Leading superannuation research house SuperRatings has just finalised super fund estimated performance for calendar year 2024.

It has been a year of surprisingly strong and consistent positive returns for the industry, where Superannuation funds have strongly benefited from international share exposure leading to double digit returns. The median Balanced option expected to return 11.5% return for 2024, with the vast majority of options are expected to deliver a return of over 10% for the year and leading providers expected to return over 12.5% for the period. A balanced option has 60-76% of assets invested in growth assets over the long term, across areas like Australian shares, International Shares, Property, Alternatives, Fixed Interest and Cash.

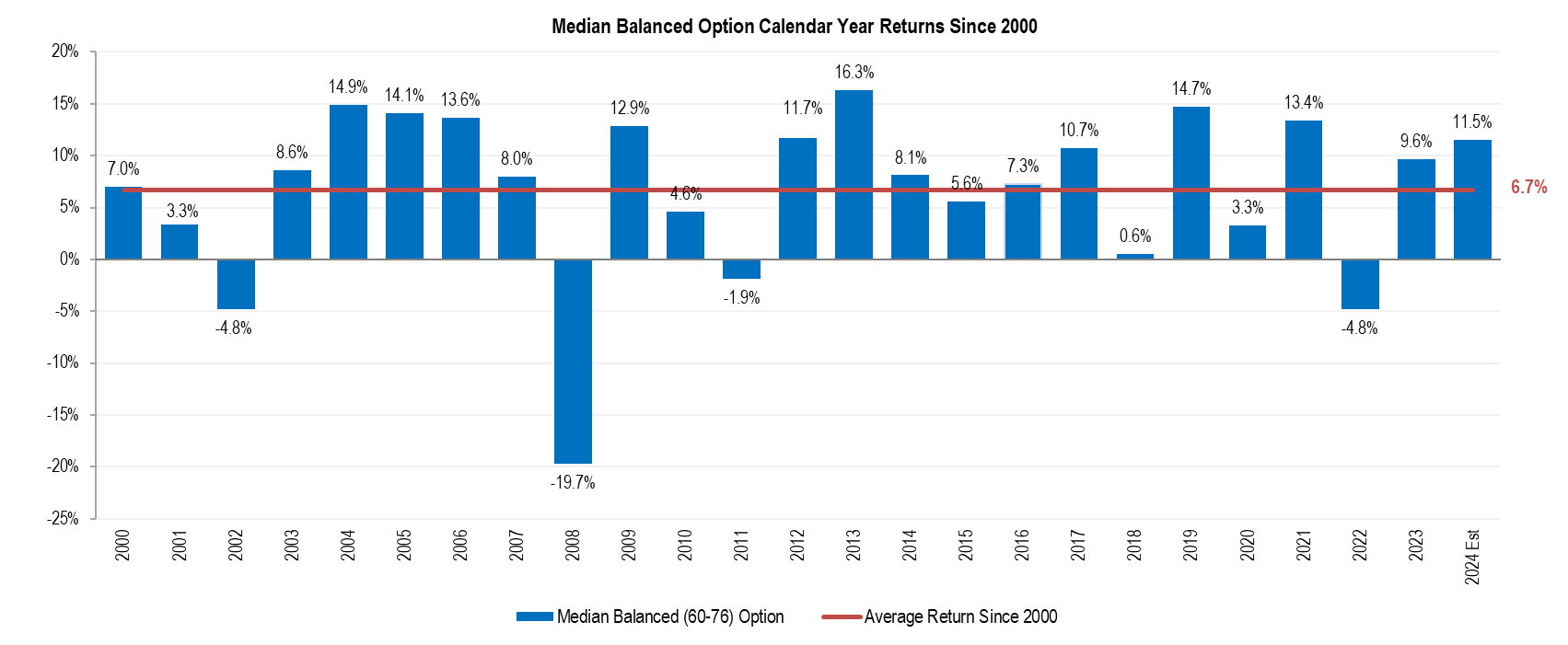

Returns were modest leading into Christmas, with SuperRatings estimating that the median balanced option (60-76% growth assets) generated a return of 0.4% over the month*. However, positive returns over 11 of the 12 months in the year have added up, resulting in the median estimated return for balanced options of 11.5% for calendar year 2024.

This is another strong result on a number of fronts:

- Firstly, while 11.5% exceeds last year’s 9.6% return, it remains only the 8th highest return since 2000, showing the ability of superannuation to deliver for everyday Australians at consistently high levels.

- Secondly, long term returns remain strong with an estimated median return of 6.7% per annum since 2000, and back above the target objective CPI+3% return.

- Thirdly, this year’s return has continued to outpace slowing inflation and withstood market volatility, demonstrating the superannuation systems strong ability to benefit when markets rise.

Despite the consistent positive returns over 2024 plenty of risks remain to be navigated over 2025. Most of this year’s returns have come from share markets, which are now priced at historical highs both in Australia and internationally. A correction in share markets would have a strong flow on effect to member’s superannuation balances and members should be prepared to see ups and downs over the short term. Inflation, particularly in Australia, also continues to be persistent with Australian interest rates likely to come down slowly over time, and cost of living pressures remain elevated.

While risks remain the focus for most members should be on the long term. Funds have consistently demonstrated their ability to swiftly recover from downturns and members with many years until retirement can afford to block out short term noise in returns.

The chart below shows median Balanced option returns since 2000:

We estimate the median balanced option, with growth assets between 60%-76% will return 6.7% pa since 2000, in line with the CPI+3% objective most funds set for this option type and despite experiencing a range of market environments over that time.

This year will be the second consecutive year of strong returns as funds continue to deliver for members over the long term. We have continued to see strong performance in equity markets that have been the key driver of this return outcome. Top performing options for 2024 are likely to again be those with high equity exposures. Despite the feeling of uncertainty in market conditions, this has not been seen in 2024 returns. Overall, this should provide reassurance in superannuation fund’s ability to navigate the noise of markets.

The discussion around risk, and particularly the ability of investors to tolerate the ups and downs of the markets seems to has not been central this year. Indeed, with the strength of equity markets in recent times, the benefits of diversification have been more muted, although likely to be front and centre if volatility returns. This again reinforces the need for a long term focus as funds seek to meet their objectives over the market cycle and the need for members to understand their ability and willingness to take risk.

Focusing on this measure and setting course accordingly, with the help of experts that can guide you to consider important factors of your circumstances, is likely to provide confidence throughout any shifts that may occur in the market. Setting a plan for the long term and sticking to it is most likely to support strong long-term outcomes.

Release ends

We welcome media enquiries regarding our research or information held in our database. We are also able to provide commentary and customised tables or charts for your use.

For more information contact:

Kirby Rappell

Executive Director

Tel: 1300 826 395

Mob: +61 408 250 725

Kirby.Rappell@superratings.com.au

Require further information? Simply visit www.superratings.com.au.