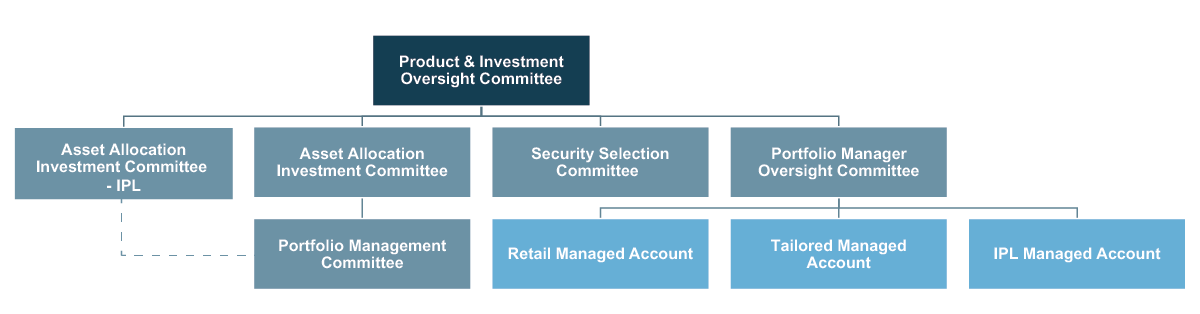

Lonsec Group Investment Governance

All Lonsec Investment Solutions portfolios are overseen by Lonsec’s various internal investment committees. The committees include our asset allocation, security selection, portfolio manager oversight and portfolio management committees which are all comprised of senior members of the Lonsec Investment Solutions team, as well as a panel of independent investment experts.

Product Investment Oversight Committee

Dr Steve Garth

Independent Chair

Mike Wright

Lonsec Group CEO

Bruce Hawkins

Chief Operating Officer

Deanne Baker

Portfolio Manager

Nathan Lim

Executive Director – LIS, CIO

Committees

Asset Allocation Investment Committee (LIS AAIC)

Nathan Lim (Chairperson), Deanne Baker, Veronica Klaus, Emmanuel Calligeris, Phil Graham, Waylen Ramsey (Secretary)

IPL Asset Allocation Investment Committee (IPL AAIC)

Nathan Lim (Chairperson), Paul Dortkamp (Secretary), Tim Farrelly, Nick Field, Chris Robertson, Chris Smith

Security Selection Committee (SSC)

Nathan Lim (Chairperson), Veronica Klaus, David Matesic, Nick Field, Brook Sweeney, Eleanor Menniti, Chris Robertson, Ron Mehmet, Deanne Baker, Danial Moradi, Isrin Khor, David Boyle, Waylen Ramsey (Secretary)

Portfolio Manager Oversight Committee (PMOC)

Nathan Lim (Chairperson), Deanne Baker, Veronica Klaus, Danial Moradi, Nick Field, Waylen Ramsey (Secretary)

Portfolio Management Committee (PMC)

Nathan Lim (Chairperson), Deanne Baker, Danial Moradi, Nick Field, Chris Robertson, Veronica Klaus, Ron Mehmet, Brook Sweeney, David Matesic, Eleanor Menniti, David Boyle, Waylen Ramsey (Secretary)

Committee Members

Nathan Lim

LIS AAIC (chair), IPL AAIC (chair), SSC (chair), PMOC (chair), PMC

Danial Moradi

SSC, PMOC, PMC

Paul Dortkamp

IPL AAIC

(independent & secretary)

Tim Farrelly

IPL AAIC (independent)

Deanne Baker

LIS AAIC, SSC, PMOC, PMC

Chris Robertson

IPL AAIC, SSC, PMC

Nick Field

IPL AAIC, SSC, PMOC, PMC

Veronica Klaus

LIS AAIC, SSC, PMOC, PMC

Ron Mehmet

SSC, PMC

Brook Sweeney

SSC, PMC

Phil Graham

LIS AAIC (independent)

Emmanuel Calligeris

LIS AAIC (independent)

David Matesic

SSC, PMC

Eleanor Menniti

SSC, PMC

Chris Smith

IPL AAIC

Isrin Khor

SSC

David Boyle

SSC, PMC

Waylen Ramsay

LIS AAIC (secretary), SSC (secretary), PMOC (secretary), PMC (secretary)