The possibility of the RBA undertaking a quantitative easing program could have major ramifications for retirees, who may be forced to increase their exposure to equities if interest rates continue to spiral downwards.

It’s been an eventful month for markets – the Coalition won the federal election in a surprise upset, the RBA cut rates to record lows, and US-China trade tensions re-emerged with a vengeance. Domestic markets reacted positively to the Coalition win, with some of the pessimism surrounding the housing market subsiding. The RBA’s rate cut was not unexpected, with most analysts having already priced in the cut and potentially another.

Interestingly, the market narrative has turned to the possibility of the RBA undertaking a quantitative easing (QE) program domestically, similar to what we have seen in Europe and the US. This would involve the RBA buying government and corporate bonds using cash on its balance sheet, effectively flooding the market with liquidity while keeping rates low. Should rates continue their downward trajectory and QE become a reality, it may force investors into equities, providing a tailwind for markets as we have seen in the US and Europe in recent years. This is particularly relevant for retirees, who may be increasingly forced to lift their exposure to Australian equities as a source of income.

While it’s difficult to know exactly what the relationship is between large-scale asset purchases and the stock market, evidence in the US and Europe suggests there is a positive correlation. The launch of QE in the US resulted in significant share market gains, in part because the market anticipated an improvement in macroeconomic conditions. Proponents of QE tend to be critical of the US Fed for undermining the effectives of the program through its forward guidance (which made the program less open-ended by emphasising the eventual exit from QE), as well as not going hard enough for long enough. Critics of QE claim that large-scale asset purchases inflate asset values, which can lead to a stock market bubble and greater inequality. Yet others believe that monetary policy is entirely fruitless, and fiscal policy is the only effective mechanism.

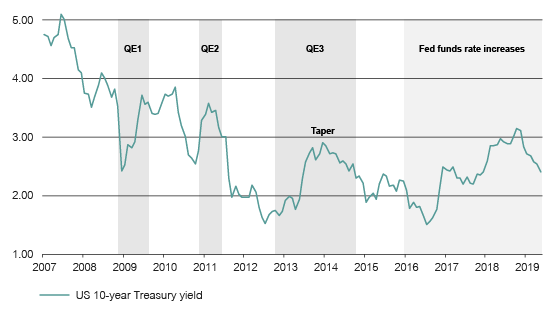

The precise effect of QE is difficult to determine. While some claim it has been responsible for lowering interest rates, the evidence suggests it might in fact have led to an increase in yields during those periods where it was in effect (see chart below). Bond purchases raise the price of these assets, resulting in a fall in yields, which negatively impacts the return of safe assets like Treasuries, high-quality corporate debt, and cash. This is bad news for retirees who rely on these safe assets to preserve capital or generate a secure income stream. However, if QE manages to raise expectations for long-term growth, this would lead to a rise in longer-term yields, reflecting the prospect for higher growth and inflation.

QE episodes in the US have coincided with a rise in the 10-year yield

Source: FRED, Lonsec

How seriously the RBA is considering QE is unknown, but given the challenges facing conventional monetary policy with interest rates nearing zero, it must be something the bank is thinking about. If the RBA does go down the QE path, it will be difficult to satisfy the critics on both sides of the QE divide. According to economist Stephen Kirchner, the US experience with QE suggests the RBA would need to buy securities equivalent to around 1.5% of GDP to achieve the same effect as 25 basis point reduction in the official cash rate. This would represent a QE program of significant scale for Australia.

If retirees are worried about QE, the RBA is likely just as reluctant to pull the trigger. The not-so-subtle comments from Phillip Lowe and others about the need for structural reform should be heeded by Canberra to avoid placing too great a burden on monetary policy. This is critical given the challenges facing the global economy, including the current trade tensions between the US and China, which continue to adversely impact markets and are contributing to bouts of volatility. The longer the trade wars drag on, the higher the probability that we will see a longer-term impact on global growth.

This is a challenging period for investors, where factors other than fundamentals are having a material impact on the trajectory of markets. In such an environment, we believe selective valuation opportunities will present themselves for long-term investors, however ensuring that your portfolio is diversified will be very important in navigating an increasingly volatile market environment. It’s also a timely reminder that complex macro issues can play a large role in determining the right asset allocation in retirement portfolios, which requires an experienced investment committee with a range of skills and knowledge. This is especially important when it comes to the construction of retirement portfolios, where complex macro issues can have dynamic effects on outcomes.