When accumulating savings for retirement, the investment objective is clear – to grow and maximise savings. Risk in the accumulation phase is also well-defined and focused on the loss of capital, as measured by the volatility of investment returns or related downside risk measures. Risk tolerance is then typically used to determine appropriate investment profiles, with the aim of achieving greater wealth to fund retirements.

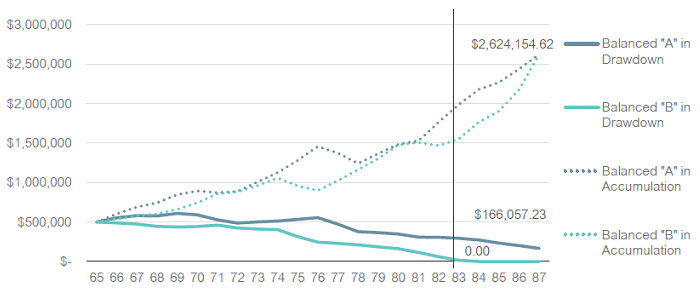

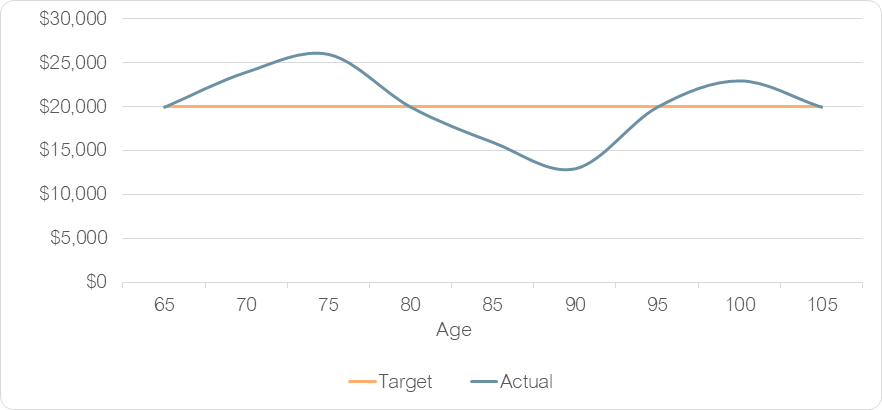

However, the risk-return landscape becomes significantly more complex once retirement comes into the picture. The primary objective in the decumulation phase ceases to be pure growth and more about using accumulated wealth to sustain a target level of income throughout retirement. Therefore, volatility of investment returns is no longer a suitable risk measure as it does not describe the risk of failing to meet this objective.

Retirement income risk measure

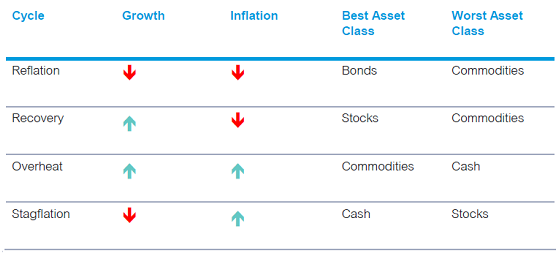

Traditional measures of variance (standard deviation) focus on both upside and downside variation. However, behavioural economists commonly point out that individuals are more averse to downside variation than upside variation. A more relevant risk measure in the context of decumulation is the probability of running out of money, or a measure of income variation. This captures important dynamics such as the sequence of returns, which can be particularly damaging in decumulation.

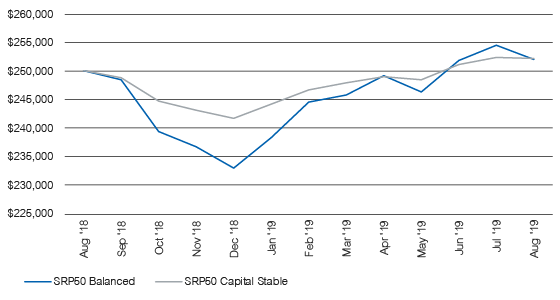

The risk can be depicted as:

The importance of risk measurement in retirement products is highlighted in a Treasury consultation paper which proposes a range of standard metrics to help consumers make decisions about the most appropriate retirement income product for their own circumstances.

The discussion paper proposes that a measure of income variation be provided in respect of all retirement income products and this measure is presented on a seven-point scale.

The finance industry uses terms like longevity risk, market risk, sequencing risk and inflation risk, which are all relevant to the outcome experienced by investors in a retirement income product. However, these terms are not well understood by a lay person, so an income variation measure could help fill in some gaps.

Retirement objectives

Lonsec’s Retirement Lifestyle Portfolios are objectives-based portfolios focused on delivering a sustainable level of income in retirement, as well as generating capital growth. Specifically, the portfolios are designed to assist advisers in constructing portfolios to meet retiree essential and discretionary income needs, while generating some capital growth to meet lifestyle goals.

Differences to Lonsec’s core accumulation model portfolios are:

- Income objective of 4% p.a. for all portfolios

- Greater bias to AUD denominated assets – historically higher dividends, franking credits

- Greater focus on absolute rather than relative performance

- Constructed to manage capital drawdown risk

- Fixed income allocations have less duration and greater credit exposure

- Key building blocks are Yield, Capital Growth & Risk Control

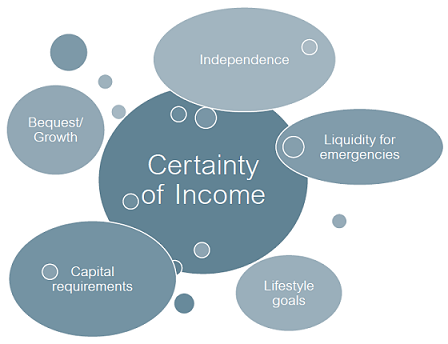

In reality, risk in retirement is multi-dimensional. An individual retiree may have multiple goals, such as leaving a bequest, with a different level of importance attached to each. An individual’s risk aversion in retirement will therefore be defined by a holistic view of their retirement goals, and the risks to those goals across all scenarios that could play out during retirement. Typically, more than one risk measure is necessary, with multiple scenarios required to truly appreciate the risks inherent with each solution.