Our range of Managed Account solutions

Lonsec offers a broad suite of investment solutions to suit a diverse range of adviser and investor requirements for advice businesses of all sizes.

We understand that there is no ‘one size fits all’ product and that each business will have unique preferences when it comes to selecting the right investment solutions for them and their clients.

Each of our investment options come with distinct features and functionality, ensuring that we can work with you to determine the ideal solution for you.

This, together with our genuinely collaborative approach, allows us to truly personalise our partnership with advice businesses, so that whether you a large licensee or smaller practice searching for a ready-made, tailored or customised solution, we can work alongside your business to achieve your investment goals.

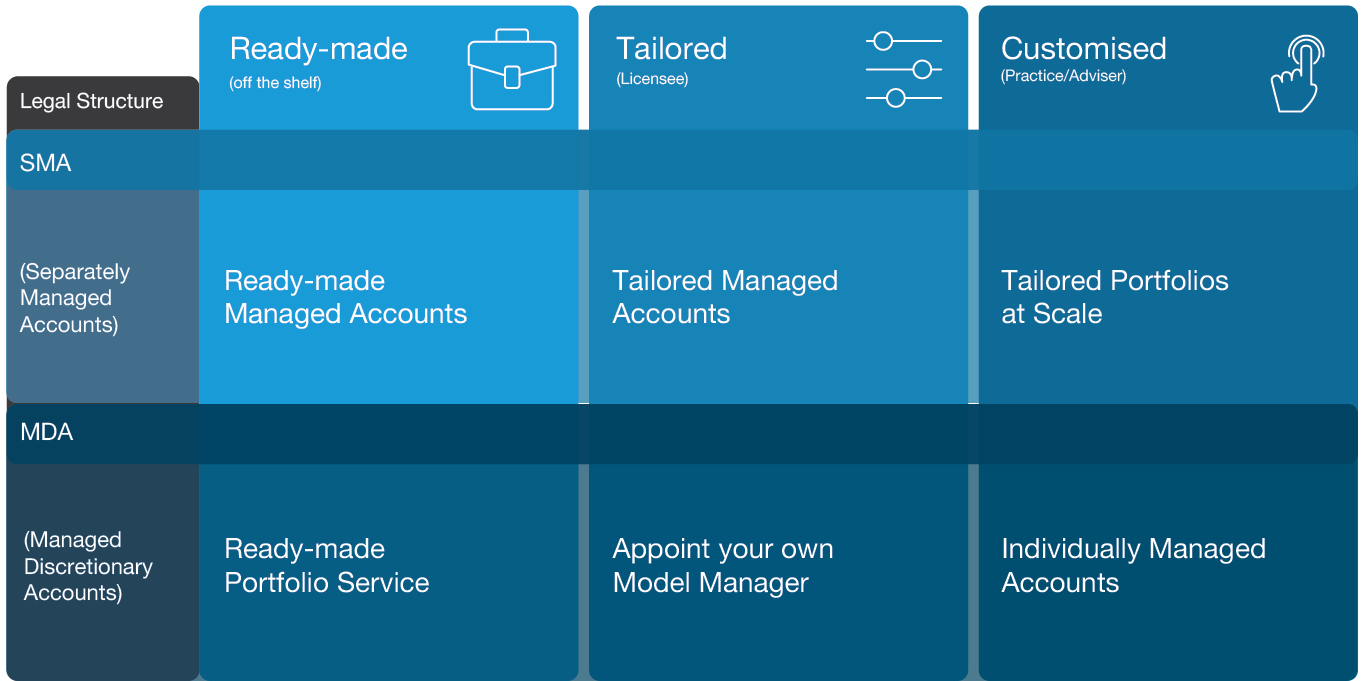

Lonsec’s suite of managed account solutions

Legal Structure

Ready-made

(Off the shelf)

Tailored

(Licensee)

Customised (Practice / Adviser)

SMAs

(Separately Managed Accounts)

MDAs

(Managed Discretionary Accounts)

Let us know which solution best suits your practice’s needs

Ready-made managed accounts

MDA Model Manager service

Tailored Managed Accounts

Individually Managed Accounts

Ready-made managed accounts to suit a broad range of investment objectives

Lonsec offers a range of ready-made investment solutions to advice businesses and Licensees looking for professionally managed portfolios, with no minimum funds under management to access.

These multi-sector portfolios provide different exposures to suit various investment objectives and time horizons, covering a choice of underlying investment vehicles (SMAs and MDAs) to cater for different client goals.

Our diversified range of ready-made managed accounts reflect our research backed investment ideas, incorporating dynamic asset allocation, with a choice of either an active or passive approach to investment selection.

Leverage Lonsec’s model manager capabilities

Lonsec offers licensees and large advice businesses the ability to run a bespoke selection of external or in-house models within a Managed Discretionary Account (MDA) structure, providing advisers and their clients with a high touch, individualised investment experience, whilst freeing valuable time and resources for both Licensees and their Advisers to grow and scale their businesses.

Our unique MDA offering enables external investment managers with in-house investment capability to run models within the service, including Licensees and large Advice Practices who have the ability to set up their own models and customise at all levels.

Discover the power of Lonsec’s Tailored Managed Accounts

Lonsec partners with innovative licensees and advice businesses looking to grow and scale, to help deliver a unique investment experience to clients.

We recognise that our ready-made investment solutions may not be suitable for all clients which is why we also offer a suite of tailored investment solutions for licensees and Advisers. These tailored portfolios allow advisers to cater to more individualised investment preferences, in order to help facilitate better investment outcomes for clients.

Individually Managed Accounts

IPL – The Individual Managed Account Experience

The IPL (Implemented Portfolios) individually managed account service provides customisation functionality on a client level via a Managed Discretionary Account. Our team of professional portfolio managers remodel and manage end clients’ portfolios on your behalf, in line with their individual investment preferences. This includes incorporating any instructions provided to suit the unique requirements of the end client.

LIS Growth Alternatives (LGA) IMA

With the positive trends we are seeing in private markets, Lonsec Investment Solutions (LIS) have a unique investment solution designed exclusively for Advisers and their high-net-worth clients.

LIS sees these Alternative markets providing HNW investors an opportunity to add uncorrelated assets to their portfolio further lifting the benefits of owning a well-diversified portfolio by potentially enhancing returns and simultaneously lowering overall portfolio risk.

The LIS Growth Alternatives IMA provides an entry point into these sophisticated investments with a minimum initial investment of $500,000, an investor can begin their investment journey into Alternative markets with a highly individualised portfolio.

Lonsec Group Investment Governance

All Lonsec Investment Solutions portfolios are overseen by Lonsec’s various internal investment committees. The committees include our asset allocation, security selection, portfolio management and portfolio manager oversight committees which are all comprised of senior members of the Lonsec Investment Solutions team, as well as a panel of independent investment experts.