Last night Treasurer Frydenberg handed down his first budget a month before the regular budget season. With the possibility of a May election, this budget is as much a political statement as an economic one, with tax measures to please key voter groups, a further boost to infrastructure spending, and the much-vaunted return to surplus. But the implementation of these measures depends on the re-election of the current government, while the surplus itself remains at the mercy of the economic outlook.

The long-awaited surplus

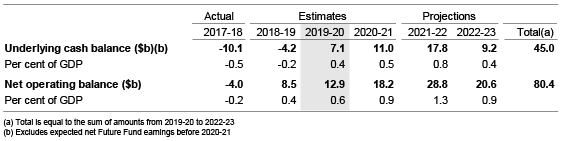

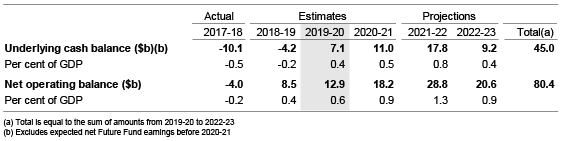

As expected, the underlying cash balance is forecast to return to a surplus of $7.1 billion in 2019-20, or 0.4% of GDP. Revenue growth is being driven by an improving economy, and a surplus may even be achieved slightly sooner than expected given the rise in commodity prices (especially iron ore) and associated company tax receipts.

Budget aggregates

Source: Budget 2019-20

The Budget also forecasts that the surplus will be maintained through the four-year period. However, these forecast surpluses remain small at less than 1.0% of GDP and are based on a range of assumptions. If the global and domestic economies slow, or if the government is not as frugal as it expects to be, the slim surpluses could easily be eroded.

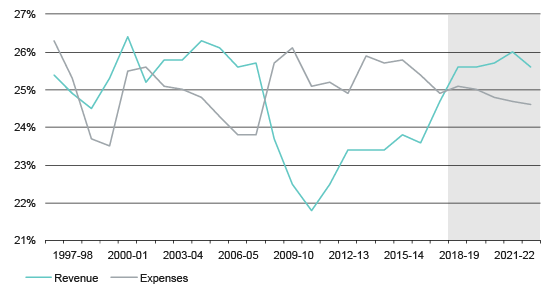

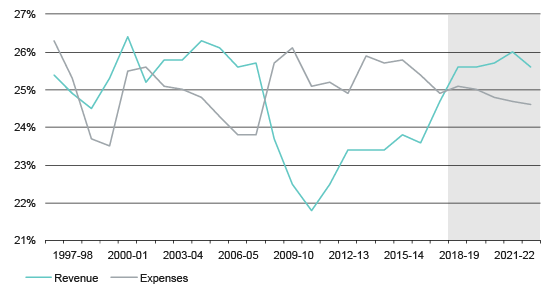

Commonwealth revenue and expenses (% GDP)

Source: Treasury

Income tax cuts

Another key selling point of this Budget is the income tax cuts, both to low- and middle-income earners and high-income earners. The Low and Middle Income Tax Offset (LMITO) will be more than doubled from $445 to $1,080 for this financial year. From 2022-23, the Government will increase the top threshold of the 19% tax bracket from $41,000 to $45,000 and increase the Low Income Tax Offset (LITO) from $645 to $700.

These measures have promised more than what the opposition proposed and are designed to peel low- and middle-income voters away from Labor. These measures are likely to be passed in parliament with oppposition support given many of the measures align with Labor policies, but it will be interesting to see Labor’s response to match these.

The long-term tax changes will take effect from July 2024 and will see a reduction in the marginal rate from 32.5% to 30% for those earning between $45,001 and $200,000. Tax changes this far out will inevitably be subject to future changes and election bargaining, and will likely not receive Labor’s support given their opposition to tax cuts for wealthier Australians.

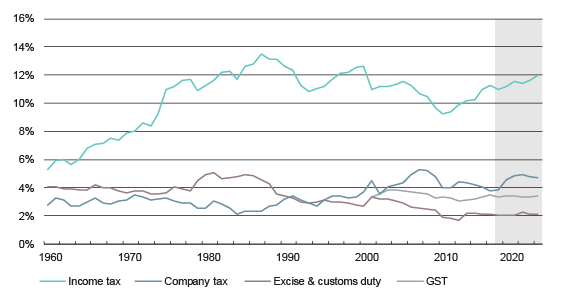

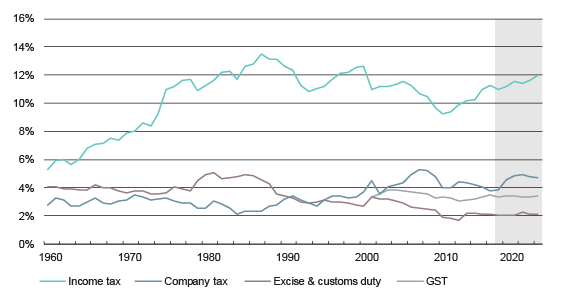

Taxation receipts (% GDP)

Source: Treasury

Infrastructure spending boost

Infrastructure spending for the next ten years has been increased from $75 billion to $100 billion, or around 0.4% of GDP. This is a small increment from the already committed infrastructure spending and a lot of the money is scheduled for the outer years. Some of the bigger projects include the $2 billion fast rail from Geelong to Melbourne, the $3.5 billion Western Sydney Rail, the $1.6 billion M1 Extension in NSW, the $1.5 billion North-South Corridor in SA, and the $800 million Gateway Motorway upgrade in QLD.

Economic outlook is still shaky

While the budget has delivered a surplus, it remains at the mercy of the economic outlook. The Government is assuming GDP growth of 2.25% this financial year, and 2.75% for the next two years. It also assumes the unemployment rate will remain at 5.0% until 2020-21 and that wages growth will pick up to 3.25% in 2020-21. While the labour market remains strong and is likely to continue to improve further, the wages growth assumption seems optimistic.

The Budget also forecasts inflation to return to 2.5% in 2020-21. This also seems overly optimistic and will likely be revised down again given that wages growth has been incredibly modest despite a tightening labour market. Australia’s GDP growth also faces a range of external uncertainties, including a slowdown in our biggest trading partner China, a slowdown in Europe, and geopolitical risks including Brexit and China-US trade tensions. Overall the economic outlook remains subdued.

Implications for the Australian dollar, RBA and financial markets

The RBA left the cash rate unchanged at 1.5% at its April meeting, however the easing bias saw the Australian dollar trade lower. In contrast, the Budget failed to move the dollar as markets had anticipated the surplus and there were no surprises in the budget measures. While income tax cuts and infrastructure spending—as well as other spending on education and health—are supportive of the economy, there is little in the Budget to boost productivity or shift the economic fundamentals. This means the RBA will likely remain in wait-and-see mode before deciding on the next rate move.

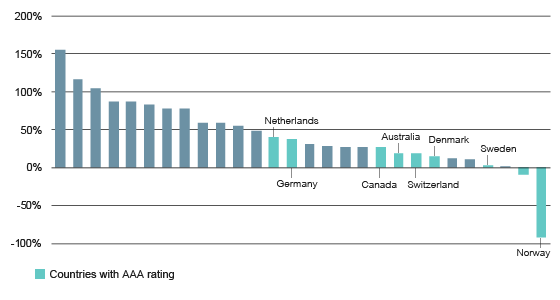

Australia holds on to its AAA rating

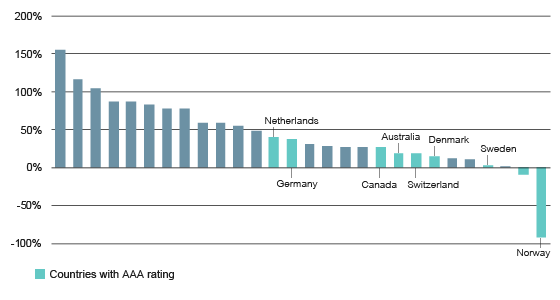

Australian general government net debt has been increasing since 2010 but is forecast to peak at 19.2% of GDP in 2018-19. The expected return to surplus and improvement in our fiscal position had already seen Standard & Poors lift its outlook for Australian sovereign debt from ‘negative’ to ‘stable’ back in September 2018. With few surprises in this Budget, Australia is likely to maintain its coveted AAA rating, along with only a handful of other countries.

At below 20%, its net debt-to-GDP ratio remains in the middle of the pack compared to other AAA-rated economies, while the average for advanced economies is higher at a 70% ratio. Holding onto the AAA rating means the Australian government can continue borrowing at cheaper interest rates (compared to lower-rated peers), with the rating favourably affecting the state and local governments as well as Australia’s banks, which tend to be rated one or a few notches below the sovereign credit rating.

Net government debt in advanced economies (% GDP)

Source: IMF World Economic Outlook Database, October 2018; Bloomberg

This is an election budget containing few surprises. A return to surplus is undoubtedly welcomed, but the forecast surpluses are slim and vulnerable to the economic outlook. This Budget does not change the economic outlook for Australia, meaning the RBA will remain in wait-and-see mode with an easing bias. While the Budget contains many measures to please the electorate, it remains unclear whether they will be implemented, especially the long-term tax changes. With a federal election looming, it will also be interesting to see the response from Labor, which currently leads the government in the opinion polls.

IMPORTANT NOTICE: This document is published by Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL 421 445 (Lonsec).

Please read the following before making any investment decision about any financial product mentioned in this document.

Warnings: Lonsec reserves the right to withdraw this document at any time and assumes no obligation to update this document after the date of publication. Past performance is not a reliable indicator of future performance. Any express or implied recommendation, rating, or advice presented in this document is a “class service” (as defined in the Financial Advisers Act 2008 (NZ)) or limited to “general advice” (as defined in the Corporations Act (C’th)) and based solely on consideration of data or the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (“financial circumstances”) of any particular person.

Warnings and Disclosure in relation to particular products: If our general advice relates to the acquisition or possible acquisition or disposal or possible disposal of particular classes of assets or financial product(s), before making any decision the reader should obtain and consider more information, including the Investment Statement or Product Disclosure Statement and, where relevant, refer to Lonsec’s full research report for each financial product, including the disclosure notice. The reader must also consider whether it is personally appropriate in light of his or her financial circumstances or should seek further advice on its appropriateness. It is not a “personalised service” (as defined in the Financial Advisers Act 2008 (NZ)) and does not constitute a recommendation to purchase, hold, redeem or sell any financial product(s), and the reader should seek independent financial advice before investing in any financial product. Lonsec may receive a fee from Fund Manager or Product Issuer (s) for reviewing and rating individual financial product(s), using comprehensive and objective criteria. Lonsec may also receive fees from the Fund Manager or Financial Product Issuer (s) for subscribing to investment research content and services provided by Lonsec.

Disclaimer: This document is for the exclusive use of the person to whom it is provided by Lonsec and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by Lonsec. Conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error, inaccuracy, misstatement or omission, or any loss suffered through relying on the information.

Copyright © 2019 Lonsec Research Pty Ltd, ABN 11 151 658 561, AFSL 421 445. All rights reserved. Read our Privacy Policy here.

10% UK exposure” width=”561″ height=”301″ class=”alignnone size-full wp-image-5666″ style=”margin: 0;” />

10% UK exposure” width=”561″ height=”301″ class=”alignnone size-full wp-image-5666″ style=”margin: 0;” />