Property and Australian shares weighed on fund returns in November, breaking the seven-month run of positive returns that have been boosting superannuation balances. Leading superannuation research house SuperRatings estimates that the median balanced option returned -0.5% to members over the month.

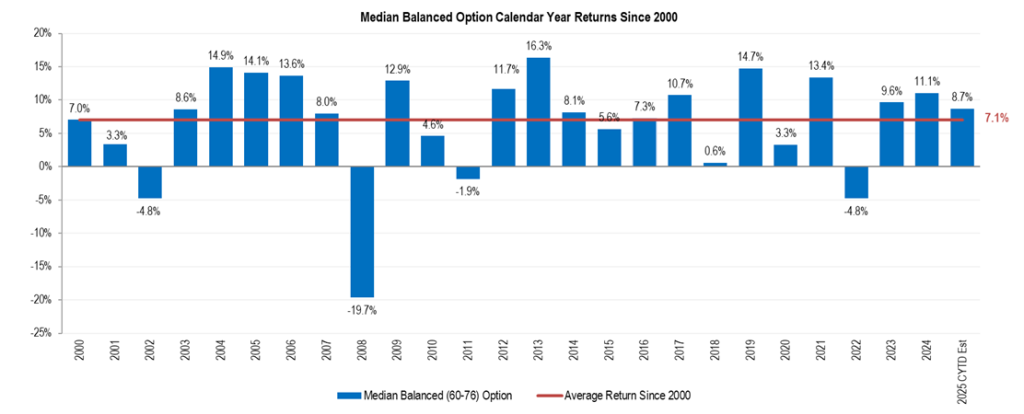

“We expect most asset classes to have delivered negative returns over the month with Listed Property and Australian shares seeing a pullback.” commented Kirby Rappell, Director of SuperRatings. “While this month breaks the strong run, 2025 is well on track to be an above average year for member balances, with the 11 months to 30 November 2025 estimated to have returned 8.7% against a median of 7.1% for the full year since 2000.”

The median growth option fell by an estimated -0.6% in November, while the median capital stable option is estimated to return -0.2% for the period.

Accumulation returns to 30 November 2025

| Monthly | FYTD | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a) | 7 yrs (p.a.) | 10 yrs (p.a.) | |

|---|---|---|---|---|---|---|---|

| SR Balanced (60-76) Index | -0.5% | 4.3% | 8.2% | 9.2% | 7.7% | 7.9% | 7.5% |

| SR Capital Stable (20-40) Index | -0.2% | 2.6% | 5.9% | 6.0% | 4.3% | 4.6% | 4.5% |

| SR Growth (77-90) Index | -0.6% | 4.9% | 9.1% | 10.7% | 9.2% | 9.3% | 8.6% |

Pension returns also fell over the month, with the median balanced pension option also falling by an estimated -0.5%. The median capital stable pension option is estimated to fall -0.2% over the month, while the median growth pension option is estimated to fall -0.7% for the same period.

Pension returns to 30 November 2025

| Monthly | FYTD | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a) | 7 yrs (p.a.) | 10 yrs (p.a.) | |

|---|---|---|---|---|---|---|---|

| SRP Balanced (60-76) Index | -0.5% | 4.9% | 8.9% | 10.3% | 8.5% | 8.8% | 8.4% |

| SRP Capital Stable (20-40) Index | -0.2% | 3.0% | 6.6% | 6.8% | 4.8% | 5.1% | 5.0% |

| SRP Growth (77-90) Index | -0.7% | 5.4% | 9.7% | 11.8% | 9.9% | 10.1% | 9.4% |

“The estimated decline means a second consecutive double digit calendar return is unlikely”, continued Mr Rappell, “however members should be pleased that returns remain strong over the long term with the median balanced option providing an estimated 7.1% per annum over the last 25 years. For pension members, the results have been even better with the median balanced pension product is estimated to return 9.5% for the 11 months to 30 November 2025”.

While the returns so far are worth celebrating, the reserve bank of Australia held interest rates in the final meeting of 2025 and the trajectory of inflation into 2026 remains somewhat uncertain. It is important to remember the long-term nature of superannuation and the benefit of holding steady to your long-term strategy should we see increased ups and downs over the second half of the 2026 financial year.

Release ends

We welcome media enquiries regarding our research or information held in our database. We are also able to provide commentary and customised tables or charts for your use.

For more information contact:

Kirby Rappell

Director of SuperRatings

Tel: 1300 826 395

Mob: +61 408 250 725

Kirby.Rappell@superratings.com.au

Require further information? Simply visit www.superratings.com.au.