Can lifecycle MySuper options really deliver a Magic Pudding or is it all just pie in the sky?

Experience working with members and employers suggests a real lack of understanding of the difference in approach between a lifecycle product and the alternative ‘single strategy’ product type. Yet in a future environment where legislation such as Your Future, Your Super is designed to encourage members to compare performance and determine whether they should potentially change funds, it is fundamental that members should understand and be able to compare the two product types. Particularly, since 37% of the 75 MySuper products registered with APRA as at 31 March 2022 were designated as ‘lifecycle’ products.

The value proposition of a lifecycle product is to place members in a lower risk strategy as they approach retirement, while still maintaining overall lifetime return by investing more aggressively during the earlier years of the member’s career. A fair comparison of lifecycle and single strategy products must therefore take into account both return over a typical member’s lifetime and the relative risk position at or near retirement.

Measuring lifetime investment performance

We have determined a methodology for calculating an ‘Equivalent Lifetime Return’ (ELTR) for MySuper products.

For a single strategy option, the ELTR is simply the annualised return for the option over the stated period (e.g. 5 years to 30 June 2022).

For a lifecycle strategy, the ELTR is the annualised return over a member’s lifetime from age 20 to 67 using each lifecycle stage option’s returns over the selected period, applied to the years during which the member would be invested in each lifecycle stage. For more detail and an example, refer to the Appendix to this article.

The ELTR as defined is designed to be calculated from the normal performance data published by super funds and collected by SuperRatings. Other methods could be used, but this definition is consistent with the use of long-term average rates of return which forms the basis for current performance comparisons across the industry.

Evaluating Risk at Retirement

There are several possibilities for measuring the portfolio risk of an investment option, including Growth / Defensive allocation and standard deviation of return. We have opted to use the ‘Standard Risk Label’ published by funds as part of their MySuper Dashboards. Despite some known shortcomings, the Standard Risk Measure has the virtue of being developed within the superannuation industry and being legislated for this purpose. In our comparisons, ‘Risk at Retirement’ is the Standard Risk Measure for the investment portfolio that would apply to a member at age 67 under a specific MySuper product. For single strategy MySuper products, it is simply the Standard Risk Measure for that strategy. For lifecycle products, it will typically be the lowest risk option in the product’s ‘glidepath’.

Product sample set

For this comparison, we included only registered MySuper products for which at least 5 years of historical performance is available. Returns were calculated to 30 June 2022. There were 45 products in total, of which 15 were classified as ‘lifecycle’ structures.

Top performers by ELTR

The following table summarises the Top 10 performing MySuper products by Equivalent Lifetime Return (ELTR):

| Rank | Fund Name | Structure | ELTR | Risk at Retirement |

| 1 | Qantas Super | Lifecycle | 7.94% | Medium to High |

| 2 | Hostplus | Single strategy | 7.76% | Medium to High |

| 3 | Aware Super | Lifecycle | 7.45% | Medium |

| 4 | AustralianSuper | Single strategy | 7.28% | High |

| 5 | HESTA | Single strategy | 6.75% | High |

| 6 | Vision Super | Single strategy | 6.71% | High |

| 7 | UniSuper | Single strategy | 6.65% | High |

| 8 | Lutheran Super | Single strategy | 6.60% | Medium to High |

| 9 | Cbus | Single strategy | 6.55% | Medium to High |

| 10 | VicSuper | Single strategy | 6.46% | High |

Perhaps as expected, the list is dominated by single strategy products with High or Medium to High risk profiles. Qantas Super and Aware Super were the only funds with lifecycle products to make the Top 10, and Aware Super was the only product that was able to put retiring members into a ‘Medium’ risk position at age 67.

Above-median performers by Risk at Retirement

Advocates of lifecycle products might contend that their objective is not necessarily to be in the Top 10 performers, especially if it involves a higher risk categorisation at retirement. Outperforming the median return might be a more realistic and consistent goal.

The median ELTR for our sample set was 5.92% per annum.

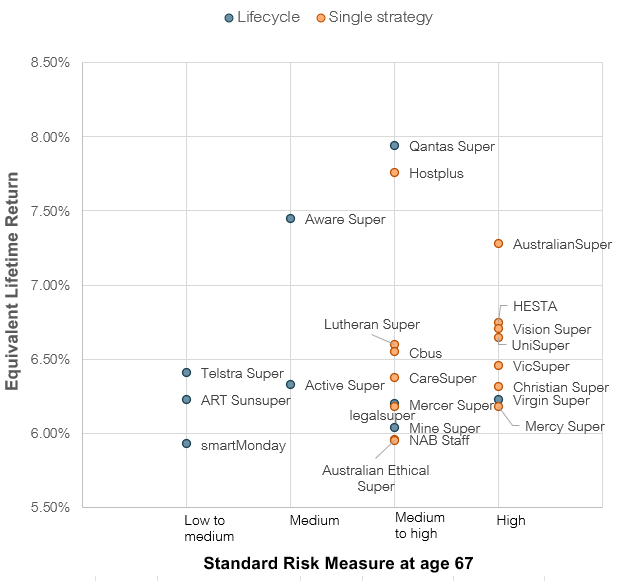

The chart below displays the 23 products which exceeded the median ELTR by risk at retirement category. We found that 9 out of 15 (60%) lifecycle products achieved an ELTR greater than the median, while 14 out of 30 (47%) single strategy products exceeded this benchmark.

Evidently, several lifecycle products have been able to deliver above-median performance (measured over a member’s lifetime) whilst placing their members in a lower-risk position close to retirement.

Conclusions

The aim of this research was to demonstrate a means of fairly comparing different types of MySuper products and assessing whether lifecycle products are able to deliver on their promise. Our main conclusion is that yes, there are lifecycle products that are able to deliver above-median lifetime performance whilst achieving their risk objectives near retirement. Nevertheless, the top performing products remain predominantly single strategies that are able to maintain exposure to higher returning assets (but with a higher risk classification) up until retirement.

The next questions are of course – how important is ‘de-risking’ near retirement for ‘disengaged’ members? Is there such a thing as a ‘disengaged’ member approaching retirement? Is a ‘one-size fits all’ approach to retirement risk suitable to address the differing needs of retirees? A secondary aim of this research is to open up these more fundamental questions in the context of measurable objectives. If we have achieved this objective, we may indeed have baked a magic pudding.

Appendix:

- Calculating the ELTR

The return shown in the MySuper performance tables is the Equivalent Lifetime Return (ELTR) calculated by SuperRatings for the 5 year period ending 30 June 2022. The model can determine the ELTR using either returns over 1, 3, 5, 7, 10, 15 or 20 years. The reason we haven’t focused on simply compounding 1-year returns is due to the volatility that we see over the short term.

For a single strategy option, the ELTR is simply the annualised return for the option over the stated period (e.g. 5 years to 30 June 2022).

For a lifecycle strategy, the ELTR is the annualised return over a member’s lifetime from age 20 to 67 using each lifecycle stage option’s returns over the selected period, applied to the years during which the member would be invested in each lifecycle stage. For example, if a lifecycle strategy has (say) a High Growth option applying up to age 50, then a Balanced option from age 50 to 60 and then a Capital Stable option applying until retirement, the ELTR would be calculated by compounding 30 years of the High Growth option’s returns together with 10 years of the Balanced option’s returns and 7 years of the Capital Stable option’s returns, converted to an average annualised rate of return over the entire 47-year period.

One challenge for this approach is the fact that there is currently insufficient data to provide 40 or more years of actual historical returns for each component investment option. To overcome this issue, the ELTR calculation is based on published average returns over a shorter time period, such as 1 year, 3 years, 5 years, 7 years, 10 years, 15 years or 20 years. In each case, the average return over the stated period is used as a proxy for each lifecycle stage’s return during the appropriate period of membership. For example, if the stated period is 5 years, a time-series of returns is developed for the member’s lifetime with the 5-year return used as the proxy return at each age i.e. the High Growth option 5-year return is used as the return for the member from ages 20 to 50, the Balanced option 5-year return then applies for ages 50 to 60 and finally the 5-year return for the Capital Stable option is applied from ages 60 to 67. These returns are then compounded over the 47 years and converted to an average annualised rate of return.

- Risk at Retirement

The measure of Risk at Retirement used for this analysis was determined by the product’s investment strategy at an assumed retirement age, which is age 67 for the purposes of this article. The risk metric is the Standard Risk Label at age 67 as disclosed in the product’s Product Dashboard.