Increasingly, it is no longer enough for advisers to be reactive when clients ask about sustainable investing. It is vital that you have an ESG/Sustainable alternative as part of portfolio recommendations for your clients.

We have put together 5 questions you should be asking your clients when discussing sustainable investments ranging from how much clients now about ESG and sustainable investing to whether they need to see the sustainability credentials of underlying holdings.

- Do you want sustainable/ESG options?

An obvious first question but acting in the best interest of a client means delivering a solution that ties into a client’s interests. For some, it means investing sustainably, for others, it is not a factor. FASEA Code #6 states a solution must consider a client’s long term aims, which may involve investing sustainably.

- Do you know what ESG actually means?

This might seem like a simple question, but most investors are unaware that ESG is an investment process and not the means by which the “goodness” of a portfolio can be immediately assessed.

As an investment process, ESG takes into consideration the risk and downside potential of investing in a company (or investment) from an environmental, social or governance perspective. However, it does not mean that such an investment will not take place if the potential upside outweighs these risks. Understanding this difference is important to ensure you match investment suggestions with your client’s values.

- Do you want to make a difference to society through your investment choices?

Given that ESG is about investment process and doesn’t necessarily consider whether an investment delivers positively to society, unpacking this difference might narrow the selection of investment options. By narrowing these options, you will ultimately ensure that you are really acting in the best interest of your client by only suggesting solutions that match their views on sustainable investing.

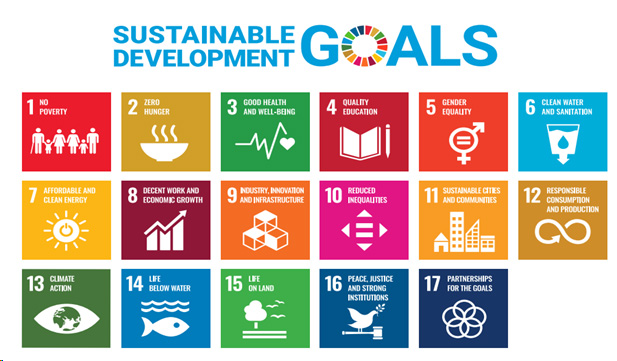

The Lonsec Sustainable Managed Portfolios consider both ESG risk and sustainability measures. These sustainability measures focus on the goodness the funds included in the Portfolios and are underpinned by the United Nations’ 17 Sustainable Development Goals.

- Are there specific industries that you would prefer to exclude?

Each client is different and what one considers inappropriate could be appropriate for others Having a good understanding of what lines cannot be crossed is important and once you have this information, you can then identify a solution that meets your client’s requirements.

The filter tool in Lonsec’s iRate® platform allows you to exclude ten specific controversial industries from your product selection. In addition, our Sustainability reports give in depth reviews of how products support sustainable outcomes and the extent to which any controversial industries are included in a portfolio. This way you can screen out any controversial industries that you client specifically does not want to invest in.

- Do you want to be able to see how much “good” your investment is delivering?

As the number of ethical and Sustainable products have grown, many are not as green or sustainable as they claim. With some solutions it is difficult to see exactly how they are delivering on their sustainability claims as the underlying holdings or progress against sustainable goals are not clearly reported.

If visibility of an investment’s sustainability promise is important to a client, you must identify solutions that report openly and clearly on these factors. Lonsec reports on its delivery against its Sustainable goals. The portfolios actively report against a number of factors such as reduction in CO2.

IMPORTANT NOTICE: This document is published by Lonsec Investment Solutions Pty Ltd ACN 608 837 583, a Corporate Authorised Representative (CAR 1236821) (LIS) of Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec Research). LIS creates the model portfolios it distributes using the investment research provided by Lonsec Research but LIS has not had any involvement in the investment research process for Lonsec Research. LIS and Lonsec Research are owned by Lonsec Holdings Pty Ltd ACN 151 235 406. Please read the following before making any investment decision about any financial product mentioned in this document.

DISCLOSURE AT THE DATE OF PUBLICATION: Lonsec Research receives a fee from the relevant fund manager or product issuer(s) for researching financial products (using objective criteria) which may be referred to in this document. Lonsec Research may also receive a fee from the fund manager or product issuer(s) for subscribing to research content and other Lonsec Research services. LIS receives a fee for providing the model portfolios to financial services organisations and professionals. LIS’ and Lonsec Research’s fees are not linked to the financial product rating(s) outcome or the inclusion of the financial product(s) in model portfolios. LIS and Lonsec Research and their representatives and/or their associates may hold any financial product(s) referred to in this document, but details of these holdings are not known to the Lonsec Research analyst(s).

WARNINGS: Past performance is not a reliable indicator of future performance. Any express or implied rating or advice presented in this document is limited to general advice and based solely on consideration of the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (“financial circumstances”) of any particular person. Before making an investment decision based on the rating or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances or should seek independent financial advice on its appropriateness. If the financial advice relates to the acquisition or possible acquisition of a particular financial product, the reader should obtain and consider the Investment Statement or the Product Disclosure Statement for each financial product before making any decision about whether to acquire the financial product.

DISCLAIMER: No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by LIS. The information contained in this document is current as at the date of publication. Financial conclusions, ratings and advice are reasonably held at the time of publication but subject to change without notice. LIS assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, LIS and Lonsec Research, their directors, officers, employees and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from, this document or any loss or damage suffered by the reader or any other person as a consequence of relying upon it.

Copyright © 2021 Lonsec Investment Solutions Pty Ltd ACN 608 837 583 (LIS). This document may also contain third party supplied material that is subject to copyright. The same restrictions that apply to LIS copyrighted material, apply to such third-party content.