A number of property funds have recently acted to modify or restrict redemptions in response to sharply rising interest rates that have created heightened uncertainty and impacted net capital flows into all asset classes, including real estate. The redemption status for several direct property funds currently rated by Lonsec are outlined below. Importantly, the actions undertaken by the funds in respect of modifying redemption terms are permissible and outlined in the respective Constitutions and PDSs.

How did we get here?

- The risk-free rate (10 yr government bond rate) n the U.S. has moved from 1.6% at start of 2022 to close to 5.0% recently (Australia from 1.9% to 4.75%). The sharp increase in yields over a relatively short space of time has precipitated a repricing of all asset classes, particularly long duration assets.

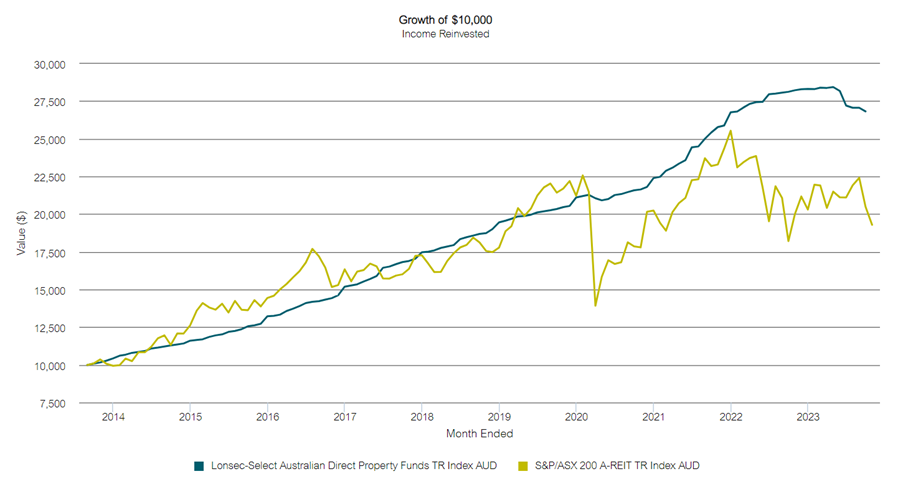

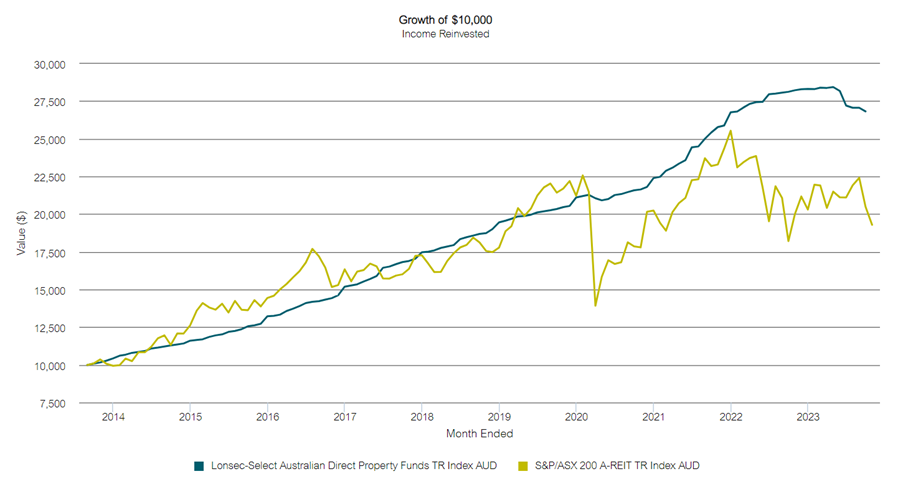

- Exchange-listed assets, as shown by the S&P/ASX 200 A-REIT Index, responded far more quickly than unlisted assets and historically have tended to overshoot before retracing. Australian REITs are currently trading at steep discounts to NAV of up to 30%, particularly office REITs.

- Unlisted assets, as shown by the Lonsec-Select Australian Direct Property Fund Index, typically adjust with a lag, often causing asset allocation imbalances in diversified portfolios. History suggests the listed and unlisted markets will again converge, though the timeframe is uncertain.

- Worth noting that a similar theme is playing out elsewhere in the world. In late 2022, one of the most high-profile REITs, Blackstone’s USD70bn REIT (unlisted), limited redemption requests. The Blackstone REIT focused on rental housing and logistics in the sun belt states and had grown very quickly on the back of ultra-low interest rates. Redemption requests had eased by Q3 and Q4 2023.

While direct property funds have different liquidity terms, broadly speaking the managers endeavour to satisfy redemption requests (in order of priority):

Fund inflows – inflows have slowed to a minimum for most funds, reflecting uncertainty and repricing of asset classes.

Reducing distributions – some funds have done this, but most are reluctant, particularly while occupancy and fund cashflows remain strong.

Selling assets – arguably the best option but challenging conditions mean long lead times. There are also currently minimal real estate transactions taking place as buyers and sellers adjust expectations, slowing the price discovery process.

Debt facilities – satisfying redemptions by drawing down on debt facilities is not considered good practice particularly with asset values falling (double-whammy for loan-to-value ratios).

In circumstances where fund redemptions exceed a fund’s ability to meet its liquidity terms, Responsible Entities / Trustees have a fiduciary obligation to treat all unitholders equally. Temporarily modifying redemption terms is a prudent decision for these Funds and a means to balance the different priorities of all investors.

Where to from here?

It is likely conditions will only ‘normalise’ when interest rates peak, and all asset classes have had a chance to reprice. At this point, liquidity will remain dependent on the volume of investors seeking to withdraw versus those happy to remain invested.

Property funds by their very nature offer limited liquidity. The funds outlined below are well managed, with relatively conservative debt levels providing headroom to LVR and ICR covenants. Lonsec remains in close contact with all managers and our next review of the of the sector will be in Q1 2024.

| Direct Property Funds – Redemption Status |

| Fund |

Status |

Next Liquidity Window* |

| Cromwell Diversified Property Fund |

Ceasing redemptions for 6 months from Oct 2023. Scaling of redemption requests via limited monthly withdrawal facility no longer meaningful. Distributions reduced to 5.75 cpu ~5.17%. |

July 2025 |

| Centuria Healthcare Property Fund |

Redemptions exceeding threshold of 2.5% per quarter. Redeemers pro-rated and in queue. |

Aug 2025 |

| Centuria Diversified Property Fund |

Redemptions exceeding thresholds of 2.5% per quarter. Redeemers pro-rated and in queue. |

Dec 2025 |

| Charter Hall Direct PFA Fund |

Most recent major Fund liquidity event closed in October 2022; 35% of redemption payments have been completed to date with the Manager targeting the balance for 1H 2024. |

Aug 2027 |

| Charter Hall Direct Office Fund |

Recent limited withdrawal offer oversubscribed and investor redemptions were scaled back. |

Dec 2024 |

| Chater Hall Direct Long WALE Fund |

Most recent major Fund liquidity event closed in May 2023. Redemption requests will be satisfied in full this calendar year, with the payment targeted to occur in November 2023. |

May 2028 |

| Charter Hall Direct Industrial Fund 4 |

Recent limited withdrawal offer oversubscribed and investor redemptions were scaled back. |

Nov 2026 |

| Dexus Core Property Fund |

Hybrid fund – listed (REITs) & unlisted, currently at extremes of 30% – 70% range. Monthly redemptions restricted to 0.5% of the Fund’s assets from October 2023. |

N/A |

| Dexus Wholesale Australian Property Fund |

Payment of withdrawal requests extended firstly from 30 days to 6 months in May 2023 and then to 12 months in October. |

N/A |

| Invesco Global Property Fund |

Fund targets 70% global direct property / 30% GREITs. Gated Aug 2023 after redemptions exceeded 15% of the Fund’s assets over a rolling 90-day period. |

N/A |

| Partners Group Global Real Estate Fund |

Redemptions exceeded 5% quarterly redemption gate in Aug 2023. Redemption requests not accepted do not carry forward, quarterly gates reset in October. The 4% sell spread remains in place, redeemers paid that fee which goes to the benefit of the fund. |

N/A |

*Cromwell, Centuria and Charter Hall funds have 5-year full liquidity events. The liquidity strategy may include selling properties; raising new equity; arranging new debt financing; listing on the Australian Securities Exchange (ASX); winding up the Fund; or a combination of these. That said, liquidity events may be deferred in exceptional circumstances for so long as it is impracticable to offer liquidity, or it would not be in the best interests of the remaining investors for liquidity to be offered.

IMPORTANT NOTICE: This document is published by Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL No. 421445 (Lonsec). Please read the following before making any investment decision about any financial product mentioned in this document.

Disclosure as at the date of publication: Lonsec receives fees from fund managers or product issuers for researching their financial product(s) using comprehensive and objective criteria. Lonsec receives subscriptions for providing research content to subscribers including fund managers and product issuers. Lonsec receives fees for providing investment consulting advice to clients, which includes model portfolios, approved product lists and other advice. Lonsec’s fees are not linked to the product rating outcome or the inclusion of products in model portfolios, or in approved product lists. Lonsec and its representatives, Authorised Representatives and their respective associates may have positions in the financial product(s) mentioned in this document, which may change during the life of this document, but Lonsec considers such holdings not to be sufficiently material to compromise any recommendation or advice.

Warnings: Past performance is not a reliable indicator of future performance. The information contained in this document is obtained from various sources deemed to be reliable. It is not guaranteed as accurate or complete and should not be relied upon as such. Opinions expressed are subject to change. This document is but one tool to help make investment decisions. The changing character of markets requires constant analysis and may result in changes. Any express or implied rating or advice presented in this document is limited to “General Advice” (as defined in the Corporations Act 2001 (Cth)) and based solely on consideration of the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (‘financial circumstances’) of any particular person. It does not constitute a recommendation to purchase, redeem or sell the relevant financial product(s).

Before making an investment decision based on the rating(s) or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances, or should seek independent financial advice on its appropriateness. If our advice relates to the acquisition or possible acquisition of particular financial product(s), the reader should obtain and consider the Investment Statement or Product Disclosure Statement for each financial product before making any decision about whether to acquire a financial product. Where Lonsec’s research process relies upon the participation of the fund manager(s) or product issuer(s) and they are no longer an active participant in Lonsec’s research process, Lonsec reserves the right to withdraw the document at any time and discontinue future coverage of the financial product(s).

Disclaimer: This document is for the exclusive use of the person to whom it is provided by Lonsec and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by Lonsec. Financial conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from, this document or any loss or damage suffered by the reader or any other person as a consequence of relying upon it.

Copyright © 2023 Lonsec Research Pty Ltd (ABN 11 151 658 561, AFSL No. 421445) (Lonsec). This document is subject to copyright of Lonsec. Except for the temporary copy held in a computer’s cache and a single permanent copy for your personal reference or other than as permitted under the Copyright Act 1968 (Cth), no part of this document may, in any form or by any means (electronic, mechanical, micro-copying, photocopying, recording or otherwise), be reproduced, stored or transmitted without the prior written permission of Lonsec.

This document may also contain third party supplied material that is subject to copyright. Any such material is the intellectual property of that third party or its content providers. The same restrictions applying above to Lonsec copyrighted material, applies to such third party content.