Household consumption accounts for 56% of Australia’s GDP, making it the main engine of growth for the economy. When households cut back, the economy suffers, with flow-on effects to business and government in the form of lower sales and taxation revenue.

As consumers start making dramatic changes to their daily habits due to the coronavirus, what is the likely impact on discretionary spending and, by extension, GDP growth over the next quarter?

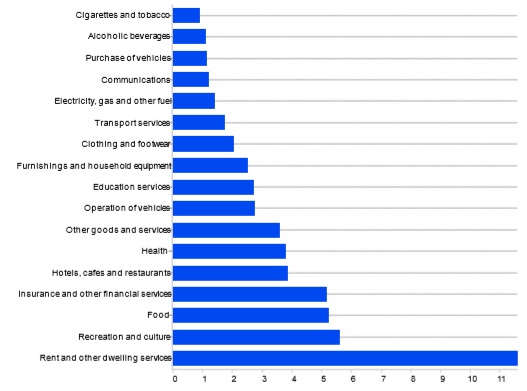

Based on the ABS national accounts data, rent and dwelling services is the largest component of consumer spending, representing 11.5% of GDP. This is followed by recreation and culture at 5.6%, food at 5.2%, and hospitality at 3.9%.

Australia’s consumption as a % of GDP

Source: ABS, Heuristic

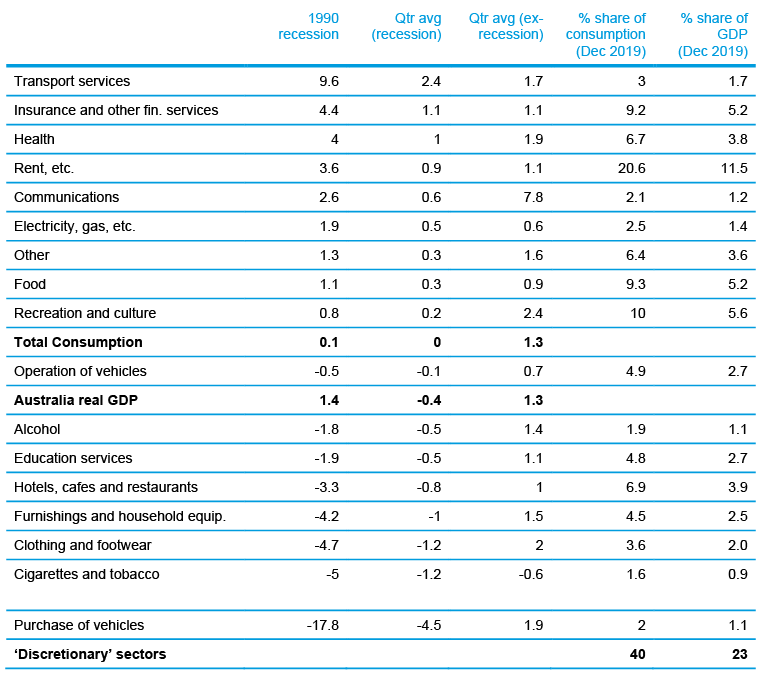

Some of these components of household spending are more cyclical – that is, they’re more sensitive to changes in the economic environment. The table below, prepared by Heuristic, shows each sector’s growth during the 1990s recession when GDP dropped 1.4% over four quarters. For example, it shows that purchases of new cars declined 17.8%, while food rose 1.1%.

The second and third columns show the average quarterly growth of each component in ‘recession’ and ‘non-recession’ regimes. This gives us an idea of which sectors might be more ‘discretionary’. For example, communications may have grown 2.6% in the 90’s recession, but growth outside of recessions was 7.8% per quarter. The final two columns show the share of each component of overall consumption and GDP.

We estimate that 40% of consumption is ‘discretionary’, and therefore at risk in the current environment, at least for the next one or two quarters. Note that the ABS’s retail sales data is ‘discretionary’ and represents around 30% of consumption. We estimate discretionary spending is around 22% of GDP. Some of these sectors (such as hospitality) are experiencing declines of 50% or more, while others may experience declines of 10%. Other sectors are experiencing significant increases in the short term (such as food).

Given the nature of the coronavirus pandemic, transport services are unlikely to lift as it did in the previous recession, while recreation and culture will suffer more than in the last recession.

Spending on the discretionary sectors could decline by at least 17% over the quarter. This would force overall consumer spending down some 6–7%. Once we allow for an imported component of 20%, the potential near-term impact on GDP could be in the vicinity of 3%. Chinese retail sales data released earlier in the week revealed a 20.5% decline over January and February due to business and industry shutdowns.

Hopefully we start to see positive effects from fiscal stimulus, along with the rate cuts and other measures announced by the RBA, although this won’t be evident until the June quarter. The good news, if there is any, is that markets have likely already priced in a significant hit to GDP, meaning there shouldn’t be much of a reaction when the next GDP release comes along.

Consumption during recessionary and non-recessionary periods

Source: ABS, Heuristic