While inflation indicators continue to be closely watched, markets recorded a positive return in March following the slight fall in February, closing the first three months of 2023 on a positive note. Leading superannuation research house SuperRatings estimates that the median balanced option generated a return of 0.9% for March and 3.4% for the first three months of the year.

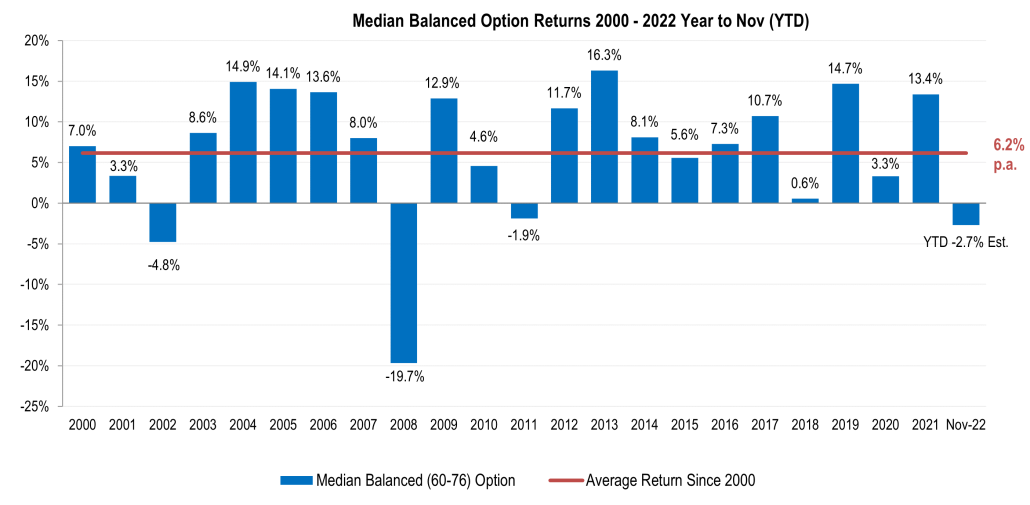

While the Reserve Bank paused their increases to the cash rate in April after 10 consecutive rises, significant uncertainty remains over the direction of the federal funds rate. While markets may anticipate a pause; there has been no pause in volatility as half of the previous 8 months returns were negative, with further volatility remaining the outlook for the remainder of the financial year.

The median growth option also rose by an estimated 0.9% over March, while the median capital stable option rose by an estimated 1.0% for the month.

Accumulation returns to March 2023

| Monthly | 1 yr | 3 yrs (p.a.) |

5 yrs (p.a.) |

7 yrs (p.a.) |

10 yrs (p.a.) |

|

| SR50 Balanced (60-76) Index | 0.9% | 0.6% | 8.9% | 6.1% | 6.9% | 7.4% |

| SR50 Capital Stable (20-40) Index | 1.0% | 0.9% | 3.9% | 3.3% | 3.9% | 4.5% |

| SR50 Growth (77-90) Index | 0.9% | 0.6% | 10.9% | 7.2% | 8.0% | 8.7% |

Source: SuperRatings estimates

Pension accounts provided slightly better returns over the period, with the median balanced pension option rising an estimated 1.1%. The median capital stable pension option is also estimated to have gained 1.2% over the month while the median growth pension option is estimated to rise by a slightly smaller 0.9% for the same period.

Pension returns to March 2023

| Monthly | 1 yr | 3 yrs (p.a.) |

5 yrs (p.a.) |

7 yrs (p.a.) |

10 yrs (p.a.) |

|

| SR50 Balanced (60-76) Index | 1.1% | 0.4% | 9.9% | 6.6% | 7.7% | 8.1% |

| SR50 Capital Stable (20-40) Index | 1.2% | 1.0% | 4.5% | 3.7% | 4.4% | 4.9% |

| SR50 Growth (77-90) Index | 0.9% | 0.2% | 11.8% | 7.9% | 8.9% | 9.4% |

Source: SuperRatings estimates

“Super funds continue to demonstrate their ability to capture upside benefits for members when they are available in the market while managing for market volatility through diversification. As we edge closer to the end of the financial year the outlook feels slightly more stable, although there is still a chance that annual returns could drop back into negative territory depending on the final quarter of the financial year”, commented Executive Director of SuperRatings, Kirby Rappell.

“While there has been significant ups and downs over each month in the year so far, the estimated financial year to 31 March return sits at 6.6%. Superannuation remains a long term investment for most and these shifts also have a much smaller impact when considering 10 year performance. Funds are well equipped to navigate changing markets, with 10 year performance estimated to be 7.4% and demonstrating resilience to date” Mr Rappell added.

Release ends

We welcome media enquiries regarding our research or information held in our database. We are also able to provide commentary and customised tables or charts for your use.

For more information contact:

Kirby Rappell

Executive Director

Tel: 1300 826 395

Mob: +61 408 250 725

Kirby.Rappell@superratings.com.au