Super funds set to finish the financial year on a high

SuperRatings has released preliminary performance figures for superannuation fund performance for the period to 30 June 2021, with member accounts on track to balloon by over $300 billion.

Though the financial year isn’t quite over yet, and all eyes are on the government’s response to the latest COVID-19 outbreak, markets have continued to rebound strongly to date.

According to SuperRatings’ forecasts of performance for June, the median balanced option rose an estimated 1.2% over the month. Positive performance estimates were also released for the median growth option at 1.6% and the median capital stable option delivered an estimated 0.5%.

Over the 2020-21 financial year, the median balanced option is on track to deliver a return of 17.1%, the second highest figure since 1992. The key drivers of this result have been a rapid recovery in domestic and global equity markets since falls of 20-30% at the outset of the pandemic and strong listed property returns.

Accumulation returns to June 2021

| Financial Year | Calendar Year | 3 yrs (p.a.) | 5 yrs (p.a.) | 7 yrs (p.a.) | 10 yrs (p.a.) | |

|---|---|---|---|---|---|---|

| SR50 Balanced (60-76) Index | 17.1% | 7.9% | 7.6% | 8.5% | 7.9% | 8.2% |

| SR50 Growth (77-90) Index | 21.5% | 9.9% | 8.9% | 9.8% | 8.8% | 9.1% |

| SR50 Capital Stable (20-40) Index | 7.2% | 3.0% | 4.3% | 4.6% | 4.7% | 5.3% |

Source: SuperRatings estimates

Pension returns were also positive in June. The median balanced pension option returned an estimated 1.4% over the month and 18.6% over the financial year to date. The median pension growth option returned an estimated 1.7% and the median capital stable option gained an estimated 0.6% through the month.

Pension returns to June 2021

| Financial Year | Calendar Year | 3 yrs (p.a.) | 5 yrs (p.a.) | 7 yrs (p.a.) | 10 yrs (p.a.) | |

|---|---|---|---|---|---|---|

| SRP50 Balanced (60-76) Index | 18.6% | 8.3% | 8.2% | 9.4% | 8.5% | 9.1% |

| SRP50 Growth (77-90) Index | 23.2% | 10.5% | 9.6% | 10.7% | 9.7% | 10.2% |

| SRP50 Capital Stable (20-40) Index | 7.9% | 3.3% | 5.0% | 5.2% | 5.2% | 5.8% |

Source: SuperRatings estimates

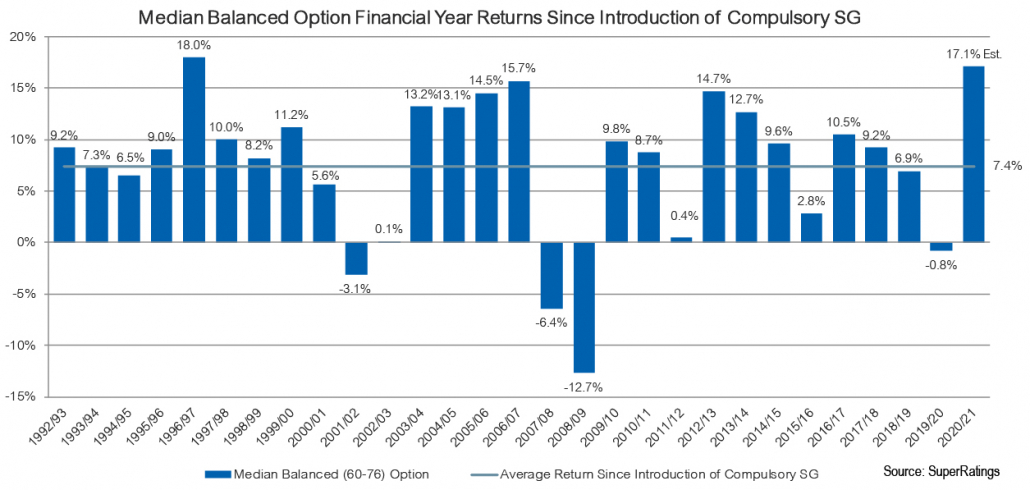

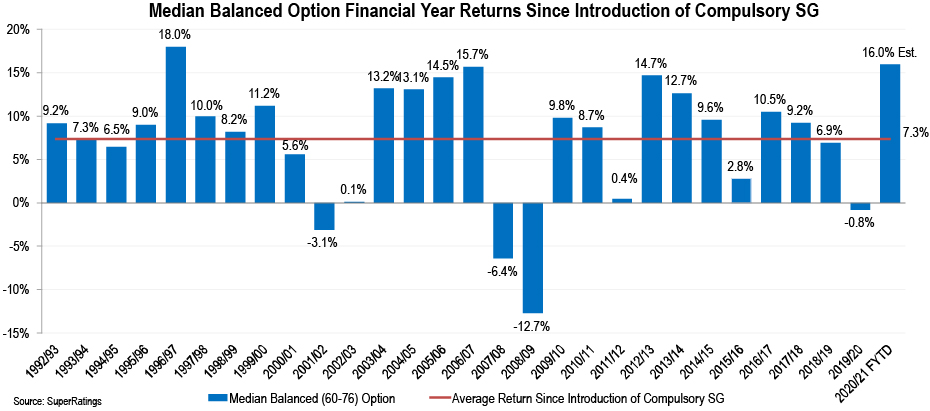

Strong performance over time

The chart below shows the return to the median balanced option over each financial year since the inception of the superannuation system, as well as the average return over this complete period. Over the 12 months to 30 June 2021 a forecast of 17.1% is displayed for the median balanced option based on SuperRatings’ SR50 Balanced (60-76%) Index.

A year ago, it would have been hard to believe that the typical balanced option would be delivering a near record return for the 2021 financial year. Since 1992, the benefits delivered by super funds are clear, with an average return of 7.4% each year. This is over 2% per annum ahead of fund objectives and demonstrates the value added to everyday Australians over the long term. The way in which funds have weathered the COVID-19 storm also shows the resilience of funds’ portfolios, as well as the levers they have in place to protect members when the market ride becomes bumpy.

Funds recover from initial pandemic impacts

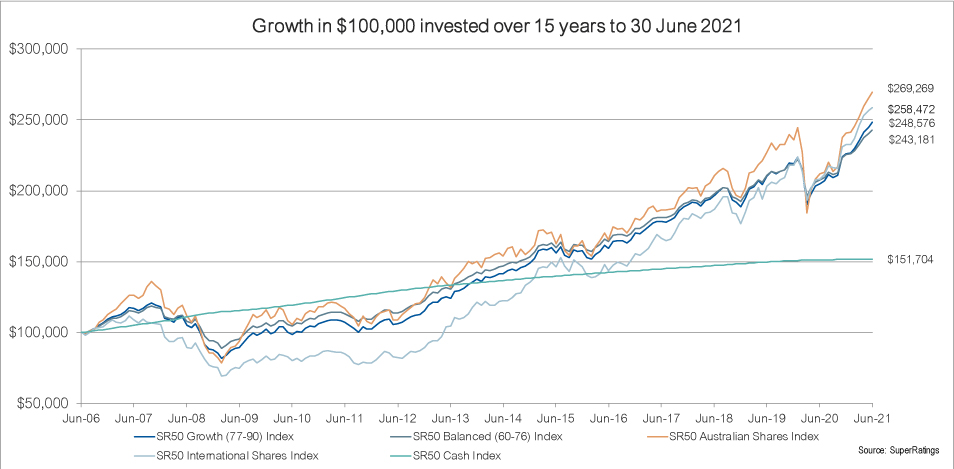

Super funds continue to build members’ wealth, with the median balanced option fund adding more than 140% over the past 15 years, while members in growth options have seen their savings grow by almost 150%.

This is despite the significant drawdowns members experienced during February and March of 2020, with balanced options recovering by November 2020 and growth options by December 2020. We found that a member who had a balance of $100,000 in January 2020 and switched to cash from balanced or growth at the end of March would now be around $20-25,000 behind their position if they had not switched. This again highlights the problems with trying to time the market.

Over the last fifteen years, the median balanced option has risen substantially, with a balance of $100,000 in June 2006 accumulating to $243,181, more than doubling in size. Growth members have experienced an even stronger result, with a similar starting balance growing to $248,576.

Share focused options have delivered the highest returns, with the median Australian shares option growing to $269,269 and the median international shares option growing to $258,472, though these types of options involve greater ups and downs.

Mr Rappell commented: “It’s pleasing to see another solid year of performance for Australian superannuation members, particularly in light of the pandemic environment. As the past year has again shown us, it is important not to get distracted by the ups and downs or short term noise, with these bumps ironing out over time.”

“While we have seen accumulation members fare well over this period, it remains a concerning time for retirees and members on the cusp of retirement for whom the challenges of deriving a meaningful income are very real. With cash and cash like investments such as bonds offering very limited returns and income for these members, we believe it is imperative that we focus on making super more relevant for those people relying on it and this is an area where more attention is needed.”

Funds outperform long-term objectives

Strong performance aside, it’s important to put this into context, funds aim to beat inflation by a certain amount, with targets of CPI + 3% or 3.5% over 10 years being common benchmarks used. Considering our estimate of performance over the 10 year period to 30 June 2021 of 8.2% for the median balanced option, this benchmark is easily being exceeded against an inflation estimate of around 2%.

Mr Rappell said “we continue to encourage members to focus on the long term and emphasise the importance of not trying to time the market, particularly since market uncertainty or the likelihood of ups and downs, is at an all time high. Super funds continue to meet the performance targets they have set over the long run, which should be reassuring to all Australians.”

The RBA board outlined it expects GDP to grow by 4.75% this year and 3.50% in 2022, supported by fiscal measures and accommodative financial conditions, while jobs, inflation, and wage pressures are expected to remain subdued.

Mr Rappell commented “the outlook for the year ahead is challenging to forecast. I expect to see choppy markets continue and hope to see economies and travel pick up as vaccination programs spread. Overall, the long-term story for super continues to be a positive one. I encourage members to set themselves in good stead for the financial year ahead and run a health check on their super. Contact your fund and update your details, insurance cover and beneficiaries and seek advice if you are unsure of anything such as the type of investment option or level of insurance cover suitable for you. A new financial year is a perfect time to organise what is often Australians’ second largest asset after their home.”

Release ends

Warnings: Past performance is not a reliable indicator of future performance. Any express or implied rating or advice presented in this document is limited to “General Advice” (as defined in the Corporations Act 2001(Cth)) and based solely on consideration of the merits of the superannuation or pension financial product(s) alone, without taking into account the objectives, financial situation or particular needs (‘financial circumstances’) of any particular person. Before making an investment decision based on the rating(s) or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances, or should seek independent financial advice on its appropriateness. If SuperRatings advice relates to the acquisition or possible acquisition of particular financial product(s), the reader should obtain and consider the Product Disclosure Statement for each superannuation or pension financial product before making any decision about whether to acquire a financial product. SuperRatings research process relies upon the participation of the superannuation fund or product issuer(s). Should the superannuation fund or product issuer(s) no longer be an active participant in SuperRatings research process, SuperRatings reserves the right to withdraw the rating and document at any time and discontinue future coverage of the superannuation and pension financial product(s).

Copyright © 2021 SuperRatings Pty Ltd (ABN 95 100 192 283 AFSL No. 311880 (SuperRatings)). This media release is subject to the copyright of SuperRatings. Except for the temporary copy held in a computer’s cache and a single permanent copy for your personal reference or other than as permitted under the Copyright Act 1968 (Cth.), no part of this media release may, in any form or by any means (electronic, mechanical, micro-copying, photocopying, recording or otherwise), be reproduced, stored or transmitted without the prior written permission of SuperRatings. This media release may also contain third party supplied material that is subject to copyright. Any such material is the intellectual property of that third party or its content providers. The same restrictions applying above to SuperRatings copyrighted material, applies to such third party content.

ANZ Default KiwiSaver Scheme

ANZ Default KiwiSaver Scheme AMP KiwiSaver Scheme

AMP KiwiSaver Scheme