Trend following strategies have undergone notable evolution in their programmes over time. We discussed these changes, the motivation driving them, and their overall programme impacts in our 2019 Alternatives Sector Review. Market expansion, specifically expanding the tradeable instrument set to non-traditional and alternative markets, was briefly highlighted as one such modification at the time. In Lonsec’s view, this has been an acute and accelerated focus of managers of late, being a key research agenda item and translating to model enhancements warranting a more detailed discussion. That said, peer group constituents have generally utilised such markets or instruments in other strategies historically and/or have incrementally expanded the market set traded within their trend programmes over time. The pace of market inclusion of late has however been pronounced in the majority of researched trend peers.

The definition of alternative or non-traditional markets is inchoate being generally manager specific albeit with some commonality across trend peers. A key point is that these markets are distinct from traditional futures contracts and foreign currency forwards and can refer to markets, albeit not mutually exclusive, which are potentially more difficult to access (e.g. traded on specific exchanges), over-the-counter (OTC) or manual/voice-traded, exotic, or less liquid, by way of example. Assets can include esoteric interest rate swaps, cash (physical) equities, emerging market currencies, cash bonds, credit (e.g. ITRAX Xover, CDX HY and IG), volatility (e.g. VIX, VSTOXX) and certain commodities (e.g. Henry Hub Natural Gas futures, rapeseed), amongst others.

Man AHL’s Alpha strategy has doubled the quantum of markets traded post 2008 driven heavily by non-traditional markets/instruments additions with this now totalling over 350 markets, the majority of the c.530 instruments the programme can currently trade. For further context, since 2020, 13 US natural gas basis markets; two Asian REITs; 10 US sector ETF options; 10 US single name credit default swaps (CDS); three equity variance swaps were added to the AHL programme alone. The firm has largely been at the forefront of this continually evolving area in Lonsec’s view. This trend is also visible with newer entrants into the domestic market such as PIMCO TRENDS, an equity-hedge focused trend following product. PIMCO has incrementally expanded its tradeable markets over time with a c.10% (+18) increase in instruments occurring since January 2020. Additions include a range of equities and credit indices (e.g. CDX IG, ITRAX IG, ITRAX Xover), rates, currencies and commodities markets.

Winton has accelerated the use of OTC and non-traditional markets within its programme since 2020 with 32 new markets (the programme trades over 150 markets) added in December 2020, including interest rate swaps and a range of non-traditional commodities (e.g. Dutch Natural Gas). This was later followed by five credit default swaps and a further 17 Chinese commodity markets. Non-traditional markets now comprise 20% of that programme’s risk allocation. Integration of non-traditional markets within domestically available trend products has been a lesser focus in Lonsec’s view for Aspect which nonetheless has implemented non-traditional markets into its diversified programme (e.g. interest rate swaps and CDS were added in Q4 2017 and Q1 2018, respectively) and AQR (AQR on specifically product philosophy grounds) although the latter does trade a more relatively diversified currency programme. Both also manage standalone alternative market programmes whilst market expansion remains a key research agenda item.

Reasons driving this change are interrelated. A common observation amongst trend managers is that the behaviour of traditional commodity trading advisor (CTA) markets has changed post the Global Financial Crisis (GFC); for example, interest rates in many developed economies have remained at all-time lows through central bank actions and increased correlation in traditional commodity markets such as WTI Crude Oil to broader equity benchmarks. This has created a less favourable environment for trends and has partly impacted returns over the past decade. Relatedly, traditional futures markets have been impacted more by risk-on/risk-off market sentiment. Whereby higher correlations intra and inter markets and asset classes have been evident, there has been a pursuit to broaden diversification within programmes to discover markets with improved correlations. This has been an outcome of research into non-traditional markets.

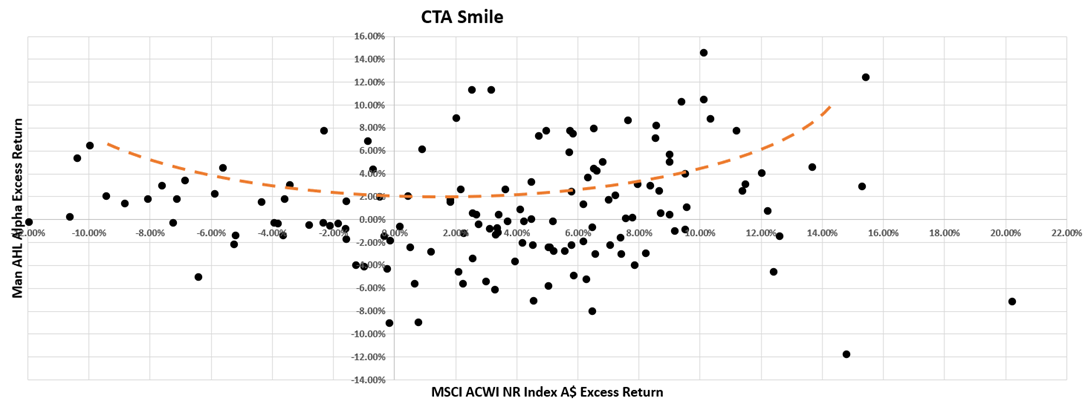

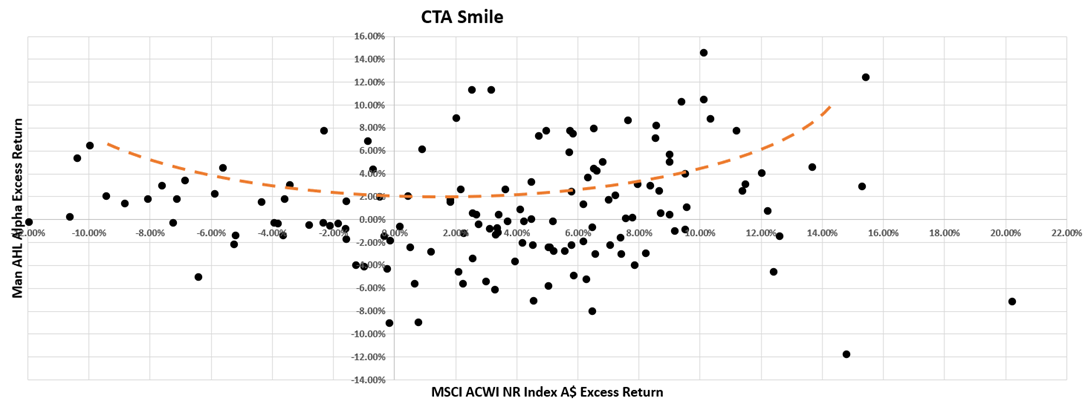

Notably, these markets have demonstrated correlation benefits to traditional futures and FX markets (e.g. 0.5 correlation between a dedicated AQR Alternative trends strategy and the BarclayHedge CTA Index simulated over January 1990 to December 2020) (AQR, 2021). This is however programme dependent. Further, such markets have generally not exhibited increased correlation to the extent otherwise evident in traditional futures and FX markets post the GFC (AHL, 2021). This improves overall programme diversification. Research has also shown these markets to have displayed attractive Sharpe ratios when applying time series, momentum-based models through back-testing over an extended period (AQR, 2021). Arguably of most critical importance, such markets have been additive to the desired convexity (i.e. CTA smile or ‘crisis alpha’) synonymous with trend following, that is, being able to perform well in equity bull and bear markets whether that be via a dedicated non-traditional markets trend strategy or as programme additions to an existing trend following strategy. We believe the long-running AHL Alpha product which, as detailed earlier, has included a high number of non-traditional markets over time, provides a good indication of this convexity profile (below).

Figure 1 – Monthly Excess Returns (measured against Bloomberg AusBond Bank Bill Index A$) of AHL Alpha vs. MSCI ACWI NR Index A$. Period: September 2009 to September 2021.

Source: Lonsec

A broader market set available for trading has also meant product evolution amongst systematic and trend following managers in more recent times with dedicated non-traditional markets trend following strategies. Man AHL stands as an outlier having managed the dedicated non-traditional markets (e.g. OTC asset classes, emerging markets, ETFs, less liquid futures and credit and swaps markets) focused Evolution programme since the mid 2000’s. Aspect has managed a programme dedicated to alternatives markets (e.g. OTC asset classes, emerging markets, ETFs, less liquid futures and harder to access credit and swap markets) since 2017 whilst AQR (2018) and Winton (2020) have launched products in the years following.

The process to implement such markets however naturally creates a range of complexities, namely relating to operations and execution/trading which requires navigation. The ability to trade such markets effectively ultimately requires prior experience to understand their nuances. Access, needless to say, is paramount, particularly for esoteric markets where new relationships may need to be cultivated with specialist brokers. Further, these markets can be manual, or voice traded, or sometimes available only on niche exchanges. The ability to establish trading relationships is therefore integral whilst potential upgrades to a firm’s execution capability may be required. That said, some markets such as ETFs, swaps and futures can leverage a manager’s existing trading infrastructure given these more align with traditional CTA assets. Counterparty (e.g. multiple clearing and execution brokers, monitoring of credit ratings) and collateral risk management cannot be understated as well.

Liquidity is an important consideration for competitive pricing but also to ensure product redemption terms are not compromised (i.e. the portfolio retains the ability to liquidate its positions at a reasonable time and pricing is not overly impactful). Higher trading costs can be expected for a variety of reasons (e.g. traded only niche exchanges, cannot be directly traded) potentially contributing to less volume but this is market dependent with access issues being on occasions a more pressing issue. There may be however a need to have a diverse set of banks and electronic communication networks at a manager’s disposal. That said, with the influx of participants, an argument could be mounted around liquidity improving through time. Analysis from AQR indicates that alternative trends comprise only US$8.8bn of total managed futures assets under management (US$110.5bn) as at December 2020 albeit growth in alternative trend strategy assets has been steadily increasing since 2012 (AQR, 2021). From a process standpoint, strategy capacity, given these markets are less liquid in general, can be impacted. There is also the potential for such markets to not provide the intended correlation benefits expected thereby compromising diversification properties which investors should be mindful of.

A trend towards China

Expanding into China has also been a noteworthy development amongst trend following peers via research into potential model enhancements (e.g. market expansion) and product development. This has been driven by the China Securities Regulatory Commission (CSRC), alongside the People’s Bank of China and the State Administration for Foreign Exchange’s decision to expand the framework of the Qualified Foreign Institutional Investor programme (QFII) which became effective in November 2020. This scheme provides the regime for offshore investors to gain direct access to onshore Chinese assets. The recent reformations to this framework further highlights China’s willingness to further open up and insitutionalise its capital markets.

Administrative benefits have been an important feature from this framework’s evolution (e.g. a simplified, digitised application process combined with swifter turnaround times for outcomes) alongside relaxation of qualification requirements (Mark, 2020). The revised scheme has also been expanded to cover all types of asset managers, notably, hedge funds who were previously restricted (Mark, 2020). Of perhaps greater relevance is the expansion of investment markets and instruments. The revised scheme now enables investment in securities and shares listed on China’s National Equities Exchange and Quotations; derivatives relating to bonds, interest rate and foreign exchange traded in the China Inter-bank Bond Market; private investment funds and commodity futures contracts and options traded at the relevant futures exchanges subject to approval (PricewaterhouseCoopers, 2020).

Lonsec has since observed a strong focus in research agendas and strategic direction of some of its trend following managers post these recent rule changes, particularly a focus on research into and potentially expanding (regulatory approval pending which is discussed later) its tradeable markets to commodity futures contracts. The greater breadth of commodity markets available in China alongside some idiosyncratic and exclusively traded markets on local commodity future exchanges are key attractions of these markets. Greater diversification in return drivers, programme breadth and correlation benefits; similar to the reasons underpinning the trend managers’ expansion into non-traditional and OTC markets has driven this geographical push.

Highly differentiated markets exclusive to Chinese futures exchanges include egg and bitumen by way of example which can provide correlation benefits to existing programmes (Bordigoni, Chang, Mackiic, Rossini, and Straker, 2021). Recent analysis by Man AHL into systematic investing in China prompted by the QFII scheme changes highlights this across a range of Chinese commodities. Apple, for example, showcases an attractive correlation profile (measured as monthly correlation over January 2015 to December 2020) with other commonly traded commodities: Corn (-0.09) and Soybeans (-0.33) whilst the average correlation against a range of Chinese and global commodities is only 0.03 (Bordigoni et al., 2021). Similar conclusions are drawn from a more recently published and comparable analysis by Aspect Capital (Aspect Capital, 2021). There are also strong correlation benefits from trading more traditional commodities futures such as globally traded corn with Chinese futures equivalents. Aspect’s analysis highlights that only a 0.29 correlation exists between corn futures respectively traded in China and the US over the period January 2015 to June 2021 (Aspect Capital, 2021). That said, high correlations do exist with China’s silver futures exhibiting near perfect positive correlation with its US equivalent (Bordigoni et al., 2021). Correlations can also time vary with Apples for example being uncorrelated or slightly negatively correlated (-0.05) with WTI Crude for the period of January 2015 to December 2020 (Bordigoni et al., 2021) although exhibits moderate positive correlation (0.38) when the analysis is extended for six further months under Aspect’s study. From an asset class perspective, generally low-to-moderate positive correlations are also evident when comparing Chinese equity indices (e.g. CSI 300) to other broader regional equity benchmarks; likewise this is also a similar observation for bonds (e.g. Bloomberg Barclays China Treasury + Policy Bank 1-10 Years TD Index Unedged US$) when comparing against other equivalent regional fixed income indices (Bordigoni et al., 2021).

Liquidity is a key consideration in the decision to add and delete markets from a programme. Data highlights that China’s commodity exchanges, defined as a combination of the Dalian Commodity Exchange, Shanghai Futures Exchange and Zhengzhou Commodity Exchange, ranked third in terms of volume traded for commodities options and futures in 2020 whilst esoteric markets such as bitumen surpass some more frequently traded global futures such as gold in terms of volume (number of contracts traded) (AHL, 2021). Chinese commodity futures markets being highly liquid is further evident from analysis undertaken by Aspect (Aspect Capital, 2021). This analysis shows Chinese commodity exchanges have overwhelmingly led trading volume (defined by number of contracts traded) in 2020 (Aspect Capital, 2021). When adjusting for US$ traded volumes, there is a lesser skew to Chinese futures with greater representation from global futures contracts with Gold (CMX), WTI (NYM) and brent crude (ICE) being the leaders (Aspect Capital, 2021). Chinese commodity markets nonetheless remain highly liquid, and liquidity has increased over time across metrics such as volume of contracts traded, US$ volume of contracts and open interest.

A key point to bear in mind however that as at the time of writing, individual contracts for commodities are still required to be approved for trading, which is an ongoing and evolving process, whilst stock indices in particular, can only be used for hedging purposes and cash bonds require full-funding (i.e. no leveraged exposure). There could be future developments in these respects. Managers are also required to apply for a QFI licence, some of whom are at various stages of this process. The sentiment ascertained from asset managers is that these should evolve positively in a way through time to enable a gateway of potential diversification and return opportunities.

References

AQR. 2021. Alternative Trends Strategy.

Man AHL. 2021. AHL Alpha Programme.

PricewaterhouseCoopers, 2020, China’s new R/QFII scheme announcement: Braving the wind and the waves while managing tax uncertainties, October 2020.

Mark, L 2020, China Releases New QFII/RQFII Rules, Haynes Boone, 27 October.

Bordigoni, G, Chang, A, Mackiic, A, Rossini, S, & Straker, K 2021, A Hot Commodity: Systematic investing in China, pp. 1-12.

Aspect Capital. 2021, Diversification: Made in China, 1 September 2021.

IMPORTANT NOTICE: This document is published by Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL No. 421445 (Lonsec). Please read the following before making any investment decision about any financial product mentioned in this document.

Disclosure as at the date of publication: Lonsec receives fees from fund managers or product issuers for researching their financial product(s) using comprehensive and objective criteria. Lonsec receives subscriptions for providing research content to subscribers including fund managers and product issuers. Lonsec receives fees for providing investment consulting advice to clients, which includes model portfolios, approved product lists and other advice. Lonsec’s fees are not linked to the product rating outcome or the inclusion of products in model portfolios, or in approved product lists. Lonsec and its representatives, Authorised Representatives and their respective associates may have positions in the financial product(s) mentioned in this document, which may change during the life of this document, but Lonsec considers such holdings not to be sufficiently material to compromise any recommendation or advice.

Warnings: Past performance is not a reliable indicator of future performance. The information contained in this document is obtained from various sources deemed to be reliable. It is not guaranteed as accurate or complete and should not be relied upon as such. Opinions expressed are subject to change. This document is but one tool to help make investment decisions. The changing character of markets requires constant analysis and may result in changes. Any express or implied rating or advice presented in this document is limited to “General Advice” (as defined in the Corporations Act 2001 (Cth)) and based solely on consideration of the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (‘financial circumstances’) of any particular person. It does not constitute a recommendation to purchase, redeem or sell the relevant financial product(s).

Before making an investment decision based on the rating(s) or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances, or should seek independent financial advice on its appropriateness. If our advice relates to the acquisition or possible acquisition of particular financial product(s), the reader should obtain and consider the Investment Statement or Product Disclosure Statement for each financial product before making any decision about whether to acquire a financial product. Where Lonsec’s research process relies upon the participation of the fund manager(s) or product issuer(s) and they are no longer an active participant in Lonsec’s research process, Lonsec reserves the right to withdraw the document at any time and discontinue future coverage of the financial product(s).

Disclaimer: This document is for the exclusive use of the person to whom it is provided by Lonsec and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by Lonsec. Financial conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from, this document or any loss or damage suffered by the reader or any other person as a consequence of relying upon it.

Copyright © 2021 Lonsec Research Pty Ltd (ABN 11 151 658 561, AFSL No. 421445) (Lonsec). This document is subject to copyright of Lonsec. Except for the temporary copy held in a computer’s cache and a single permanent copy for your personal reference or other than as permitted under the Copyright Act 1968 (Cth), no part of this document may, in any form or by any means (electronic, mechanical, micro-copying, photocopying, recording or otherwise), be reproduced, stored or transmitted without the prior written permission of Lonsec.

This document may also contain third party supplied material that is subject to copyright. Any such material is the intellectual property of that third party or its content providers. The same restrictions applying above to Lonsec copyrighted material, applies to such third party content.

Lonsec Manager of the Year

Lonsec Manager of the Year Lonsec Multi-Asset Fund of the Year

Lonsec Multi-Asset Fund of the Year Lonsec Active Equity Fund of the Year

Lonsec Active Equity Fund of the Year Lonsec Passive Fund of the Year

Lonsec Passive Fund of the Year Lonsec Active Fixed Income Fund of the Year

Lonsec Active Fixed Income Fund of the Year Lonsec Property and Infrastructure Fund of the Year

Lonsec Property and Infrastructure Fund of the Year Lonsec Alternatives Fund of the Year

Lonsec Alternatives Fund of the Year Lonsec Emerging Manager of the Year

Lonsec Emerging Manager of the Year Lonsec Innovation Award

Lonsec Innovation Award SuperRatings Fund of the Year Award

SuperRatings Fund of the Year Award SuperRatings MySuper of the Year

SuperRatings MySuper of the Year  SuperRatings MyChoice Super of the Year

SuperRatings MyChoice Super of the Year SuperRatings Pension of the Year

SuperRatings Pension of the Year SuperRatings Career Fund of the Year

SuperRatings Career Fund of the Year  SuperRatings Momentum Award

SuperRatings Momentum Award SuperRatings Net Benefit Award

SuperRatings Net Benefit Award SuperRatings Smooth Ride Award

SuperRatings Smooth Ride Award SuperRatings Infinity Award

SuperRatings Infinity Award