The financial services industry was collectively holding its breath on Monday as Commissioner Hayne delivered the final report into misconduct and the 76 recommendations for how the system can be redeemed. Already chastened by the interim report, and already responding to the increased public awareness, there was a palpable sense of standing outside the headmaster’s office waiting for the punishment to be meted out.

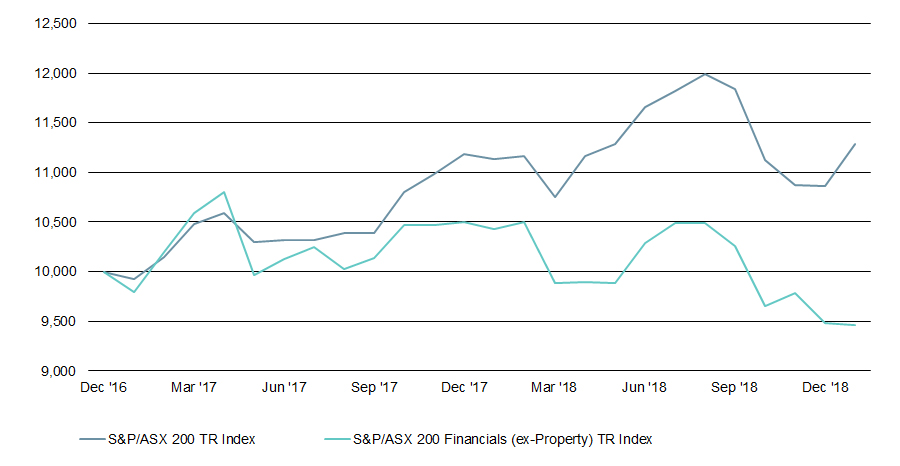

But it was a case of ‘sell the rumour, buy the fact’ as the market had clearly factored in more severe measures, particularly with respect to the vertical integration model. The share prices of the major banks and financial services institutions rose in the wake of the report’s release, but the sector as a whole took a beating through 2018, weighing down the index and contributing in part to the relative underperformance of Australian equities. Investors were reminded of the importance of a sustainable financial services industry given its predominant weighting in the ASX.

ASX index performance versus financials

Source: FE

While the Royal Commission has played an important role in highlighting specific instances of gross misconduct and brought to the public’s attention some of the key regulatory challenges facing the industry, the seeds of change had been laid much earlier. The shift in behaviour and the heightened focus on risk and the management of conflicts has already resulted in three of the major banks largely exiting the funds management business, which has kept the research team, and the fund managers we interact with, busy for almost two years. The Royal Commission may act as an important catalyst for further cultural change, but already self-interest and common sense have prevailed in setting the major institutions on the right course.

On a sector specific basis, Lonsec will be having further discussions in its upcoming income sector reviews with funds impacted – directly or indirectly – by the ban on trailing commissions and the heightened focus on responsible lending.