As it continues to grapple with the challenges facing retirees, the Australian retirement industry in some ways resembles a research institution―continually coming up with ideas for solutions to those challenges, testing them, then implementing them and reviewing the results.

For those involved in such an enterprise, it’s always interesting to see how well (or badly) those solutions work in practice, and the extent to which they’ve validated their research hypotheses.

At AllianceBernstein, we’ve been running the numbers on an investment strategy we launched five years ago, primarily for investors saving for retirement.

The strategy was developed in collaboration with a major Australian superannuation fund which had asked us to look for ways to “smooth the ride” for its members―that is, to help them earn meaningful investment returns while reducing the downside risk in their portfolios.

Reducing downside risk is, of course, important for investors who are in retirement or approaching it: the less their portfolios lose, the more money they have left over to deal with future market drawdowns, and the risk that they might live longer than expected.

There are several aspects to the strategy but, at its heart, is a portfolio of low-volatility stocks and a focus on aiming to limit downside risk to 50% of what the market experiences, while seeking to capture 80% of the upside when the market recovers.

Our research indicated that this might be achievable by combining careful stock selection (about which more later) with the so-called low-volatility paradox (the well-attested fact that a portfolio of low-volatility stocks can outperform the market over time on a risk-adjusted basis).

It’s been an eventful five years with several market ups and downs and our research hypothesis has been well tested. What have we learned?

SMOOTHER, BUT STILL THE OCCASIONAL BUMP

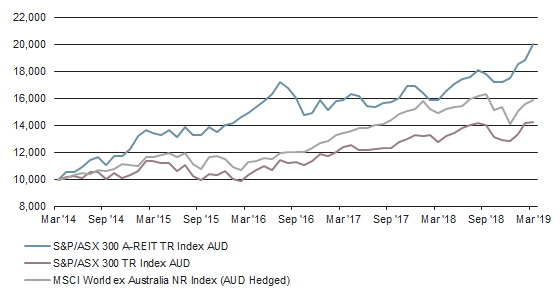

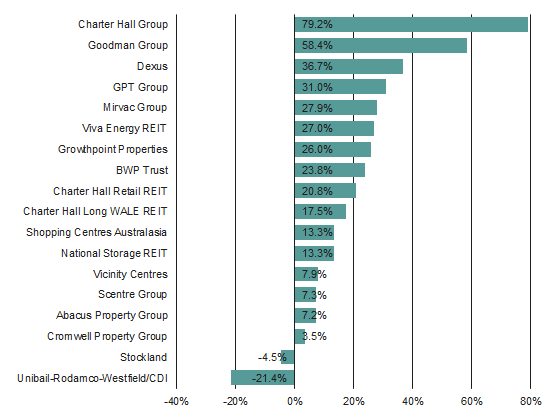

Pleasingly, the strategy has performed well, outperforming the market over the period (Display) and providing investors with a smoother ride, particularly when the market fell.

Downside Protection Generated Outperformance

April 1, 2014 to March 31, 2019

Source: S&P Dow Jones and AB; see Performance Disclosure.

As of March 31, 2019

Past performance does not guarantee future results.

Based on a representative Managed Volatility Equities account vs. S&P/ASX 300 Franking Credit Adjusted Daily Total Return (Tax-Exempt)

The returns presented above are gross of fees. The results do not reflect the deduction of investment-management fees or Fund costs. Performance figures include the value of any franking (or imputation) credits received. Numbers may not sum due to rounding. Periods of more than one year are annualised.

*For determining months when index is up or down, performance of S&P/ASX 300 (i.e., excluding franking credits) is used.

In fact, the strategy’s buffer on the downside contributed most to outperformance: the portfolio’s mean monthly return was 1.4% higher than the index when the market dipped and 0.3% lower when the market rose.

It’s interesting to note, too, that the strategy exceeded our aims in terms of upside/downside performance, with the portfolio suffering only 47% of the downside when the market fell (compared to our 50% target) and capturing 90% of the upside (our target was 80%).

There is a compounding effect at work here: limited downside means that the portfolio has less ground to make up when the market recovers, and this can contribute to outperformance over time.

It turns out, however, that even a strategy carefully designed to withstand volatility can experience the occasional bump, as happened when banks and mining companies performed very strongly after Donald Trump was elected US President in November 2016.

Bank and mining stocks tend to be volatile and, because they don’t figure highly in our low-volatility strategy, they were underweighted by our portfolio at the time. Financials and materials, of course, are the Australian share market’s biggest sectors. As they drove the market up, our portfolio lagged.

But the effect was short-lived and had relatively little impact on overall performance, appearing to validate one part of our hypothesis, that a low-volatility portfolio can outperform over time. What about the other part, regarding stock selection and portfolio management?

THE BIGGEST LESSON OF ALL

This consisted of five basic principles:

- choose low-volatility stocks where the underlying businesses are high quality, with good cash flows and strong balance sheets, and the shares are reasonably valued

- use fundamental research to avoid ‘volatility traps’, or the risk that idiosyncratic factors―such as a takeover bid―can make a normally stable stock suddenly volatile

- ignore market benchmarks when constructing the portfolio: this makes it easier to focus on low-volatility stocks, and to avoid the volatility inherent in Australian equity indices

- invest up to 20% of the portfolio in global stocks as a way of reducing risk, and making up for the necessity of limiting the portfolio’s access to the Australian market

- manage macroeconomic risk―such as the potential impact on the portfolio of Brexit or the US-China trade wars―thoughtfully, so that the removal of one risk doesn’t inadvertently create exposure to another

Applying these principles consistently contributed positively to performance over the period.

Perhaps the biggest lesson we learned, however, is that it’s possible to deliver investors above-market returns with below-market volatility.

We’re happy to share that knowledge, and the benefits it delivers, with our colleagues in the industry who are seeking to create a better retirement future for Australians.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

INFORMATION ABOUT THE AB MANAGED VOLATILITY EQUITIES FUND AllianceBernstein Investment Management Australia Limited (ABN 58 007 212 606, AFSL 230 683) (“ABIMAL”) is the responsible entity of the AllianceBernstein Managed Volatility Equities Fund (ARSN 099 739 447) (“Fund” or “AB Managed Volatility Equities Fund”) and is the issuer of units in the Fund. AllianceBernstein Australia Limited (“ABAL”) ABN 53 095 022 718, AFSL 230 698 is the investment manager of the Fund. ABAL in turn has delegated a portion of the investment manager function to AllianceBernstein L.P.(“AB”). The Fund’s Product Disclosure Statement (“PDS”) is available at the following link https://web.alliancebernstein.com/funds/au/equity/managed-volatility-equities.htm

or by contacting the client services team at AllianceBernstein Australia Limited at (02) 9255 1299.

Neither this document nor the information contained in it are intended to take the place of professional advice. Please note that past performance is not indicative of future performance and projections, although based on current information, may not be realised. Information, forecasts and opinions can change without notice and neither ABIMAL or ABAL guarantees the accuracy of the information at any particular time. Although care has been exercised in compiling the information contained in this report, neither ABIMAL or ABAL warrants that this document is free from errors, inaccuracies or omissions.

This document is released by AllianceBernstein Australia Limited ABN 53 095 022 718, AFSL 230 698.

DISCLAIMER

This document is provided solely for informational purposes and is not an offer to buy or sell securities. The information, forecasts and opinions set out in this document have not been prepared for any recipient’s specific investment objectives, financial situation or particular needs. Neither this document nor the information contained in it are intended to take the place of professional advice. You should not take action on specific issues based on the information contained in the attached without first obtaining professional advice. The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Current analysis does not guarantee future results.

INFORMATION ABOUT ALLIANCEBERNSTEIN

AllianceBernstein (AB) is a leading global investment management and research firm. We bring together a wide range of insights, expertise and innovations to advance the interests of our institutional investors, individuals and private clients in major world markets. AB offers a comprehensive range of research, portfolio management, wealth management and client-service offices around the world, reflecting our global capabilities and the needs of our clients. As at March 31, 2019, our firm managed US$555 billion in assets, including US$257 billion on behalf of institutions. These include pension plans, superannuation schemes, charities, insurance companies, central banks, and governments in more than 45 countries. This document is released by AllianceBernstein Australia Limited (“ABAL”) ABN 53 095 022 718, AFSL 230 698. AllianceBernstein Australia Limited (ABAL) is a wholly owned subsidiary of the AllianceBernstein, L.P. Group (AB).