As always there will be many different opinions on what might happen to markets in the coming year, but by and large most will agree it is unlikely to top the volatility and uncertainty of 2020. Amid the stimulus packages, lockdowns, PPE and politics, COVID-19 also brought to an end one long running market cycle and ushered in a new one, offering investors new opportunities with the potential for new risks and returns.

We believe understanding and navigating both will be more important than ever.

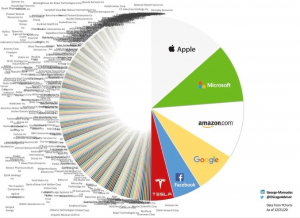

One of the main risks that still carries over from the last few years is the concentration of the index in just a few mega-capitalization companies. In fact, when considering the S&P 500, the top 10 companies still account for around 28% of the index, and as of late December 2020 the top 6 were worth more than the bottom 372 companies.

Why is this a problem?

Well if you’re buying the index you’re buying very expensive companies that have already grown substantially during 2020 such as Apple 86% and Amazon 76%. What’s riskier is Tesla (TLA) is nearly 2% of the index but only joined in late 2020, so index investors didn’t receive most of the benefit of its 700%+ growth, but bear all the downside if the stock were to fall.

Investors usually choose indices for their diversity – perhaps now they need to look again.

In addition, while global stimulus and support packages have helped economies from falling off a cliff, they have also pumped a lot more liquidity (cash) into the system. This, along with low interest rates may well support inflation for the first time in decades which even in small amounts can have a profound effect on stocks. Stocks with high valuations that are dominating the index (technology) are more susceptible to the increase in interest rates that usually accompanies inflation, meaning to get your money back you need to wait years if not decades. This is less the case with other sectors.

Is this likely?

While the potential for inflation is there, so too are signs of a rotation away from the tech stocks to those less highly valued sectors of the economy. From September to mid-December 2020, the S&P500 Value index outperformed Growth by around 8%, driven by more certainty about the real economy restarting on the back of a COVID-19 vaccine. While we can’t predict the future there is precedent here going back to the dotcom bust of 2000, where in the following 5 years Value had a resurgence to the point where it outperformed over the 10 years pre and post the bust.

To add to this are current data showing a significant increase in activity in the bellwether ISM New Orders Index which measures manufacturing activity, up 40% since the lows of 2020 and its highest level in over 3 years. The opportunity here lies in those sectors and regions that benefit from this new cycle economy, sectors that have been neglected, and so are cheap, but stand to benefit from the surge of global economic activity as populations slowly become vaccinated. The rewards here could be substantial.

Added benefit of options

Finally, the market is currently experiencing an unusual set of dynamics. Volatility (uncertainty) is higher than the long-term average, but so is the market. Usually the market is lower when volatility is higher.

This represents both heightened uncertainty alongside optimism, which has been fueled by some arguably unsophisticated market participants.

This creates unprecedented opportunity for professional investors, and especially for Talaria’s process of using put options to enter stock positions because:

- There is a greater contracted rate of return on the put options we sell, which can generate 3-4% p.a. more option premium into the portfolio p.a. all else being equal.

- The opportunity cost of not being fully invested is materially reduced given low expectations for equity market returns.

- Heightened volatility allows us to widen our buffers against loss and maintain our risk credentials.

As we like to say, certainty empowers you.