Many retirees with investments in the sharemarket will have seen the recent momentum-driven obsession and hysteria with companies like Afterpay, whose share price has gone from $20 to $100 in the space of six months, despite the fact that the company has yet to make a profit. Afterpay’s market-cap has now surpassed some of Australia’s most successful global companies, such as Amcor, Brambles, and Orica. So what’s going on, and what are the implications for retirees?

Sharemarkets around the world, including Australia’s, have experienced very strong rallies since their March lows thanks in the main to interest rates being cut to record lows and large quantitative easing from central banks. It can be argued that this flood of cheap money has led many speculative-type growth stocks to trade well above their fundamental value, led by the NASDAQ in the US.

Consumer patterns changed markedly through the COVID-19 virus lockdowns, as consumers stayed at home and as volumes in many areas facilitated by the internet have all boomed such as online shopping, social media, online conferencing, online gambling, and streaming services such as Netflix and Stan here in Australia. This has led to a significant rise in almost any stock that is technology-related.

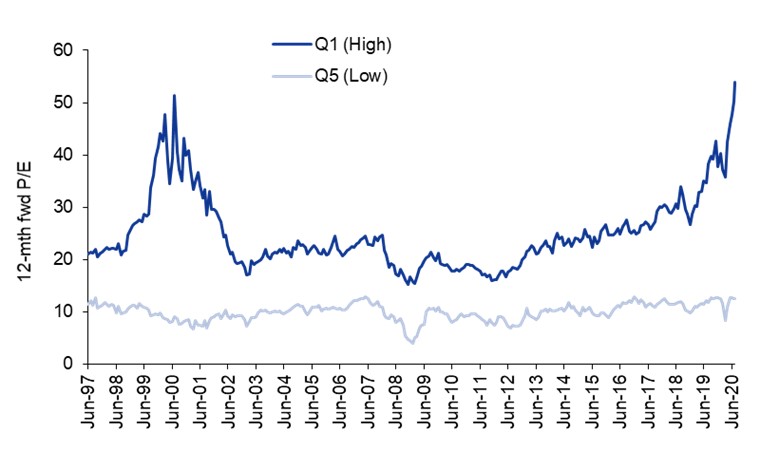

This phenomenon has driven the divergence between value and growth stocks to expand to levels which have now surpassed the ‘tech boom’ of 1999-2000, as Chart 1 below shows. With this momentum currently in full swing, many investors appear less concerned about the underlying fundamentals or valuations of many companies, and are instead focusing on anything with blue sky potential, particularly in the technology sector.

Chart 1: Average Price/Earnings of ASX200 Firms by Forward P/E Quintile

Source: Goldman Sachs Report 11 August 2020; chart range 30 June 1997 – 30 June 2020

‘Buy now pay later’ (BNPL) service provider Afterpay’s focus on reinvestment means that it is not yet profitable. Despite Afterpay’s first mover advantage and early success, competition in the sector is picking up quickly, which suggests that margins will come under pressure. As Table 1 shows, the sharemarket is assigning Afterpay an extraordinary valuation compared to well-established, profitable companies like Amcor, Brambles, or Orica. Given the global scale and profitability of these businesses, Afterpay’s valuation indicates that investors are taking an enormous leap of faith in Afterpay’s ability to reach sufficient scale and profitability to justify its nearly $30 billion market valuation.

Amcor is a global leader in consumer packaging products with US$12.5 billion in sales and US$1.03 billion underlying profit after tax in FY 2020, trading on around 16.3 times 2021 earnings, which looks reasonable for a global packaging leader which generates strong cashflows by servicing defensive end markets. Brambles is a global leader in pallet pooling solutions which earnt global revenues of US$4.7 billion and made an underlying profit after tax of US$504 million from continuing operations in FY 2020, and is trading on a P/E of around 21.6 times 2021 earnings and 19.4 times FY 2022 earnings.

Orica is the global leader in explosives and innovative blasting systems to the mining, quarrying and construction industries around the world. Orica is expected to earn global revenues of $5.6 billion in FY 2020 and make an underlying profit after tax of $320 million, and is trading on attractive multiples of around 18.2 times 2021 and 14.5 times 2022 earnings.

Table 1: Afterpay, Amcor, Brambles, Orica – Key Financial Metrics

| Company | ASX

Ticker |

FY21F Revenue

$Abn |

FY21 F Earnings

$Am |

Market-Cap

$Abn |

| Afterpay | APT | 0.9 | 25.0 | $29.7 billion |

| Amcor | AMC | 17.3 | 1,540 | $25.9 billion |

| Brambles | BXB | 6.8 | 720 | $15.9 billion |

| Orica | ORI | 6.0 | 370 | $6.7 billion |

Sources: Investors Mutual, Iress, FactSet. Data as at 10 November 2020

No matter how good Afterpay’s prospects are, to have it valued at more than one of the largest packaging companies in the world as well as higher than the largest pallet and explosive companies in the world combined seems to be an optimistic way of valuing the company. We prefer to back the proven fundamentals, management track records and steadily growing profitability of companies like Amcor, Brambles and Orica than to use what looks like excessively optimistic forecasts to try and justify Afterpay’s valuation and share price.

When markets are in an exuberant phase, it requires discipline and patience to avoid what look like excessively priced stocks and sectors. Our discipline back in 1999/2000 rewarded our investors with substantial subsequent outperformance. The conditions we see in sharemarkets today seem to echo the hype of that period. Our focus remains on companies that have recurring and predictable earnings, a strong competitive advantage, that are run by experienced and capable management teams, and that are trading at a reasonable valuation. We continue to believe that retirees will gain most benefit from owning a carefully selected collection of companies with these characteristics. This has proven over multiple market cycles to be more effective in delivery of tax-effective income and capital growth than chasing the latest exciting-sounding sector or fad.

Disclaimer

While the information contained in this article has been prepared with all reasonable care, Investors Mutual Limited (AFSL 229988) accepts no responsibility or liability for any errors, omissions or misstatements however caused. This information is not personal advice. This advice is general in nature and has been prepared without taking account of your objectives, financial situation or needs. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to buy, sell or hold that stock. Past performance is not a reliable indicator of future performance.