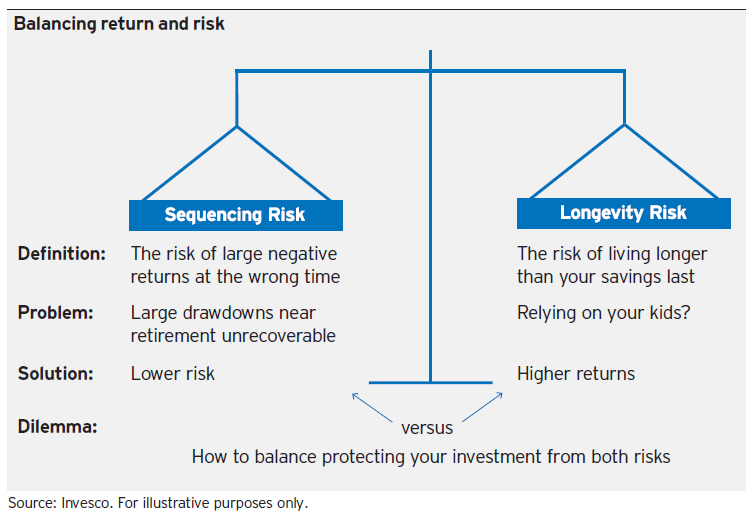

In technical terms, the two primary risks that these individual and institutional investors face are longevity risk and sequencing risk. Translated, longevity risk is the risk of living longer than your savings last, while sequencing risk is the risk of large negative returns occurring at a time that makes losses difficult to recoup.

The solution to longevity risk is to seek investments that offer attractive return potential in order to help build sufficient wealth to fund retirement. Conversely, the solution to sequencing risk is to seek stable, low-risk investments in order to avoid potentially devastating losses that could permanently impair the investor’s ability to fund retirement. The challenge for investors is to build a portfolio that balances these competing needs.

This paper will explore the issues and challenges associated with longevity and sequencing risk, especially in the current market environment, and examine how alternative investments offer investors potential solutions for these risks.

Longevity risk

While longevity risk can be simply explained as the risk of living longer than your savings last, this risk is exacerbated by the fact that many of the variables associated with this risk are unknowable. For example, no one knows how long they or their spouse will live, or whether or not they will face unexpected costs in their retirement.

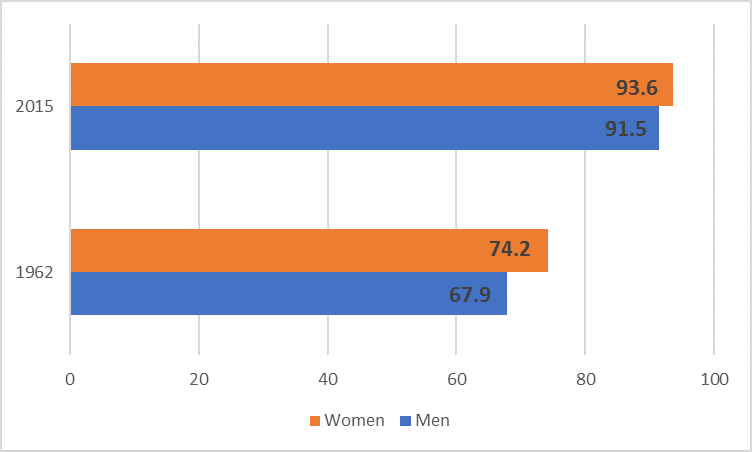

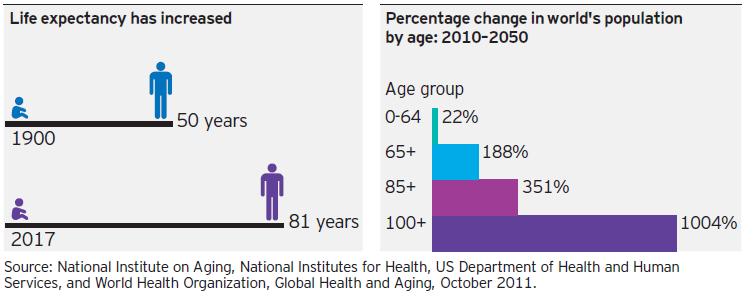

In 2011, the National Institute on Aging, National Institutes for Health, US Department of Health and Human Services, and World Health Organisation produced a report entitled Global Health and Aging. Several of the key findings of the report illustrate the complex and changing nature of longevity risk.

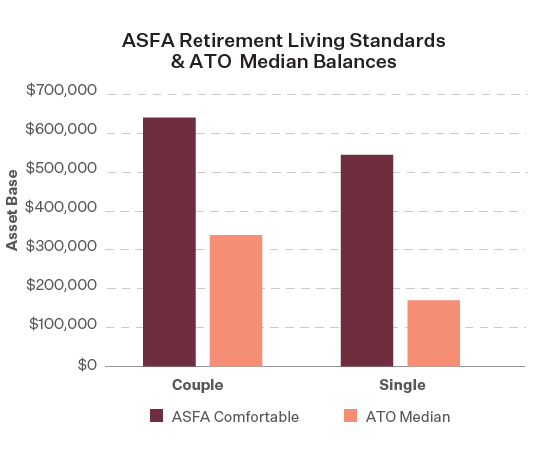

The challenges associated with longevity risk have implications not just for individuals and families trying to save for retirement, but also for society, governments, defined benefit pension plans, defined contribution pension plans and insurers. Specifically, the individuals and entities charged with helping people save for retirement need to ensure that they are doing two things: 1) saving and investing a sufficient amount, and 2) earning a return on their investments that enables them to have sufficient assets to afford retirement.

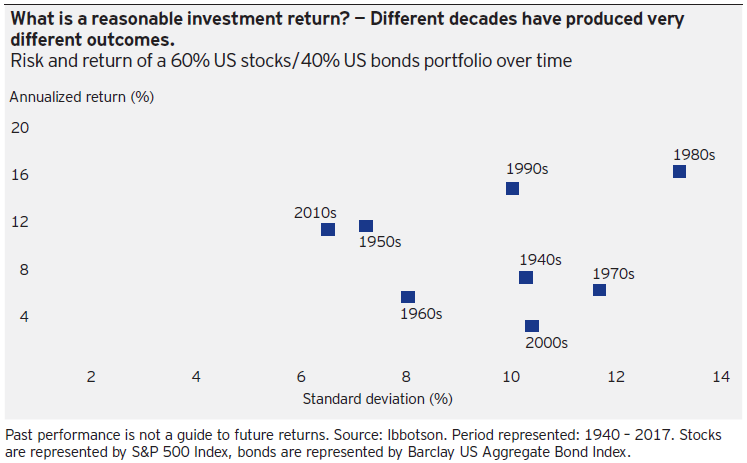

Unfortunately for investors, the ability to achieve attractive returns has been hindered by the fact that equity returns have declined sharply since 2000 on a global basis. Using the US as an example, in both the 1980s and 1990s, the S&P 500 generated an annualised return of over 17%.1 Between 2000 and 2010, however, equities experienced two bear markets and posted a negative annualised return of less than -1%1 for the decade. Since 2010, equity returns have rebounded, generating an annualised return of over 13%,1 through May 2017. For the period since 2000, equities have achieved an annualised return of just under 5%,1 well below the returns achieved in the 1980s and 1990s. As a result of declining equity returns, the returns achieved in the classic 60% stock, 40% bond portfolios have similarly declined, as shown in the chart below. While this example focuses on the US, the story of falling returns is consistent globally as most developed economies have experienced similar declines in returns.

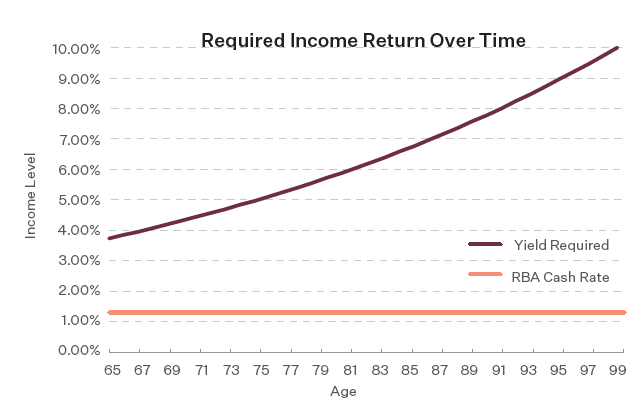

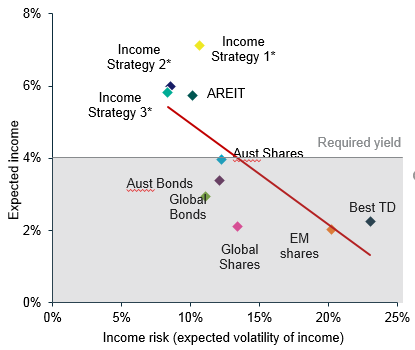

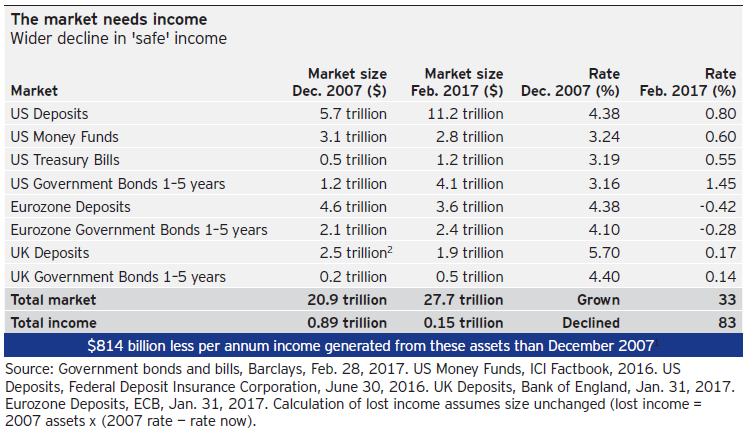

Just as equity returns have declined, so too did interest rates as central banks responded to the Global Financial Crisis by drastically cutting rates in an attempt to support the markets and economy. In some parts of the world, interest rates have turned negative, causing investors to pay for the safety of low-risk investments. The current low level of interest rates, which can be seen in the below chart2, has dramatically impaired investors’ ability to earn an attractive yield on lower-risk assets.

While the decline in interest rates accelerated after 2000, interest rates have steadily been declining over the past 30 years as bonds have enjoyed a historic bull market. Again using the US as an example, during the 1980s the yield on 10-year US government bonds ranged between approximately 7% and 10%.3 In the 1990s, yields declined but remained attractive, ranging between approximately 5% to 8%.3 In the 2000s, yields fell further and generally ranged between approximately 2.5% and 5%.3 Since 2010, yields have often fallen below 2% and today yield approximately 2.3%.3 The US experience with falling rates is broadly consistent with the experiences of other developed economies around the globe.

Taken collectively, an investor saving for retirement faces the following challenges related to longevity risk:

The need to fund a retirement of unknown duration, which could last far longer than expected due to increasing life expectancy

The risk of increased expenses and medical costs in retirement due to illnesses associated with extended life expectancy, such as dementia

A prolonged period of modest equity returns and low yields on low-risk government bonds.

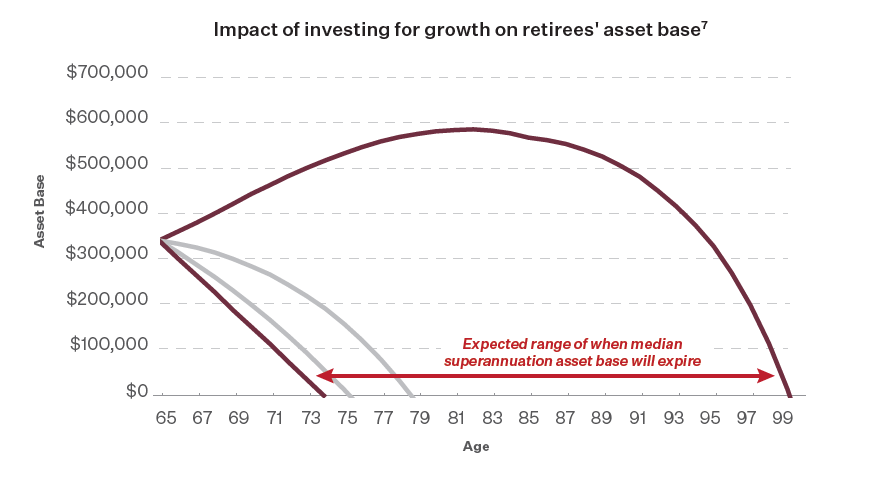

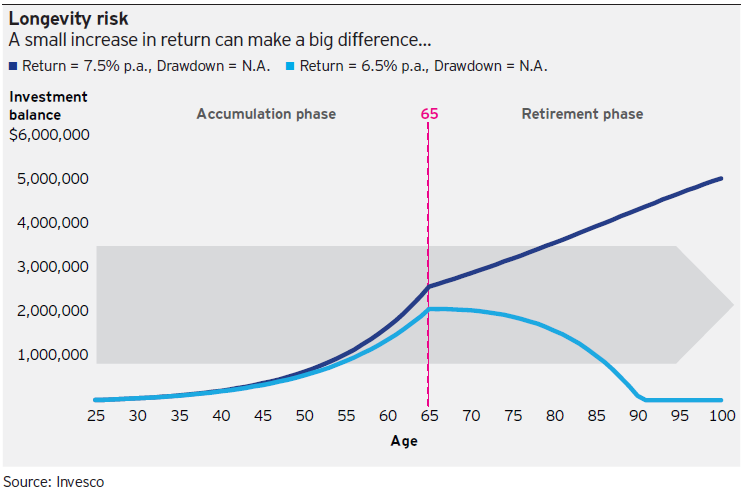

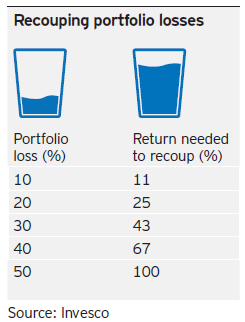

In order to address this risk, there are two steps that investors can and should take: 1) increase the amount of money being set aside for retirement, and 2) seek to prudently increase the return potential of the portfolio. As the chart below illustrates, even modest increases in return can significantly improve an investor’s ability to fund retirement.

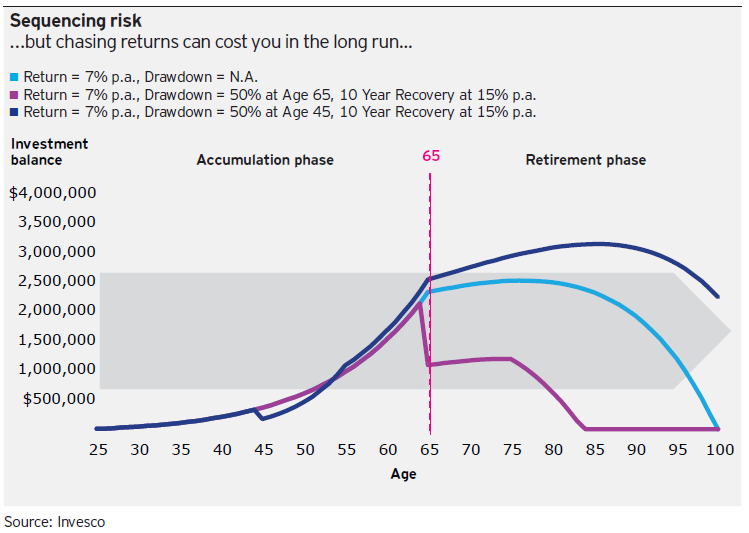

Sequencing risk

Sequencing risk is the risk of large losses occurring in a portfolio at a time when it is difficult to recoup them. For example, a 45-year-old who incurs large portfolio losses has 20 years before reaching the retirement age of 65, and therefore has a long time horizon over which to recover. The situation is very different when a 65-year-old incurs large losses in their first year of retirement. This also tends to be when an investor has the greatest amount of invested wealth during their life to date, making them more vulnerable to large losses. Such losses can force the retiree to return to the workplace and/or may require a more limited retirement than planned.

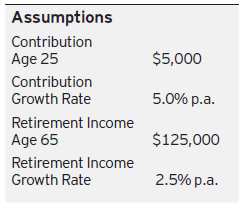

A primary reason that losses are such a concern to investors is that after a loss is incurred, the investor must achieve a return greater than the percentage of the loss in order to recoup the loss. This is due to the fact that the losses reduced the size of their portfolio and thus require a higher return to offset the smaller portfolio size. This point is illustrated in the diagram below;

For example, if an investor loses 50% on a $100,000 portfolio, the size of the portfolio shrinks to $50,000. The investor must then achieve a 100% return on the remaining $50,000 portfolio in order for the portfolio to return to its pre-loss size of $100,000. The larger the size of the loss, the greater return, and the longer it will take, to recover the losses. The impact of such losses on an investor is highlighted in the chart below.

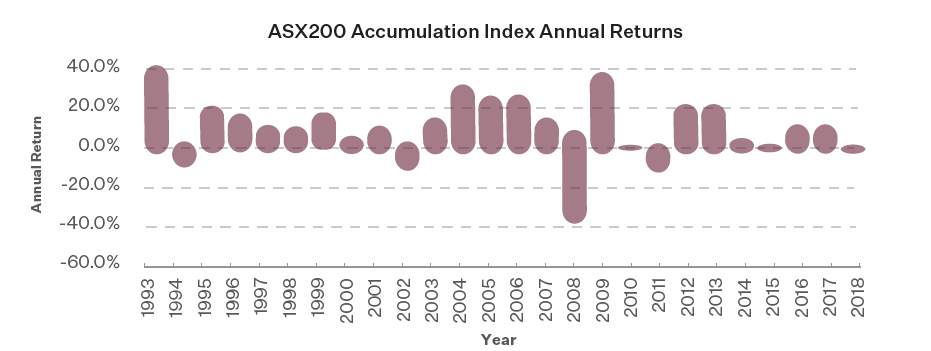

When building a portfolio, volatility and risk of loss should always be a primary focus of investors, as market downturns occur more regularly than many investors realise. Many investors, however, have short memories and discount the potential risk of incurring outsized losses, despite several historical examples of large market declines, as shown below:

- Dow Jones Industrial Average (DJIA) — In 1929, the Dow hit an all-time high of 381.17, before declining 89% to 41.22 in 1932. It took until 1954, a period of 25 years, before the index achieved a new peak.3

- DJIA — On October 19, 1987, the DJIA declined 22.6%, the largest one-day decline (in percentage terms) in its history. It took 15 months for the index to return to pre-crash levels, and 24 months for it to hit a new peak.3

- Japanese Nikkei — The Nikkei hit an all-time high of 38,916 on December 29, 1989. As of May 31, 2017, the Nikkei sat at 19,650, approximately 50% below its all-time high.3

- NASDAQ — On March 10, 2000, the NASDAQ hit a record high of 5048.62 before declining approximately 80% by October 2002. It took 15 years for the index to achieve a new peak.3

- S&P 500 — The S&P 500 hit a then record high of 1565.15 on October 9, 2007. From that lofty level, the index declined 56.8%, due in large part to the Global Financial Crisis, hitting a low of 676.53 on March 9, 2009. Over five years later, in March 2013, the index achieved a new peak.3

In order to mitigate sequencing risk, investors have long been counselled to reduce the risk of their portfolios as they age by shifting away from stocks toward bonds and cash equivalents. A common rule of thumb for investing was to subtract the investor’s age from 100 to determine how much to invest in stocks, with the remaining balance being invested in bonds and cash equivalents. Under this rule of thumb, a 30-year-old would invest 70% of their portfolio in stocks, while a 65-year-old would invest 35% in stocks. This same general principal can be seen in target date funds, as these funds typically reduce the risk exposure of the portfolio the closer they get to the target date.

This approach works well for the select few investors and pension plans that have comfortably funded their retirements and plans, but presents a challenge for investors who are dealing with underfunding or issues related to longevity risk. Furthermore, this approach worked much better for investors in the higher return era of the 1980s and 1990s, when equities achieved annualised returns of 17% and 10-year US government bonds yielded 5% to 10%.1 Since 2000, however, it has become much more challenging with equities having achieved annualised returns of less than 5% and 10-year US government bonds yielding between 2 and 3%.3 Additionally, investors in bonds may potentially face a bear market when interest rates inevitably increase from their current low levels.

The investment strategy of steadily reducing risk over time involves a clear return and risk trade-off. Specifically, by decreasing the allocation to equities and increasing the allocation to cash and bonds, investors are reducing the return potential of their portfolios in order to decrease the risk of their portfolio. This approach helps the investor address sequencing risk, but potentially exacerbates the investor’s longevity risk.

Balancing longevity risk and sequencing risk

Just as investors need to balance greed and fear, they need to strike a balance in addressing longevity risk and sequencing risk. Longevity risk pushes investors to invest in riskier assets in order to achieve higher returns and grow their portfolios, while sequencing risk does the opposite and pushes investors to increase their exposure to low-risk assets in order to reduce the risk of losses. Addressing the conflicting nature of these risks is critical, and extremely challenging, for investors.

While there is no magic solution to this issue, investors’ ability to balance these competing risks can potentially be improved by looking beyond traditional investments in stocks and bonds and considering alternative investments.

Alternatives have the potential to provide investors with unique return and risk characteristics that can help them address the issues of longevity and sequencing risk. Specifically, there are some types of alternatives that have the potential to address longevity risk by generating returns equal to, or greater than, equities, or generating current income well above that of bonds. There are other types of alternatives that have the potential to address sequencing risk by offering investors downside protection and volatility reduction. Lastly, there are some types of alternatives that can help investors simultaneously address both longevity and sequencing risk by generating equity-like returns with lower volatility and lower drawdowns than equities.

What are alternative investments?

While there is no one common definition for alternative investments, Invesco defines alternatives as investments other than publicly traded, long-only equities and fixed income. Based on this definition, investments that have any of the following characteristics would be defined as alternative investments:

- Investments that invest in illiquid and / or privately traded assets, such as private equity, venture capital, and private credit.

- Investments that engage in “shorting” (i.e., seeking to profit from a decline in the value of an asset), such as global macro, market neutral and long / short equity strategies

- Investments in asset classes other than stocks and bonds, such as commodities, natural resources (i.e. timberland, oil wells), infrastructure, master limited partnerships (MLPs), and real estate.

(Please note that the above definition is intentionally broad and inclusive. Different investor types often have their own unique definition of alternatives and may classify specific investment types differently.)

Alternatives can be broadly categorised as liquid or illiquid. Liquid alternatives predominantly invest in underlying instruments that are frequently traded and regularly priced, and provide investors with the ability to redeem their investment on a regular basis, be it daily, monthly or quarterly. Alternative mutual funds, alternative Undertakings for the Collective Investment of Transferable Securities (UCITS) funds and most traditional hedge funds are examples of liquid alternatives. Alternative mutual funds and UCITs are available for investment by retail investors, high net worth investors (i.e., individuals with a net worth in excess of $5 million) and institutional investors (i.e., pension plans, foundations, endowments and sovereign wealth funds). Traditional hedge funds, however, are typically only available to high net worth and institutional investors.

Illiquid alternatives predominantly invest in underlying instruments that are privately traded, priced on a periodic basis (often quarterly) and require investors to hold the investment over a prolonged period (typically several years) with little to no ability to redeem the investment prior to its maturity. Private equity, venture capital, direct real estate, private credit, direct infrastructure and natural resources are examples of illiquid alternatives. The availability of illiquid alternatives varies from country to country and is dependent on each countries individual regulatory environment. Generally speaking, illiquid alternatives are typically only available to institutional investors and high net worth individual investors, and are not typically available to retail investors.

When looking at alternatives, Invesco divides the universe into two baskets: alternative asset classes and alternative investment strategies:

- Alternative asset classes are investments in asset classes other than stocks and bonds. Investments in real estate, commodities, natural resources, infrastructure and MLPs are all examples of alternative asset classes. Alternative asset classes can be accessed through either liquid or illiquid investments. Examples of liquid alternative asset investments include investing in real estate through REITS, investing in the equity and / or bonds of publicly traded infrastructure companies, or investing in commodities by using futures. Examples of illiquid alternative asset investments include direct, private market investments in real estate, natural resources, and / or infrastructure.

- Alternative investment strategies are investments in which the fund manager is given increased flexibility with how to invest. The manager is often given the ability to trade across multiple markets and asset classes such as stocks, bonds, currencies and commodities, as well as given the ability to short markets. Common hedge fund strategies such as global macro, long / short equity, market neutral, managed futures and unconstrained fixed income are all examples of alternative strategies.

Strategies such as global macro, market neutral, long / short equity, and managed futures all typically invest on a long and short basis. The ability to short has the potential to significantly impact the return stream of these investments, as shorting gives these strategies the potential to generate positive returns in a falling market environment. At a minimum, the use of shorts provides these strategies with a powerful tool to potentially limit losses during such an environment.

Additionally, alternative investment strategies often are frequent users of derivatives, such as futures, forwards, options and swaps. While derivatives are often misunderstood and viewed as risky, within the context of alternative investment strategies, derivatives are commonly used to improve portfolio diversification, hedge out market risks, help protect on the downside and efficiently establish market exposure.

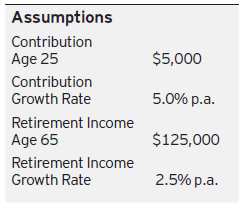

Given the myriad alternatives available to investors,4 one of the major challenges for investors is to understand the unique aspects of the various strategies. To help investors navigate this challenge, Invesco has created the below framework that organises the alternatives universe into six unique categories based on an investor’s investment objectives. The first five alternative categories (Alternative Assets, Relative Value, Global Investing and Trading, Alternative Equity and Alternative Fixed Income) represent liquid alternatives, while the sixth alternative category, Private Markets, represents illiquid alternatives.

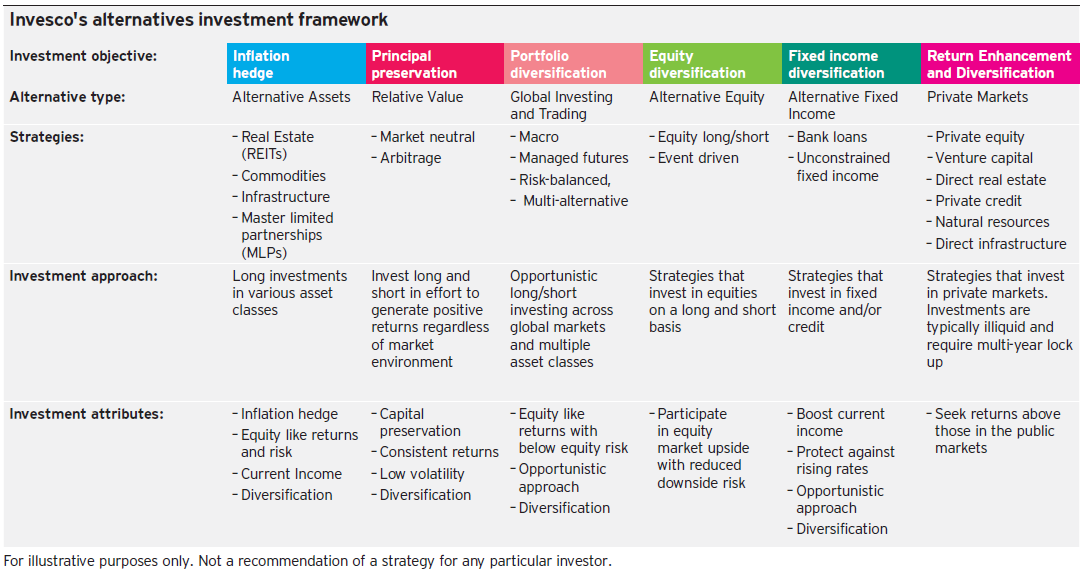

How alternative investments can help mitigate longevity and sequencing risk

The ability of alternatives to help investors mitigate longevity and sequencing risk can be seen when looking at the historical performance of alternatives. To this end, the table below shows the historical performance of the various categories within Invesco’s Alternatives Framework compared to equities (i.e. S&P 500) and fixed income (i.e. Barclay U.S. Aggregate Bond Index). (Please note that the data used for the various categories of the framework reflect quarterly returns rather than monthly returns. While the liquid alternatives categories all have monthly returns available, the indexes used for private markets only report returns on a quarterly basis. In order to ensure consistency, quarterly returns were used.)

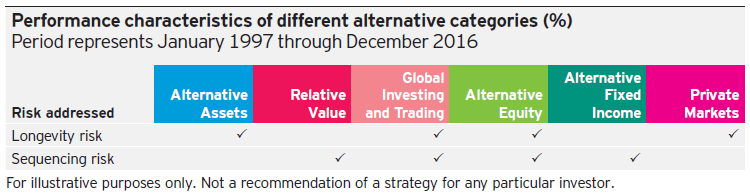

Examining the historical performance of these various alternative categories allows investors to gain a better understanding of the performance characteristics of each category, as well as how different types of alternatives can help address the challenges of longevity and sequencing risk. Based on an examination of the historical performance of the various categories, the chart below illustrates which risks the various alternative categories are best positioned to mitigate:

As a general rule, alternative investment strategies are effective tools to help reduce sequencing risk, while illiquid alternatives are well positioned to help reduce longevity risk. By combining both liquid and illiquid alternatives within a portfolio, investors can simultaneously address both longevity and sequencing risk.

How to implement alternatives into a portfolio to address longevity and sequencing risk

Once investors have made the decision to allocate to alternatives to address longevity and sequencing risk, they then need to decide how best to implement that decision. Invesco believes that the asset allocation process is as much an art as it is a science, and that there is no one-size-fits-all approach. That said, there are key issues that every investor should address when considering adding alternatives to their portfolio. Specifically, investors contemplating adding alternatives to their portfolio in order to meet longevity and sequencing risk should consider the following questions:

- What risk or risks are they seeking to address? Determining the risks an investor is seeking to address will drive the decision as to which alternatives to add to the portfolio. Investors primarily concerned about longevity risk will focus on alternatives that have the potential to deliver returns equal to, or greater than, those of equities. Investors primarily focused on sequencing risk will focus on alternatives that can reduce performance volatility and risk of loss. Finally, investors concerned about addressing both longevity and sequencing risk will focus on those alternatives that can simultaneously address both risks and/or will seek a combination of alternatives that can address each risk individually.

- Which types of alternatives do they have access to? Many liquid alternatives strategies are available to all investors in familiar structures such as mutual funds or UCITs. Private market strategies, however, are typically only available to high net worth and institutional investors.

- What are the risks associated with the alternatives they are considering? As with any investment, alternatives have unique risks associated with them. It is important that investors fully understand all associated risks before investing.

- How much should they invest in alternatives? The percentage an investor allocates to alternatives varies widely. For most investors, a typical allocation to alternatives would range between 5% and 30%. There are several institutional investors, however, such as the Yale Endowment, that allocate over 50% of their portfolio to alternatives.5

- Should the allocation to alternatives be funded from equities or fixed income? The decision of how to fund the allocation varies greatly from investor to investor, and is often driven by the investor’s return and risk objectives for both the portfolio and the investment being considered.

The answers to these questions will significantly impact which alternatives an investor uses, how they incorporate them into their portfolio, their impact on the return and risk characteristics on the portfolio, and subsequently, their effectiveness in addressing longevity and sequencing risk.

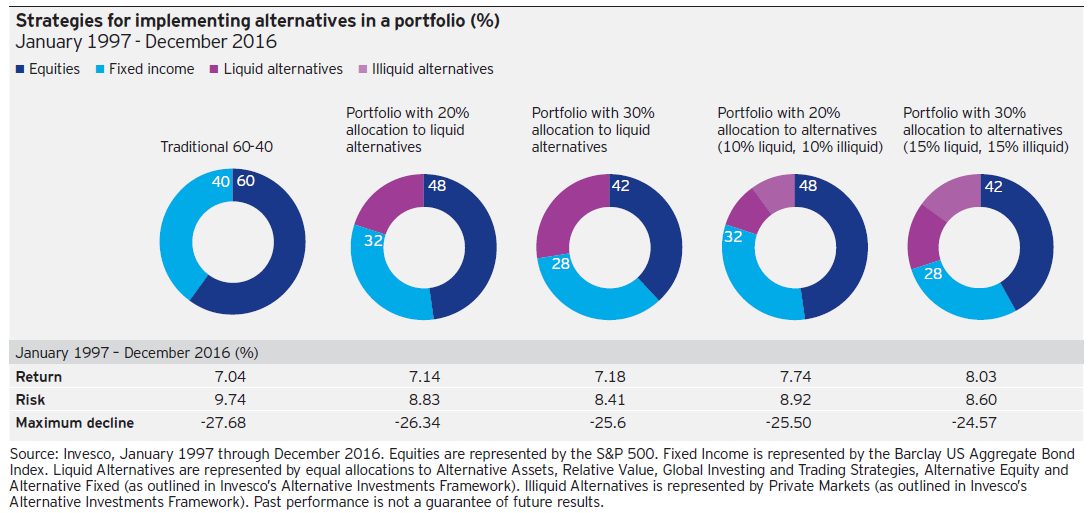

To illustrate the potential impact of incorporating alternatives into a portfolio, consider the following scenarios:

- An investor is seeking to address both longevity and sequencing risk.

- The investor’s current portfolio is 60% equities and 40% bonds.

- Retail investors only have access to liquid alternatives (i.e. cannot invest in illiquid alternatives), and allocate evenly across the five liquid alternative investment categories.

- High net worth and institutional investors have access to both liquid and illiquid alternatives, and split their allocation evenly between liquid and illiquid alternatives. These investors opt to gain exposure to alternative assets through direct, private market investments, rather than through liquid alternatives, due to the higher return potential of private market investments. Additionally, their exposure to liquid alternatives is evenly allocated across the liquid alternative investment categories, excluding Alternative Assets given they can access this exposure in direct/illiquid markets.

- To fund their allocation to alternatives, investors allocate proportionally away from stocks and bonds (i.e. a 20% allocation to alternatives will be funded by reducing exposure to equities by 20% and reducing exposure to fixed income by 20%)

- Investors allocate either 20% or 30% of their portfolio to alternatives.

Based on the above assumptions, the chart below illustrates the impact of adding alternatives to a portfolio:

In each of the above cases, an investor seeking to address both longevity and sequencing risk would benefit from higher returns and lower risk by including alternatives in their portfolio. Each portfolio’s compound annual return increased, thus helping the investor address longevity risk. At the same time, both risk (as measured by standard deviation) and maximum decline decreased, helping the investor address sequencing risk.

While the above example is relatively simple, it illustrates how the use of alternatives can help investors address longevity and sequencing risk by simultaneously boosting return and decreasing risk. Furthermore, by thoughtfully deciding which alternatives to allocate to, investors can alter the return and risk characteristics of their portfolios in order to most effectively address their unique needs vis-a-vis longevity and sequencing risk.

Summary

Investors must address the conflicting natures of longevity risk and sequencing risk if they are to invest successfully. These risks are especially acute for individual and institutional investors seeking to provide for a comfortable retirement.

The solution to longevity risk is to seek investments that offer attractive return potential in order to help build sufficient wealth to fund retirement. Conversely, the solution to sequencing risk is to seek stable, low-risk investments in order to avoid potentially devastating losses that could permanently impair the investors’ ability to fund retirement. The challenge for investors is to build a portfolio that balances these competing needs.

While there is no magic solution to this issue, investors’ ability to balance these competing risks can potentially be improved by looking beyond traditional investments in stocks and bonds and considering alternative investments.

Alternatives have the potential to provide investors with unique return and risk characteristics that can help them address the issues of longevity and sequencing risk. Specifically, there are some types of alternatives that have the potential to address longevity risk by generating returns equal to, or greater than, equities, or generating current income well above those of bonds. There are other types of alternatives that have the potential to address sequencing risk by offering investors downside protection and volatility reduction. Lastly, there are some types of alternatives that can help investors simultaneously address both longevity and sequencing risk by generating equity-like returns with lower volatility and lower drawdowns than equities.

Alternative investments at Invesco

Invesco is a leading provider of alternative investments on a global basis, and believes there are four aspects of its alternatives capabilities that collectively differentiate Invesco from its competitors:

- Proven and experienced portfolio management — Invesco has been managing alternative investments since the early 1980s, and currently has over 350 investment professionals managing over $155 billion in alternative assets.6

- Diverse array of alternatives capabilities and offerings — Invesco’s alternative capabilities span the entire alternatives universe with offerings across all six alternative categories: Alternative Assets, Relative Value, Global Investing and Trading, Alternative Equity, Alternative Fixed Income and Private Markets. Furthermore, Invesco’s offerings are available in a variety of structures, as we understand the importance of delivering offerings in the manner our clients prefer.

- Experience working with retail, high net worth, and institutional investors — Invesco has extensive experience working with and meeting the needs of retail, high net worth and institutional investors. Approximately two-thirds of Invesco’s $858B US in AUM is from retail and high net worth investors, while one-third is from institutional clients.7 Furthermore, Invesco is committed to providing our clients with industry-leading thought leadership on alternatives, in order to help them better understand the unique nature of this asset class and effectively implement alternatives into their portfolios.

- Robust risk management and corporate governance infrastructure — As a global company with a long history, Invesco understands the importance of building a strong risk management and corporate governance structure to support our offerings, including alternatives.

Given the strength of its alternatives capabilities, Invesco is well-positioned to help investors address the issues of longevity and sequencing risk through the inclusion of alternative investments in their portfolios. To learn more about Invesco alternative capabilities and specific offerings, please contact your local Invesco representative or visit our website at www.invesco.com.

1 Source: Zephyr

2 UK 2007 is based on British Banking Association data — discontinued.

3 Source: Bloomberg

4 Alternative investments are subject to various regulatory requirements that vary across the globe. Furthermore, there are often suitability requirements that an investor must meet in order to invest in alternatives. For this reason, not all alternatives may be available to all investors.

5 Source: Yale Endowment 2015 Annual Report

6 As of June 30, 2017.

7 Source: Invesco Ltd. as of March 31, 2017

About risk

Short sale risk. Short sales may cause an investor to repurchase a security at a higher price, causing a loss. As there is no limit on how much the price of the security can increase, exposure to potential loss is unlimited.

Alternative risk. Alternative products typically hold more non-traditional investments and employ more complex trading strategies, including hedging and leveraging through derivatives, short selling and opportunistic strategies that change with market conditions. Investors considering alternatives should be aware of their unique characteristics and additional risks from the strategies they use. Like all investments, performance will fluctuate.

MLP Risk. Most MLPs operate in the energy sector and are subject to the risks generally applicable to companies in that sector, including commodity pricing risk, supply and demand risk, depletion risk and exploration risk. MLPs are also subject the risk that regulatory or legislative changes could eliminate the tax benefits enjoyed by MLPs which could have a negative impact on the after-tax income available for distribution by the MLPs and/or the value of the portfolio’s investments.

Important information

This document has been prepared only for those persons to whom Invesco has provided it. It should not be relied upon by anyone else. Information contained in this document may not have been prepared or tailored for an Australian audience and does not constitute an offer of a financial product in Australia. You may only reproduce, circulate and use this document (or any part of it) with the consent of Invesco.

The information in this document has been prepared without taking into account any investor’s investment objectives, financial situation or particular needs. Before acting on the information the investor should consider its appropriateness having regard to their investment objectives, financial situation and needs. You should note that this information:

- may contain references to dollar amounts which are not Australian dollars;

- may contain financial information which is not prepared in accordance with Australian law or practices;

- may not address risks associated with investment in foreign currency denominated investments; and

- does not address Australian tax issues.

Issued in Australia by Invesco Australia Limited (ABN 48 001 693 232), Level 26, 333 Collins Street, Melbourne, Victoria, 3000, Australia which holds an Australian Financial Services Licence number 239916.