Returns bounced back in November following the subdued October return, led by the strong performance of international shares, particularly in the US, following the outcome of the US presidential election. Superannuation research house SuperRatings estimates that the median balanced option returned 2.4% to members over the month.

“Share exposure continued to drive super returns in November. Members invested in options with higher exposure to shares benefited from the strength of the market.” commented Kirby Rappell, Executive Director of SuperRatings. “2024 has been a stronger year for members than anticipated. Total superannuation balances have now topped $4 trillion as at the end of September and so far, April is the only month where funds haven’t provided a positive return to members invested in the median Balanced option.”

The median growth option grew by an estimated 2.8% in November, while the median capital stable option, with limited exposure to international shares grew a more modest 1.4%.

Accumulation returns to 30 November 2024

| Monthly | FYTD | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a.) | 7 yrs (p.a.) | 10 yrs (p.a.) | |

| SR50 Balanced (60-76) Index | 2.4% | 6.2% | 14.6% | 5.8% | 6.6% | 6.9% | 7.3% |

| SR50 Capital Stable (20-40) Index | 1.4% | 4.0% | 8.6% | 3.4% | 3.6% | 4.0% | 4.4% |

| SR50 Growth (77-90) Index | 2.8% | 7.2% | 17.4% | 6.8% | 7.9% | 8.3% | 8.6% |

Pension returns saw a similar result, with the median balanced pension option increasing by an estimated 2.7%. The median capital stable pension option is estimated to rise 1.5% over the month, while the median growth pension option is estimated to rise 3.1% for the same period.

Pension returns to 30 November 2024

| Monthly | FYTD | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a.) | 7 yrs (p.a.) | 10 yrs (p.a.) | |

| SRP50 Balanced (60-76) Index | 2.7% | 7.0% | 16.2% | 6.5% | 7.4% | 7.7% | 8.1% |

| SRP50 Capital Stable (20-40) Index | 1.5% | 4.3% | 9.4% | 3.8% | 4.0% | 4.4% | 5.0% |

| SRP50 Growth (77-90) Index | 3.1% | 7.9% | 19.1% | 7.3% | 8.6% | 9.1% | 9.4% |

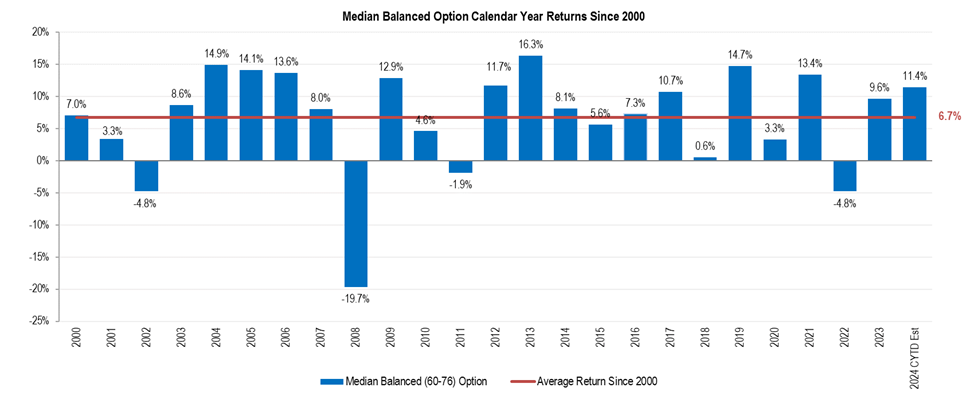

“The estimated monthly returns pushes the calendar year return into double digits, with the median balanced accumulation product estimated to return 11.4% for the first 11 months of 2024. For pension members, the median balanced pension product is estimated to return 12.8% for the 11 months to 30 November 2024” continued Mr Rappell.

“As we near the end of the year, members will be pleased to see their balances continuing to grow. Funds have delivered an estimated 6.7% annual return over the past 24 calendar years. While there are areas of clear improvement remaining for super funds, it remains reassuring that returns have remained competitive.”

Release ends

We welcome media enquiries regarding our research or information held in our database. We are also able to provide commentary and customised tables or charts for your use.

For more information contact:

Kirby Rappell

Executive Director

Tel: 1300 826 395

Mob: +61 408 250 725

Kirby.Rappell@superratings.com.au

Require further information? Simply visit www.superratings.com.au.