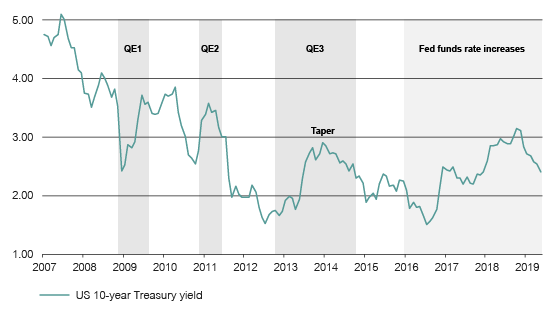

Bonds have been unrelenting in 2019, rising in stark defiance of investors who called a fade to the rally in late 2018, when the US Fed appeared determined to hike rates. This insatiable appetite for bonds has seen yields plummet to record lows in several markets, while the quantum of negative-yielding debt is climbing ever higher.

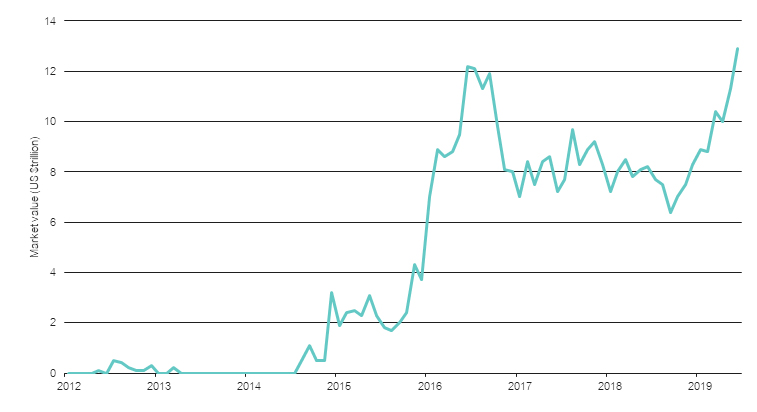

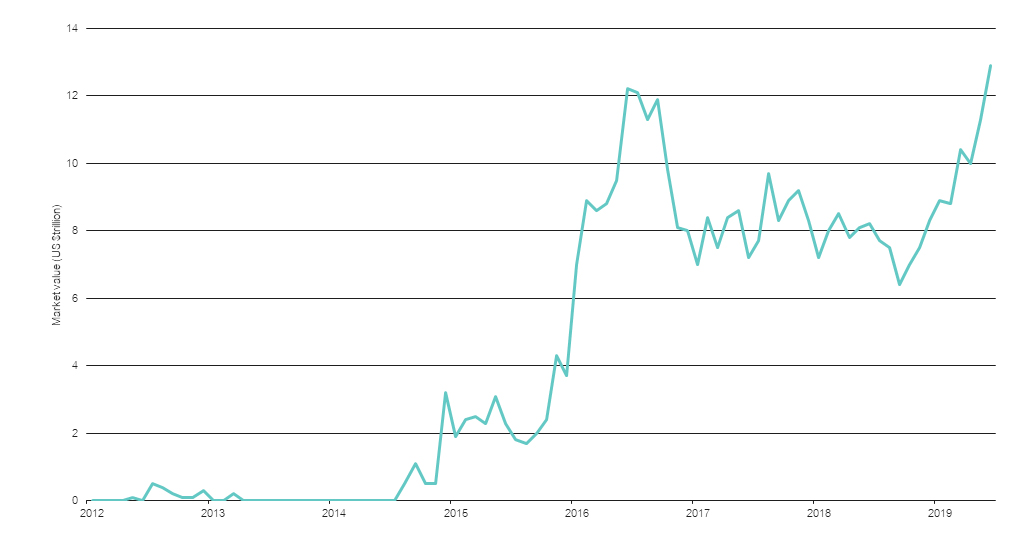

As the chart below shows, the market value of bonds tracked by the Bloomberg Barclays Global Aggregate Index has risen to nearly US $14 trillion and pushed above its 2016 peak. Negative-yielding bonds now make up around one quarter of the index. European safe-havens like Germany and France make up the lion’s share (if you can call it that), with more than 80% of Germany’s federal and regional government bonds in the red.

The value of negative yielding bonds has rocketed in 2019

Source: Bloomberg

Market fears of a faltering US economy are becoming more evident with the Fed taking out some insurance with a 25 basis-point cut to the funds rate at the end of July. The question is will there be another? The yield on 10-year US Treasury bonds has fallen from 3.24% in November 2018 to 1.71% in early August, amounting to an almost 40% rise in the value of long-duration Treasury bonds. The bond market continues to track a deterioration in global growth but so far there are few signs that more aggressive action is required by the Fed.

Unsurprisingly, most other developed nation yields have also come under pressure amid gathering storm clouds. We have observed a discernible shift in appetite, with many global managers actively seeking to diversify risk within portfolios. Going forward it is expected that global yields will continue to suffer a downward trajectory as the global economy weakens. Lonsec continues to favour global bonds over Australian bonds largely from a valuation and diversification perspective.

The prospect of various central banks providing additional support to financial markets is once again up for discussion, although there is no consensus view (noting in recent times Malaysia, New Zealand, Iceland and Sweden have all cut interest rates). With stubbornly low inflation in the US, geopolitical tensions with China and to a lesser degree Iran, a move by the Fed to ease pressures would not be surprising.

In Australia the rhetoric of the RBA has also changed, moving toward a more conciliatory tone, signalling there is still some room for further action if required. Looking forward, low inflation remains a key issue, as does spare capacity in the labour market. Pleasingly house prices have appeared to stabilise in Sydney and Melbourne, and the impact of further stimulus in the form of tax cuts and loosening a key constraint on mortgage credit are yet to be fully felt.

Lonsec views Australian 10-year bond yields as expensive at 1.3% and our DAA signals continue to favour other asset classes over domestic bonds. Domestic bonds rallied significantly during the quarter on the back of two RBA cuts and weakening economic data spooking local investors. The Australian dollar also proved volatile over the quarter, breaking out of the tight trading range of the past year. Going forward the Australian dollar is expected to come under increasing pressure as lower rates begin to bite.

Credit remains popular with active managers still favouring a bias to corporate bonds within portfolios, albeit bell-ended with more defensive positioning in sovereign bonds or cash-like assets. For the domestic market, it appears like more of the same going forward: tight spreads and limited opportunities. Once again, the popularity of relative value trades is noticeable, picking up extra basis points as and when they can.

Over the quarter, Lonsec has decreased Cash allocations from a slight overweight to a neutral position for portfolios with exposures to Alternatives and has moved the very overweight recommendation back to overweight for our traditional portfolios (excluding alternatives). We remain slightly underweight Australian bonds and neutral on global bonds. The sharp fall in US government bond yields during the June quarter was notable, but in comparison to domestic bond yields they remain attractive from a relative valuation perspective.