Credit spreads have materially moved wider in the past 12 months, reflecting market anticipation of a slowing economy. One of the reasons for the widening is higher official interest rates which has increased corporate borrowing costs and refinancing risk, while also increasing the potential for a recession. This has been further exacerbated by a number of global factors influencing credit markets such as the Russian Ukraine conflict, rising energy prices, and COVID induced lockdowns in China, to name a few.

Higher credit spreads are typically signals for heightened credit risk in the bond market. It is also a sign that the market is pricing in higher probabilities of defaults as investors demand higher risk premiums to compensation for increased credit risk.

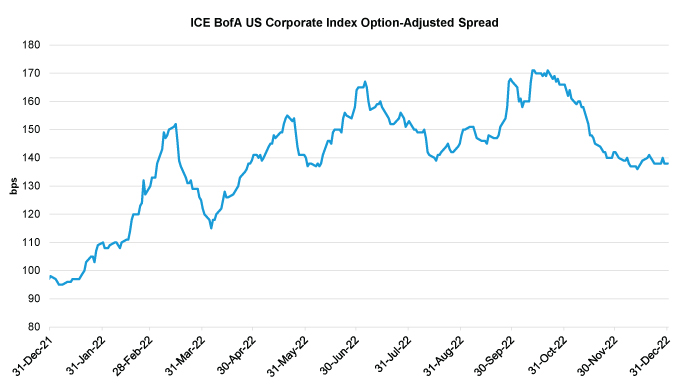

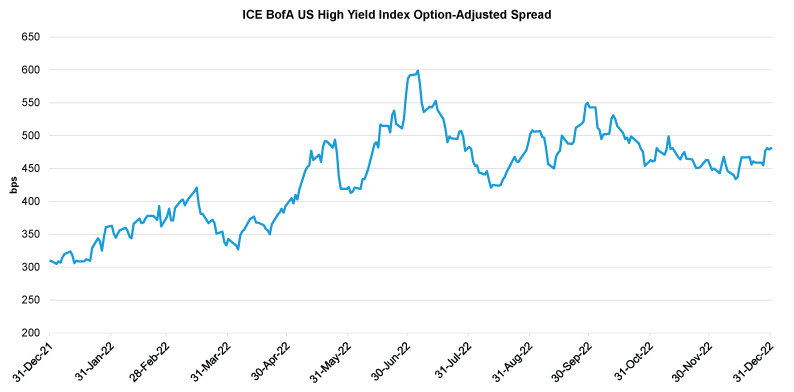

As the largest corporate bond market in the world, the US market provides a good indication of an increase in credit concerns with US Investment Grade corporate bond credit spreads, referenced by the ICE BofA US Corporate Index Option-Adjusted Spread, rising 41bps over the year to 138 basis points as at 31 December 2022. (see Figure 1). The increase in US High Yield corporate bond spreads were more stark, with the ICE BofA US High Yield Index Option-Adjusted Spread rising 176 bps over the year to 481 bps as at 31 December 2022. (see figure 2)

Figure 1 – US investment credit spread has widened.

Source: FRED, 31 December 2022

Figure 2 – …so did High yield spreads

Source: FRED, 31 December 2022

Higher credit spreads also result in higher funding costs for corporates that rely on debt capital markets for funding. The low-rate environment in the past number of years has shielded financially weak companies from financial stress, however they may find it increasingly difficult to meet their debt obligations in a higher rate environment. These companies have been coined “zombie” companies, being companies that have been earning just enough to continue operating while interest rates are low.

Faced with higher interest costs and the prospect of greater refinancing risk, corporate borrowers’ poor financial health may also be compounded by macroeconomic pressures on revenue stemming from inflation and potential recession. In the event a recession does occur, this may lead to lower corporate revenues, cash flows, and interest coverage, bringing these ‘zombie’ companies to light.

Rising rates is not all bad news as one benefit of rising rates is that fixed income assets become more attractive from an outright yield perspective. This is particularly the case for floating rate instruments, as coupons will increase as interest rates increase, benefitting investors and providing an additional buffer to protect against adverse market movements. However, while these instruments are advantageous to investors compared to fixed rate instruments, they do not offer any further protection from credit losses.

Heighten risks in the credit market, primary driven by the impact of higher interest rates, has resulted in credit spreads in both the investment grade and high yield corporate bond market to significantly widen over 2022. While higher outright yields may be more attractive to investors, investors need to be wary of the increased risk of credit losses.

by Alec Leung, Senior Investment Analyst, Lonsec Research

Sources:

- FRED (https://research.stlouisfed.org/)

- Online (https://www.livewiremarkets.com/wires/up-to-one-third-of-all-australian-and-us-companies-could-be-zombies)

- ABS Total Value of Dwellings (https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/total-value-dwellings/latest-release)

Disclaimer: This information is for personal, non-commercial purposes only and is not intended to be financial product advice. ©2023 Lonsec Research Pty Ltd. All rights reserved. You may not reproduce, transmit, disseminate, sell, or publish this information without the written consent of Lonsec Research Pty Ltd (Lonsec Research). This information may also contain third party material that is subject to copyright. To the extent that copyright subsists in a third party it remains with the original owner and permission may be required to reuse the material. This information has been prepared in good faith and is believed to be reliable at the time it was prepared, however, no representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented, which is drawn from third parties information not verified by Lonsec Research and is subject to change without notice. Lonsec Research assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec Research, its directors, officers, representatives, and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from, this document or any loss or damage suffered by the reader or any other person as a consequence of relying upon it.