Despite returns swinging between positive and negative throughout the year, super funds delivered strong returns for members over 2023, boosted by a share rally in the final quarter of the calendar year. The median Balanced option reported a 2.7% return in December, and 9.6% for the full 2023 calendar year, fully recovering the

-4.8% loss from the previous year.

Accumulation returns to 31 December 2023

| Monthly | 1 yr | 3 yrs (p.a.) |

5 yrs (p.a.) |

7 yrs (p.a.) |

10 yrs (p.a.) |

|

| SR50 Balanced (60-76) Index | 2.7% | 9.6% | 5.9% | 7.1% | 6.7% | 6.8% |

| SR50 Capital Stable (20-40) Index | 2.0% | 6.5% | 2.8% | 3.9% | 3.9% | 4.4% |

| SR50 Growth (77-90) Index | 3.0% | 11.0% | 7.0% | 8.6% | 7.9% | 7.9% |

Source: SuperRatings estimates

The median growth option returned 3.0% in December and 11.0% over the year, while a smaller allocation to shares resulted in the median capital stable option returning 2.0% for the month and 6.5% across the year.

International shares have been the standout performer over the year, led by strong growth in technology shares. Returns were also strongly supported by Australian shares and further bolstered by rising cash rates improving fixed interest and cash returns.

*Balances are based on monthly SR Index returns and assume no additional contributions over the investment period. Returns are calculated net of investment fees and taxes but do not consider administration fees or other potential deductions from member’s accounts.

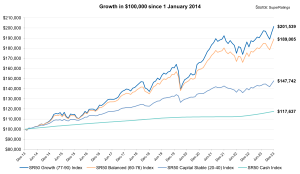

Funds have also delivered for members over the longer term. An investment of $100,000 in the median balanced option 10 years ago would now be worth $189,005 while investing in the median growth option would now be worth $201,539. Members who invested in cash would have $117,637.

The highest SuperRatings Balanced Index returns over the year was 13.2% for members in the Hostplus – Indexed Balanced option, closely followed by Brighter Super Optimiser Accumulation – Multi-Manager Growth Fund returning 13.1% while ESSSuper – Balanced Growth completes the top 3 returning 12.8%.

Top 20 balanced options over 12 months to 31 December 2023

| Rank | Option Name | 1 Year % | 10 Year % PA |

|---|---|---|---|

| 1 | Hostplus – Indexed Balanced | 13.2 | 7.3 |

| 2 | Brighter Super Optimiser Accumulation – Multi-Manager Growth Fund | 13.1 | – |

| 3 | ESSSuper – Balanced Growth | 12.8 | – |

| 4 | CFS-FC Wholesale Personal – CFS Enhanced Index Balanced | 11.9 | 6.5 |

| 5 | Vision Super – Balanced Growth | 11.7 | 7.5 |

| 6 | IOOF Employer Super Core – MLC MultiSeries 70 | 11.4 | 6.8 |

| 7 | Aware Super Future Saver – Balanced | 11.0 | 7.2 |

| 8 | GESB Super – My GESB Super Plan | 10.7 | 6.3 |

| 9 | TWUSUPER – Balanced | 10.6 | 6.7 |

| 10 | HESTA – Balanced Growth | 10.5 | 7.4 |

| 11 | ANZ Smart Choice Super – Growth | 10.4 | 6.0 |

| 12 | UniSuper – Balanced | 10.3 | 7.8 |

| 13 | Prime Super – MySuper | 10.3 | 7.1 |

| 14 | Australian Retirement Trust – Super Savings – Balanced | 10.2 | 7.9 |

| 15 | NESS – NESS MySuper | 10.2 | 6.6 |

| 16 | Raiz Super – Moderately Aggressive | 10.2 | – |

| 17 | REI Super – Balanced | 10.2 | 6.5 |

| 18 | Equip Super MyFuture – Balanced Growth | 10.2 | 7.2 |

| 19 | Brighter Super Accumulation – Balanced | 10.1 | 6.8 |

| 20 | smartMonday PRIME – Balanced Growth – Active | 10.1 | 6.3 |

| SR50 Balanced (60-76) Index | 9.6 | 6.8 |

*Performance tables are based on options included in the SR50 Balanced Index and do not represent all Balanced (60-76) options offered by superannuation funds. Returns are after investment fees and taxes and are rounded to one decimal place; however, rankings are determined using unrounded data held by SuperRatings.

Superannuation remains a long-term investment for most, with many members having several decades of returns before retirement. It is therefore important to remain focused on longer term returns, with the top performing funds over 10 years listed below.

The Hostplus – Balanced option remains the top performer over the long-term, with an average annual return of 8.3%, and is the only fund in our index with a higher than 8% annual return over 10 years.

Top 20 balanced options over 10 years to 31 December 2023

| Rank | Option Name | 1 Year % | 10 Year % pa |

|---|---|---|---|

| 1 | Hostplus – Balanced | 8.5 | 8.3 |

| 2 | AustralianSuper – Balanced | 9.0 | 7.9 |

| 3 | Australian Retirement Trust – Super Savings – Balanced | 10.2 | 7.9 |

| 4 | UniSuper – Balanced | 10.3 | 7.8 |

| 5 | Cbus – Growth (MySuper) | 9.5 | 7.6 |

| 6 | Vision Super – Balanced Growth | 11.7 | 7.5 |

| 7 | CareSuper – Balanced | 9.0 | 7.5 |

| 8 | HESTA – Balanced Growth | 10.5 | 7.4 |

| 9 | Spirit Super – Balanced (MySuper) | 10.0 | 7.4 |

| 10 | Hostplus – Indexed Balanced | 13.2 | 7.3 |

| 11 | Australian Food Super Employer – Balanced | 9.5 | 7.3 |

| 12 | Aware Super Future Saver – Balanced | 11.0 | 7.2 |

| 13 | First Super – Balanced | 9.4 | 7.2 |

| 14 | Equip Super MyFuture – Balanced Growth | 10.2 | 7.2 |

| 15 | Qantas Super – Growth | 8.8 | 7.1 |

| 16 | Prime Super – MySuper | 10.3 | 7.1 |

| 17 | IOOF Employer Super Core – MLC MultiActive Balanced | 9.4 | 7.0 |

| 18 | TelstraSuper Corporate Plus – Balanced | 8.9 | 6.9 |

| 19 | Australian Ethical Personal – Balanced | 9.7 | 6.9 |

| 20 | BUSSQ Premium Choice – Balanced Growth | 8.8 | 6.9 |

| SR50 Balanced (60-76) Index | 9.6 | 6.8 |

*Performance tables are based on options included in the SR50 Balanced Index and do not represent all Balanced (60-76) options offered by superannuation funds. Returns are after investment fees and taxes and are rounded to one decimal place; however, rankings are determined using unrounded data held by SuperRatings.

With shares driving most of 2023’s returns, passive investment options, where a fund tracks a specified index, performed well over the year. The table below displays the top 10 passive fund returns over 2023 and over 5 years, with most of these options having been available within superannuation for a shorter length of time.

Top 10 balanced passive options over 12 months to 31 December 2023

| Rank | Option Name | 1 Year % | 10 Year % pa |

|---|---|---|---|

| 1 | Aware Super Future Saver – Balanced Indexed | 14.3 | – |

| 2 | Rest – Balanced Indexed | 13.5 | 8.4 |

| 3 | HESTA – Indexed Balanced Growth | 13.3 | – |

| 4 | Hostplus – Indexed Balanced | 13.2 | 8.4 |

| 5 | netwealth Super Accelerator Core Emp – Index Opportunities Growth Fund | 13.1 | 6.7 |

| 6 | Australian Retirement Trust – Super Savings – Balanced Index | 12.9 | 7.9 |

| 7 | ClearView WealthFoundations Super – IPS Index Base 70 | 12.9 | – |

| 8 | Brighter Super Accum – Indexed Balanced | 12.8 | – |

| 9 | Cbus – Indexed Diversified | 12.7 | – |

| 10 | AustralianSuper – Indexed Diversified | 12.5 | 8.1 |

*Performance tables are based on passive options with a growth asset allocation between 60%-76%. Returns are after investment fees and taxes and are rounded to one decimal place; however, rankings are determined using unrounded data held by SuperRatings.

As we have seen MySuper offerings develop in recent years, it is also worthwhile to note that lifecycle funds had a strong year. These funds reduce members exposure to growth assets, generally from around age 45-55, and therefore have a higher exposure to growth assets than Balanced options. With growth assets performing well, these options have done well for members in 2023.

We have taken a representative cohort below, showing the returns expected to have been realised for younger members (<45 years old) in these products.

Lifecycle performance over 12 months to 31 December 2023

| RANK | LIFECYCLE | OPTION TYPE | GROWTH ASSETS | 1 YEAR % | 5 YEAR % PA |

|---|---|---|---|---|---|

| 1 | GuideSuper & Child Care MySuper – Building Lifestage | High Growth (91-100) | 98 | 14.8 | 9.0 |

| 2 | Vanguard MySuper – Lifecycle Age 47 and under | Growth (77-90) | 90 | 14.7 | – |

| 3 | Virgin Money Super – LifeStage Tracker Born 1979 – 1983 | Growth (77-90) | 90 | 14.4 | 9.2 |

| 4 | Essential Super MySuper – Lifestage 1980-84 | High Growth (91-100) | 93 | 13.8 | 7.9 |

| 5 | CFS FC MySuper – Lifestage 1980-84 | High Growth (91-100) | 93 | 13.6 | 7.9 |

| 6 | Mine Super MySuper – Lifecycle Investment Strategy Age 50 and Under | High Growth (91-100) | 98 | 13.6 | 9.3 |

| 7 | Russell iQ Super MySuper – MySuper GoalTracker Age < 50 | High Growth (91-100) | 95 | 13.3 | – |

*Table above shows lifecycle funds tracked by SuperRatings. Representative cohort above is for members 40-45 years old. Returns for younger members in these solutions are generally comparable to those above.

The table above shows that we are seeing greater levels of competition across the market, which is a good thing for consumers. While we have seen mixed outcomes for lifecycle since 2014, it is pleasing to see the renewed competition coming to market for default members in these solutions. Generally, these funds have higher allocations to listed equities, which has supported their performance outcomes in 2023.

While we see inflation slowing into 2024, as the impact of the interest rate rises throughout 2023 softens consumer demand, we expect to see continued ups and downs, as markets remain sensitive to local and global events. The new year is a good time for members to consider the level of ups and downs they are willing to tolerate and do a health check on their fund across performance, fees and insurance.

2023 was another eventful year for Australia’s superannuation members, with funds navigating a range of market environments and shocks as well as ongoing and expanded scrutiny of how well their investments are performing.

We have seen a slowing of funds merging and investment menus consolidating with a significant number of funds now well into their journey towards realising merger benefits and, hopefully, being able to pass those back to members through better servicing and investment performance. In our latest review we rated over 400 superannuation products. Our product ratings are accessible on our website here.

SuperRatings Executive Director Kirby Rappell said, “Members are likely pleased with this year’s performance, with most seeing a full recovery from last year’s losses. Long term strategy and high levels of diversification continue to result in impressive long-term performance by those managing our retirement savings. As we look ahead to what 2024 might bring for super fund returns, ongoing uncertainty means it remains important to set a strategy and stick with it despite the potential for periods of falling balances.”

Release ends

We welcome media enquiries regarding our research or information held in our database. We are also able to provide commentary and customised tables or charts for your use.

For more information contact:

Kirby Rappell

Executive Director

Tel: 1300 826 395

Mob: +61 408 250 725

Kirby.Rappell@superratings.com.au