Balancing the Needs, Challenges and Dilemmas of Retirement Investing

Retirement investing is necessarily complex.

The median super balance when entering retirement can’t support a comfortable lifestyle in the years ahead. In the first part of this series we outline the major investment building blocks and how they’re used to deliver better lifestyle outcomes for retirees.

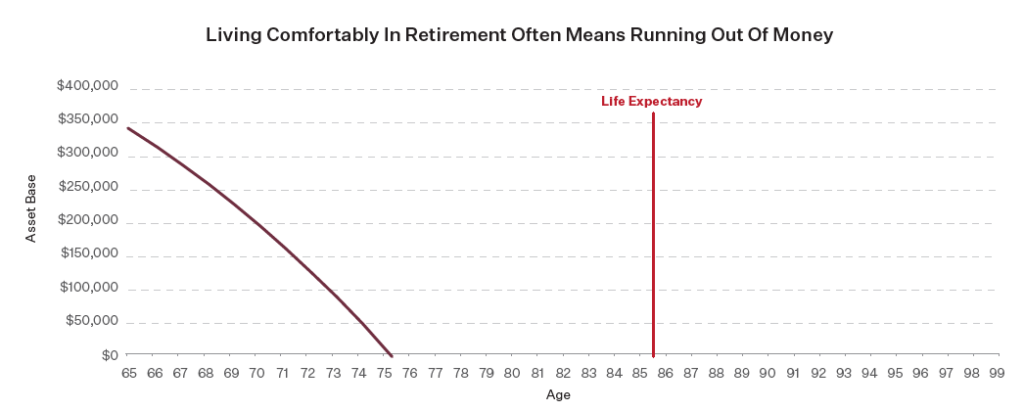

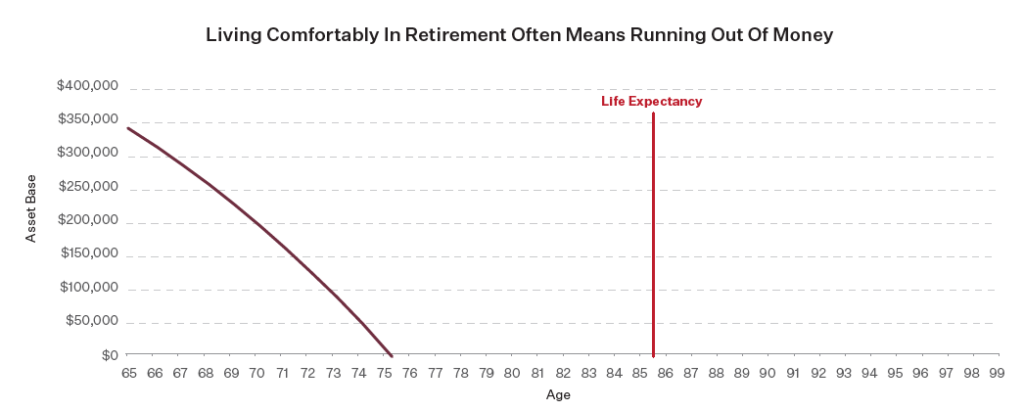

Australians spend 40 years of their working life building an asset base to retire. For the majority1 this asset base on Day 1 of retirement is insufficient to pay for their remaining life costs should they wish to live comfortably2.

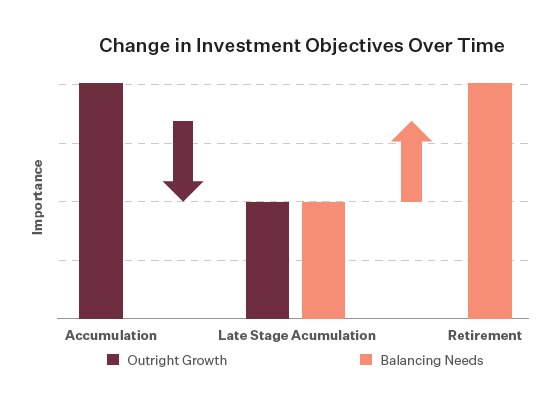

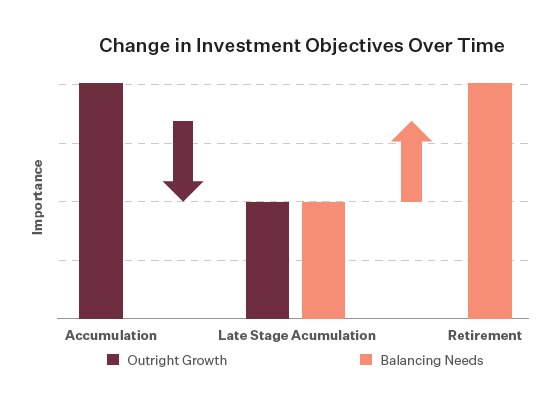

Specialised approaches to investing are the only way to breach this shortfall for retirees. Conceptually, growing our asset base in the accumulation phase is easy, we engage the growth investment engine and our risk is defined as opportunity cost.

In retirement, the engine of accumulation is still required.

Throughout the accumulation phase the investment engine was set to asset growth. For retirees, that engine must engage new gears, set for the unique combination of investment goals specific to retirement needs.

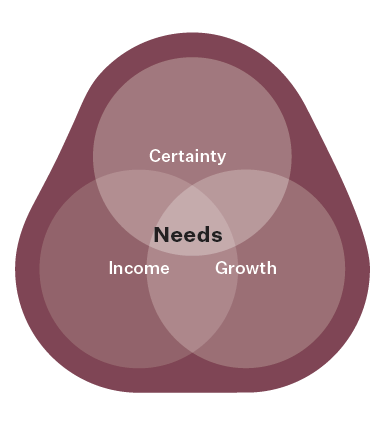

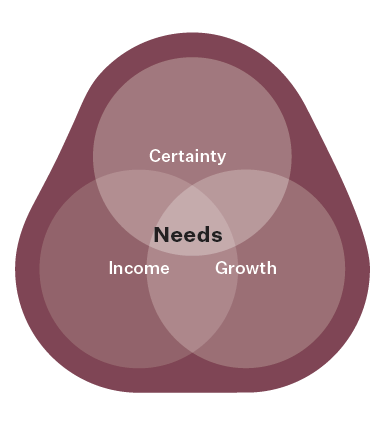

We spend 40+ years working to build an asset base to support us in retirement and in retirement we need that asset base to deliver 3 outcomes:

- Income generation, but not at the expense of capital loss;

- Growth of assets, but not risk losing all our savings;

- Certainty of outcomes…

…and do all this for an unknown number of years.

The investment engine now requires three components to successfully drive retirement outcomes:

Income, growth and certainty are important individual investment components but paradoxically are not always complementary to each other. However, it is only by combining them that retirees can meet their overall retirement needs – this makes retirement investing complex.

Whilst the sub-components of retirement investing may be complex, the investment framework and discussion of its rationale need not be. Simply put:

- Retirement investing has three core standalone objectives: Income, Growth, and Certainty which in combination are hard to balance. Each objective solves a specific Need, each Need presents a Challenge, and each Challenge has its own Dilemma

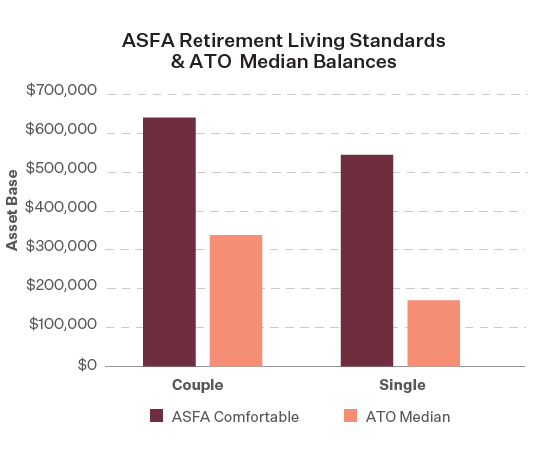

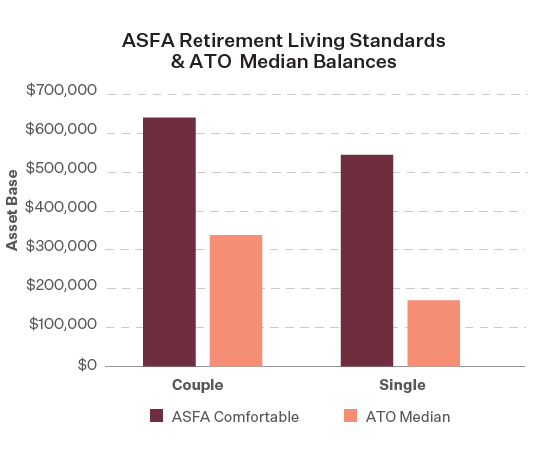

Based on the guidance provided by the ASFA Retirement Standards3, it’s clear that the Median Superannuation Balance4 isn’t enough to support a comfortable retirement.

We also know that the longer we live, the longer we’re expected to live. Thus, increasing the stress / responsibility on our savings to provide for retirement:

Life Expectancy At Age:

| Age |

At Birth |

65 |

75 |

80 |

85 |

90 |

95 |

100 |

| Males |

80.5 |

84.7 |

87.1 |

88.9 |

89.3 |

94.3 |

98.1 |

102.1 |

| Females |

84.6 |

87.3 |

89.1 |

90.4 |

89.9 |

94.9 |

98.3 |

102.3 |

Source: ABS 3302.0.55.001 – Life Tables, States, Territories and Australia, 2015-2017

With these data points in mind, aligning the investment engine to an investment strategy that meets client needs while engaging them in why and how this will help solve their problem isn’t easy, but it doesn’t need to be incomprehensible. Below we present each of the required retirement investment outcomes with their individual Need, Challenge and Dilemma concluding with a robust framework for delivering improved retiree lifestyles in retirement.

Income

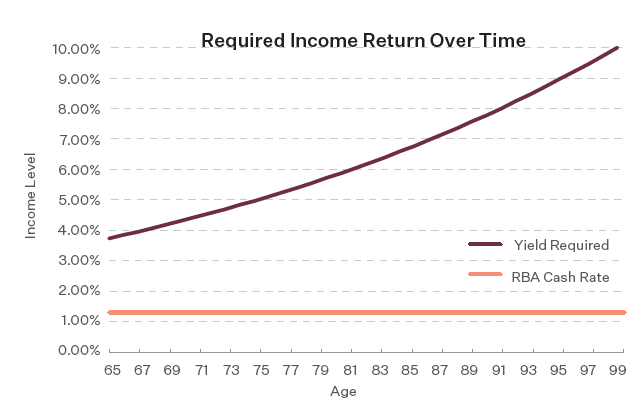

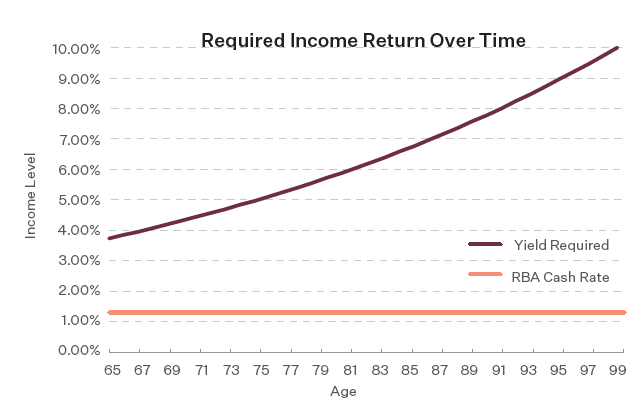

Need: Income generation, accounting for inflation, avoiding the risk of capital loss.

Challenge: To generate enough income from retirees’ existing asset base.

Footnote: Yield required from asset base based on ATO Median 64-69 year old superannuation balance, accounting for pension payment for homeowning couple (Male and Female), using ASFA Comfortable spending requirement, ASFA Inflation assumption of 2.75% p.a.

Dilemma: Income generation isn’t as easy as it once was. Today, with income levels either too low (for our needs) or too risky (as standalone investments), focusing solely on generating enough income from our asset base introduces significant risks that our asset base may be eroded while not adequately rewarding for the risk of running out of money and diminishing quality of lifestyle in retirement. Alone, investing for income is not an adequate solution for this unique challenge.

|

1990 |

2000 |

2010 |

2019 |

| RBA Cash Rate |

17.5% |

5.0% |

3.75% |

1.25% |

| Inflation |

7.8% |

1.9% |

2.1% |

1.3% |

| Real return on cash |

9.7% |

3.1% |

1.65% |

-0.05% |

Source: ABS, Inflation – Consumer price index; All groups, March 2019 (Series ID: GCPIAG)

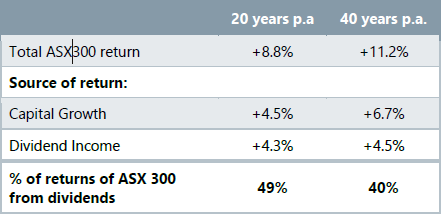

Growth

Need: Growth of assets, but not at the expense of losing my asset base.

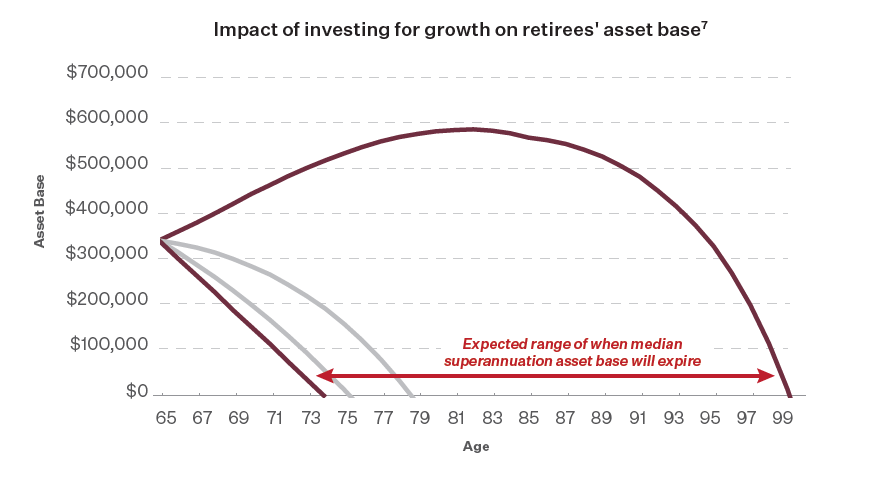

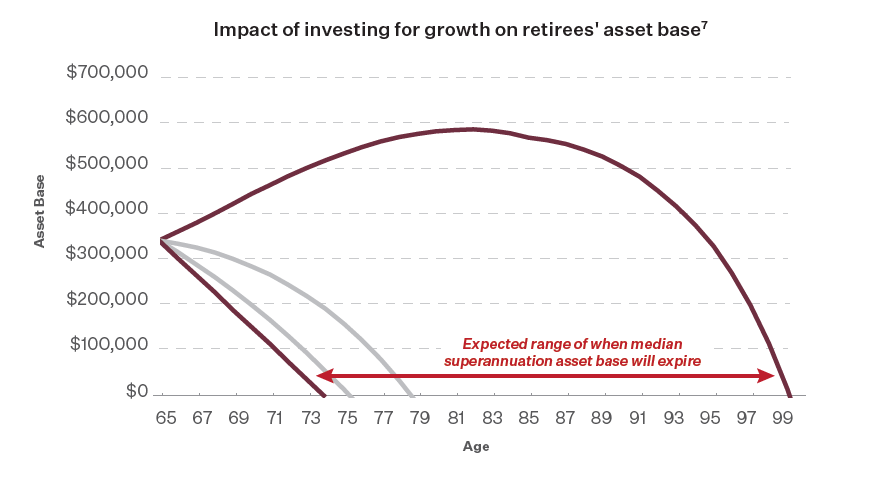

Challenge: Investing for growth is the only way to extend the duration of a comfortable retirement. However it can significantly increase the risk of reducing the extent of a comfortable retirement by eroding retirees’ asset base through poor returns. The ultimate measure of risk in retirement is “will this investment increase my risk of running out of money earlier?”, or in other words “what does this investment do to the range of outcomes for when I’ll run out of money?” To test what this risk is we add equities5 to cash, to build some simplistic scenarios to assess the impact of investing to achieve an expected 6% p.a. return6. This provides a picture of what the real risk of investing for growth to a retiree looks like.

Dilemma: Investing for growth is a prerequisite, but achieving growth and increasing the duration of a comfortable retirement isn’t risk free. Growth investing isn’t a straight-line reward, we all remember the GFC and the impact on invested savings. The risk to our asset base is real, finding the appropriate balance of this risk and appropriate growth assets can only come with a genuine understanding of the possible investments and how each may impact on retiree lifestyles.

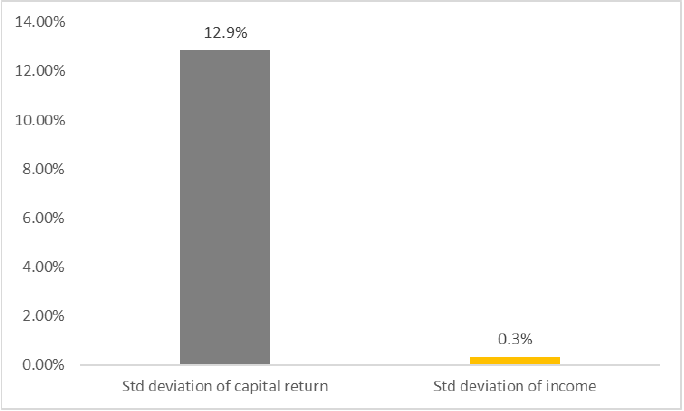

Certainty

Need: With only our asset base to support our living standards, providing certainty is critical to maintaining those standards.

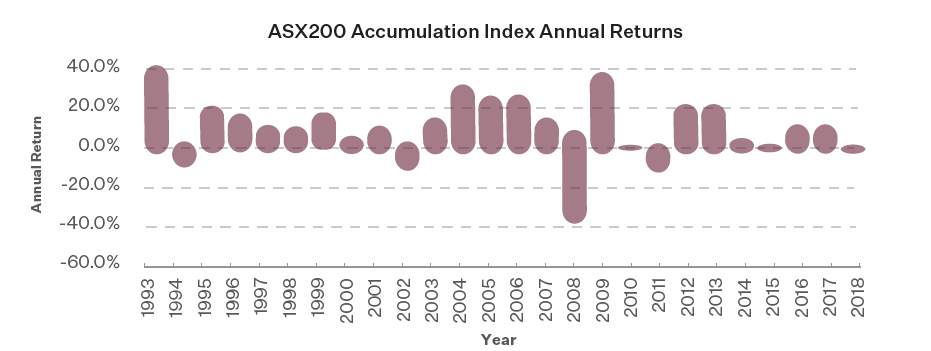

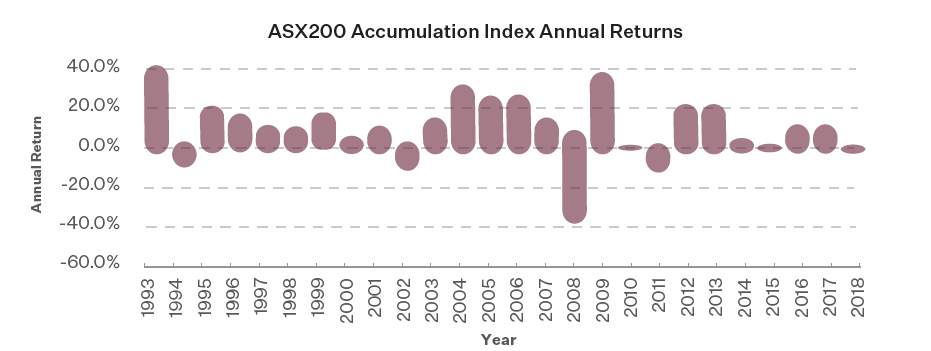

Challenge: Investing is uncertain. Retirement requires a level of certainty that traditional approaches may not facilitate. Certainty has an opportunity cost: lower risk necessitates lower expected peak returns.

There’s also a client engagement necessity of certainty. Australians are under-advised, so presenting them with comprehensible solutions and building trust as their partner is critical. It’s not hard to imagine that this trust would never eventuate if we were to introduce too much uncertainty, ultimately losing retirees through the diminished perception of the value of advice.

Being a genuine source of value to retirees throughout the most important part of their financial lives is of significant mutual benefit. This trust is facilitated through the use of solutions that provide increased certainty to investment outcomes.

Investment certainty and growth aren’t positively associated so approaches to retirement investing need to take certainty into account far more than in the accumulation phase. As a retiree knowing that my asset base will support a comfortable retirement for as long as possible is, arguably the most important goal to achieve.

Source: Bloomberg, based on calendar year total returns

Dilemma: People need advice to navigate the most complex of investment problems any of us face. Building trust in what we provide as fiduciaries is critical. The marriage of “complexity of challenge” and “simplicity of solution” isn’t straight forward or always self-evident, but is necessary to earn the trust of retirees.

Conclusion

In retirement, the investment engine of accumulation is still required. The task we set our engine is very different as finding the right mix of strategies providing Income, Growth and Certainty is imperative. Simply put, we have different needs as retirement investors.

Different needs require a different approach. The same strategies we employed in accumulation won’t work in retirement. We know this balance is imperative but equally important is the balance of the message for clients.

What remains constant, if not more important, is the trust we must maintain with retirees. We believe an understanding of the three key pillars of retirement investing, along with the challenges in achieving each and the dilemmas presented is essential. Having retirees’ needs at the centre of this understanding provides the best position to engage in the successful pursuit of a longer, more comfortable retirement.

Life is full of certainties, in retirement it’s no different: doing nothing leads to having nothing.

The solution isn’t easy, it requires; forgetting our investment approach in accumulation, different actions in the consideration of building investment structures and the adoption of unique investment approaches to truly ensure the retirement investment engine is working for retirees.

Specialised approaches to investing are the only way to breach this shortfall for retirees. Growing our asset base through a mix of growth, income and certainty increases the likelihood improving retirees’ retirement lifestyle for longer.

1 ATO Taxation Statistics 2016–17, Median super account balance, by ages 65 – 69, 2016–17 financial year

2 The Association of Superannuation Funds of Australia Limited, Retirement Standard for retirees, March Quarter 2019, Comfortable Lifestyle

3 The Association of Superannuation Funds of Australia Limited, Retirement Standard for retirees, March Quarter 2019, Comfortable Lifestyle

4 ATO Taxation Statistics 2016–17, Median super account balance, by ages 65 – 69, 2016–17 financial year

5 Lonsec Risk Profiles 2018, Step 3: Long term asset class return and risk assumptions, October 2018

6 ASFA, Retirement Standard March 2019, assumed investment earning rate

7 Calculated using Lonsec Risk Profiles, Long Term Asset Class Return and Risk assumptions to generate 6% p.a. expected return and using +/- 1 standard deviation to determine range of outcomes with c.66% confidence

Important Information

This document is intended for licensed financial advisers and institutional clients only and is not intended for use by retail clients. The information in this document is general information only and is not based on the objectives, financial situation or needs of any particular investor. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document. Financial conclusions are reasonably held at the time of completion but subject to change without notice.

Talaria Asset Management Pty Ltd ABN 67 130 534 342, AFS Licence No, 333732 assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Talaria, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from this document or any loss or damage suffered by the reader or any other person as a consequence of relying upon it.