Fund Managers

We help fund managers position their investment products to better fit the needs of financial advice clients. Through our rigorous ratings and review process, our extensive qualitative research, and by partnering with you to enhance your fund’s governance framework, investment process, and other key qualitative factors we can help you build products that financial advisers look for when recommending products or building Approved Product Lists.

Let us know which solution you’re looking for:

Benefit from a Lonsec rating

The Lonsec approach

Sustainability score

Partner with us

Benefit from a Lonsec rating

Lonsec has been in the ratings game for over 30 years, rating everything from equity funds to LIT / LICs and Super options and our direct equities research in the ASX200. In recent times we have expanded our coverage to include Private Markets and products issued under Information Memorandum. We now cover over 1700 products and that number continues to grow very strongly.

We understand the power of trusted and objective investment insight and how it can drive better outcomes for end investors. A rating from us can give financial advisers the confidence that a product meets its objectives and may be suitable for their clients. A rating from Lonsec is often the first step in the process of getting funds into model portfolios and onto approved product lists and platforms.

The Lonsec approach to research and ratings

Over the past 30 years, we have developed a tried and tested methodology to evaluate funds that looks at everything from the investment team to the sustainability of the business, fees and performance to give a holistic, qualitative assessment of the fund.

We believe that investment research should be forward-looking and qualitatively skewed. As such, qualitative factors generally account for 80% of the rating for most mainstream asset classes, with Lonsec’s assessment of people and process having the greatest impact on the research outcome.

A key component of the research process is our robust scoring models that have been developed over time and are reviewed on an ongoing basis by senior members of the Lonsec Research team. These scoring models are dependent upon by both data collected as part of the review process and the expertise of the analyst team in assessing the information gathered.

Sustainability Report & Score

The past decade has seen enormous growth in the number of sustainable investment products, with many advisers and their clients looking for guidance on how to evaluate these products’ objectives and holdings. We have two ways in which to evaluate products– the Lonsec Sustainability Report and Score and ESG evaluations in our core research reports.

Since the launch of the stand-alone Lonsec Sustainability Report in 2020, many advisers and their clients have used the reports to help shape their portfolios. Powered by data from Impact Cubed, this report reflects best practice in sustainability research and includes key environmental factors of waste, water, carbon and climate as well as provided more in-depth information on portfolio exclusions.

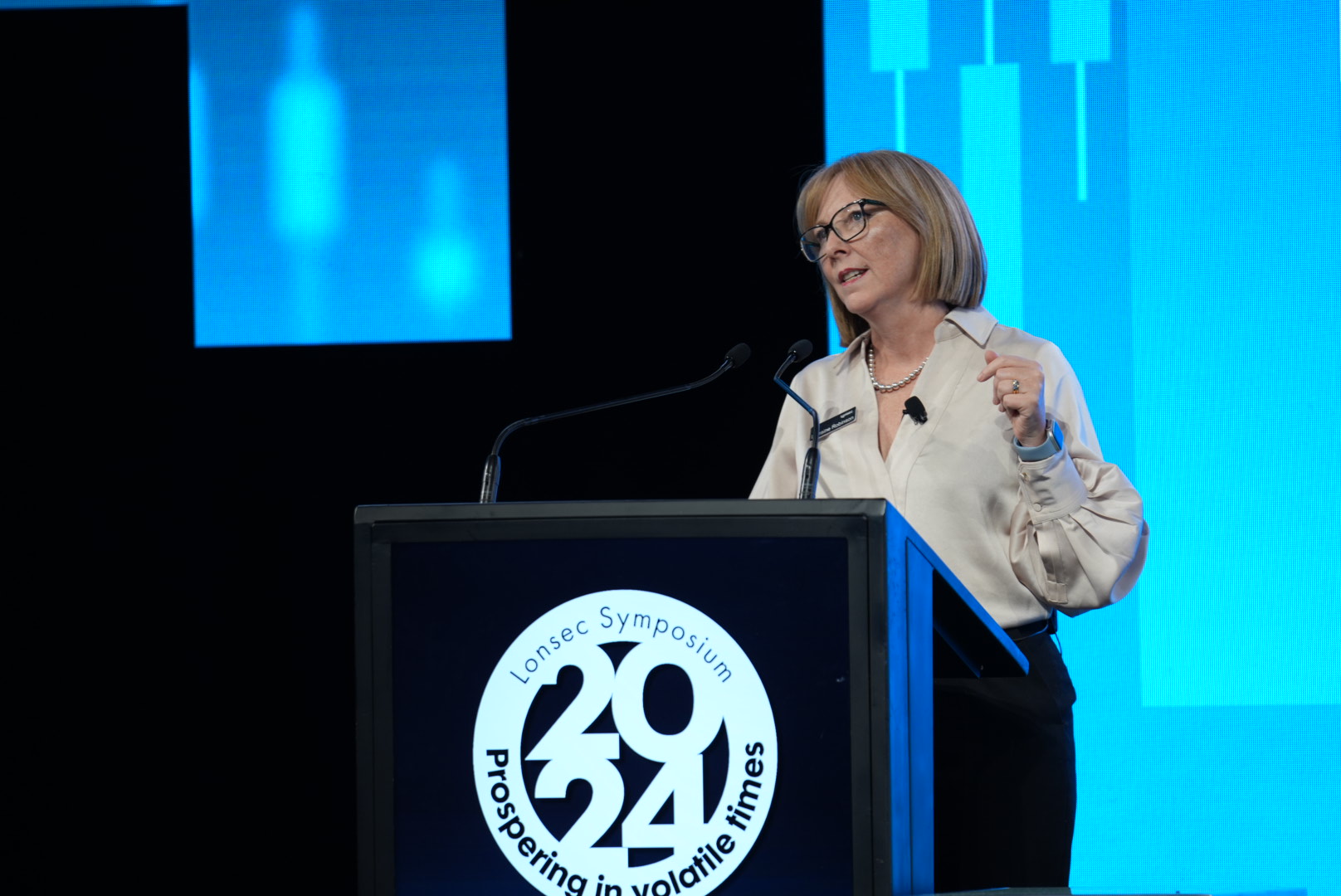

Partner with us

Lonsec has unrivalled exposure to the Australian financial services industry, with many advisers looking to us to help them make better decisions with their clients. Via our adviser targeted initiatives of the Lonsec Symposium and In the Spotlight video series, or through our investment consultants who can help you develop investment products to meet specific needs, partnering with Lonsec can help you reach a large section of advisers and dealer practices in Australia.