Last year marked the ten-year anniversary since the Global Financial Crisis (GFC), and while the global economy and our financial institutions have recovered, the same cannot be said for our democratic institutions. In a post-GFC world, liberal democracies have encountered a popular revolt from disenchanted voters expressing their resentment towards the economic systems and cultures that have left them behind. The surge in right-wing populism across the world has been symptomatic of globalisation, deregulation and the financialization of the economy at the expense of the working class.

Naturally, the resultant wage stagnation and off-shoring of domestic jobs has benefited the ‘wealthy elites’ who embrace a world of open borders and an abundance of labour. However, the growing inequality divide has stoked resentment and resulted in an insurgency against the so-called elite.

The rise of right-wing populism has had far-reaching implications for global equity markets and economic growth through increased geopolitical risks and heightened volatility. The two primary beneficiaries in modern history of this populist uprising have been US President Donald Trump and the Brexit campaign. While there are a myriad of other examples which could be drawn upon, such as the right-wing coalition government in Italy or Brazil’s recently elected populist leader Jair Bolsonaro (known as the ‘Tropical Trump’), it has been the Trump presidency and the Brexit fiasco which have had the biggest implications for global markets.

Donald Trump

Although a political novice and a bombastic provocateur, Trump unexpectedly rode into the White House by leveraging the collective anxieties of his rustbelt base. Trump was able to garner the enthusiasm of energetic, anti-establishment voters by vowing to “drain the swamp” and “make America great again”. Trump successfully portrayed himself as the voice of the downtrodden, committed to his own form of populist nationalism (despite being a billionaire himself).

The primary target of Trump’s rancor has been China, and the recent trade war has shaken equity markets both at home and abroad. Trump’s key gripe with China stems from the burgeoning trade deficit, which was US $375 billion in 2017 and which he claims has resulted in the destruction of the American manufacturing industry. America has seen a return to protectionism, with tariffs applied to a wide range of Chinese products in an effort to reduce the trade gap – even if the policy might be at odds with the traditionally pro-free market Republican party.

Predictably, China responded with its own tariffs, and global equity markets have been whipsawing erratically since. Fortunately for China, the yuan depreciated significantly against the US dollar during this period, which worked to partially offset the negative impact of the tariffs. This further fanned the flames between the two countries as Trump has frequently accused the People’s Bank of China for manipulating its currency to gain a competitive economic advantage. In addition to the trade deficit, Trump has been steadfast in his demands regarding the appropriation of foreign intellectual property in China.

While concessions might be made to reduce the trade imbalance, it is unlikely that Chinese President Xi Jinping will acquiesce to Trump’s demands regarding intellectual property theft given the ambitious ‘Belt and Road’ initiative and the ‘Made in China 2025’ policies. Consequently, equity market participants eagerly await the outcome of the negotiations when the ceasefire is set to expire on 1 March 2019.

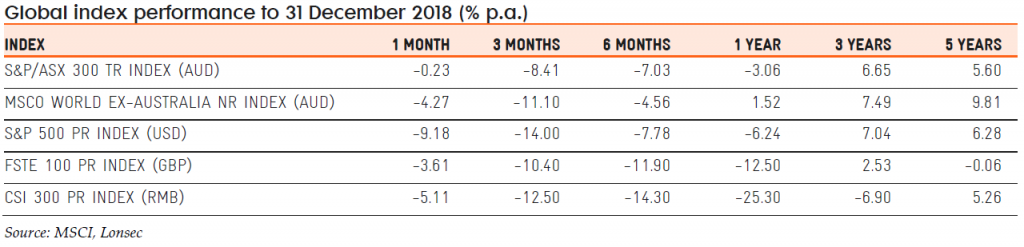

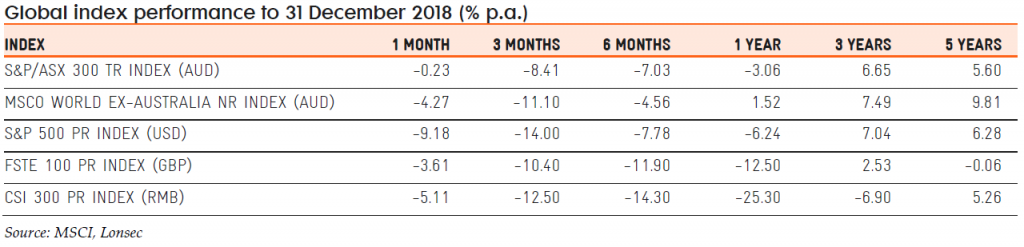

As the table below shows, the US-China trade dispute has had an undeniable impact on China’s equity market returns in calendar year 2018, with the Shanghai Shenzhen CSI 300 PR Index (RMB) falling 25.3%. Unfortunately, the concerns surrounding the trade frictions were not contained in Asia, with a contagion effect spreading across the globe, placing downward pressure on all equity markets. Thus far, it has been a war of attrition, with both sides resolute in their demands.

China’s questionable growth trajectory and the ensuing impact on their global trading partners has further compounded investor concerns. Of importance is China’s trading relationship with Australia, and given China is our largest export market, we are particularly susceptible to a slowdown in Chinese growth and consumption. Consequently, Trump’s populist policies have impacted our domestic equity market with what the pundits have termed ‘the Trump dump’, which saw the S&P/ASX 300 TR Index return a crushing -8.4% for the 2018 December quarter.

Economic ailment and a fear of the fraying of the American social fabric contributed to the formulation of a key plank of the Trump campaign: the wall. The centerpiece of Trump’s foreign policy platform with Mexico is his proposed wall on the US southern border (which Mexico will pay for, of course). However, political gridlock in Congress and the president’s unwillingness to compromise led to the longest government shutdown on record and culminated in a heavy selloff in equity markets in December 2018.

Notwithstanding Trump’s best efforts, his brand of economic nationalism is yet to bear fruit, and there has been little reprieve for the jaded working class who voted for him. While NAFTA has been renegotiated it is unclear whether the ‘wins’ match the campaign rhetoric. Moreover, the trade war is yet to reap any benefits for the forgotten manufacturing workers. Rather, it has weakened global capital markets and hurt American farmers. The wall remains stuck in the ‘swamp’ and the economic impact of the month-long government shutdown is still being tallied. Subsequently, the president has controversially declared a national emergency to release the capital to fund its construction.

Trump’s incendiary personality and Tweets aside, he has been able to successfully legislate meaningful tax reform in America and reinvigorated Regan-era trickle-down economics. Lower individual tax rates have been negotiated, however these were dwarfed by the corporate tax cuts, which were slashed from 35% to 21%. These policies have proved successful with his aspirational base while additionally providing buoyancy to one of the longest-running bull markets on record.

Brexit

The success of the Brexit vote hinged primarily on issues pertaining to sovereignty and migration, and the leaders of the ‘leave’ movement were able to successfully galvanize a support base of Eurosceptics. However, the implications for the corporate sector and the broader equity markets have been considerable. Unsurprisingly, the result of the referendum has upended the domestic share market in the UK and left global markets on tenterhooks.

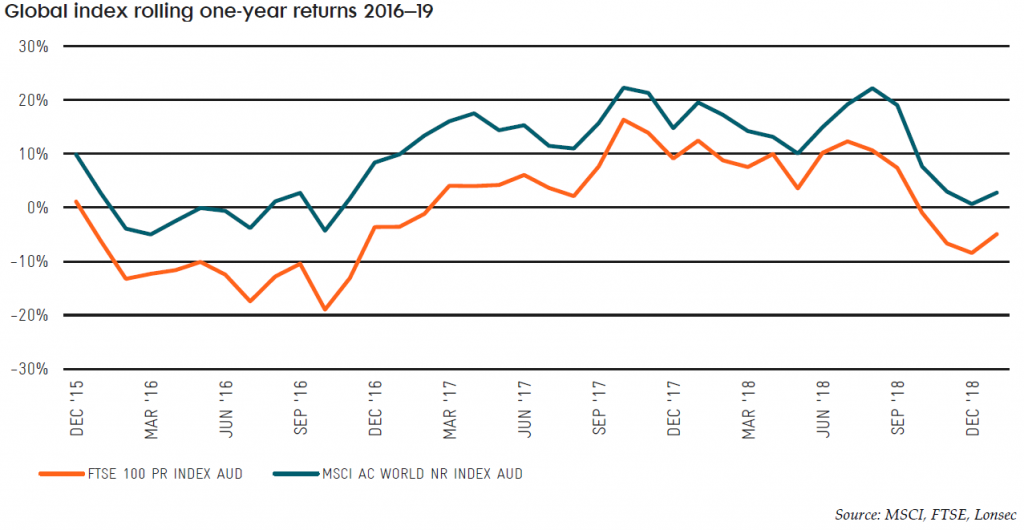

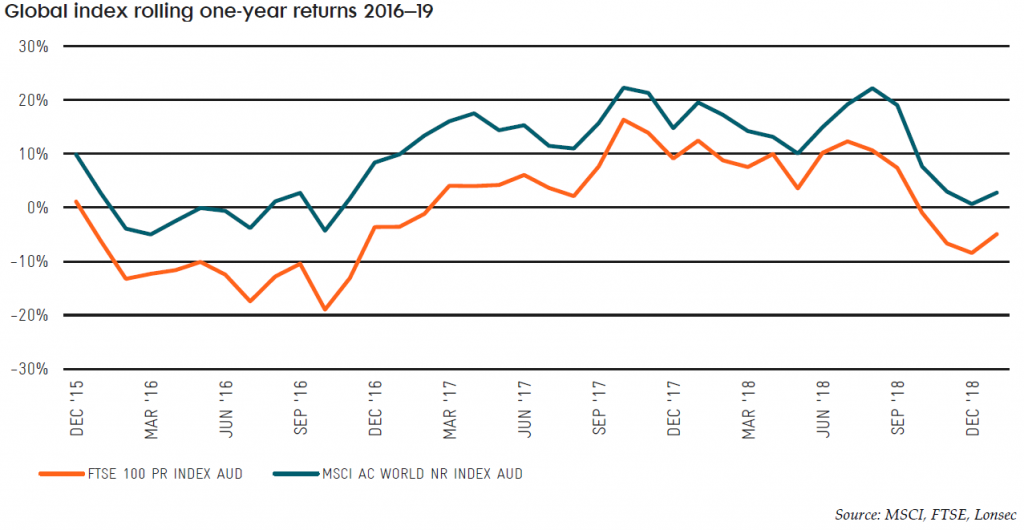

The below chart illustrates the perilous position of FTSE 100 investors since the 2016 Brexit referendum, with the index significantly underperforming the broader global equity market over this period. Similarly, the value of the pound has been on a near linear downward trajectory as investors seek protection from the uncertainty surrounding the final outcome.

There has been mounting speculation as to the longer-term economic impacts that Brexit will have on the economy and businesses domiciled in the UK. Many economists have warned that leaving the European Union would reduce per-capita income levels for UK citizens while simultaneously crimping corporate sector activity. With regards to a ‘no-deal’ Brexit, the outcome could potentially be disastrous for the UK economy and corporate sector. The consensus among economists points to a likely economic contraction due to diminished foreign direct investment, additional trade barriers and reduced immigration. This could pose significant headwinds for GDP, as immigration typically boosts growth by increasing aggregate demand.

The corporate sector has similarly been thrust into turmoil, with companies restructuring their affairs in preparation for a disorderly exit. The industries most exposed will likely be those operating in highly regulated industries such as financial services and air travel, which face additional post-Brexit uncertainty. Typically, companies at risk have sought to establish subsidiaries in neighboring countries within the European Union or to redomicile their headquarters completely. Naturally, this process is expensive and will impact profit margins. For companies operating in the retail or consumer staples sectors, a corporate restructure is not a realistic option. Consequently, these companies will most likely be mired with supply chain disruptions and adverse currency movements impacting their bottom lines. More broadly, the issue of labour shortages has come to the fore, with a reduction in access to skilled labour creating a key business risk.

Brexit is likely to continue to pose an ongoing threat to the UK economy and corporate sector, and could potentially require significant adaptation and adjustment for local businesses—at material cost. Therefore, the ongoing stability and health of capital markets both domestically and abroad is directly at risk. As can be seen, nationalist sentiment heightens geopolitical risks in a globally connected world economy and turbocharges volatility, so investors beware.

Implications for portfolio construction

Trump’s policies are based on conflicting viewpoints. He is advocating for protectionism and championing the working class through a return of the American manufacturing industry—at the expense of China. At the same time, he has overhauled corporate regulations and slashed taxes, which should hardly appeal to the anxieties of frustrated voters. A similar wave of anti-globalist and nationalistic sentiment has likewise gripped the UK and propelled right-wing populism to the fore. These are not likely to be isolated incidents, and rather are representative of a global trend to renounce the political elite in favor of populists.

This article has highlighted the relationship between an upsurge in right-wing populism, and the resultant impact on global markets. The hostile rhetoric employed by populist leaders has become all too predictable, albeit successful, in galvanizing a disenfranchised support base. With the regressive left pitched against the radical right, there are no clear winners.

The reaction across stock markets has been varied, with indiscriminate selloffs often followed by relief rallies. Consequently, as we enter periods of growing political unrest and market volatility, the role of active management within a diversified portfolio becomes more critical. Times of increased volatility create mispricing opportunities for active fund managers to exploit, and can potentially deliver alpha to patient investors. As such, prudent investors should seek to capitalize on market inefficiencies during bouts of extreme volatility. As the legendary Oracle of Omaha (Warren Buffet) put it, “Be greedy when others are fearful.”

With respect to portfolio construction:

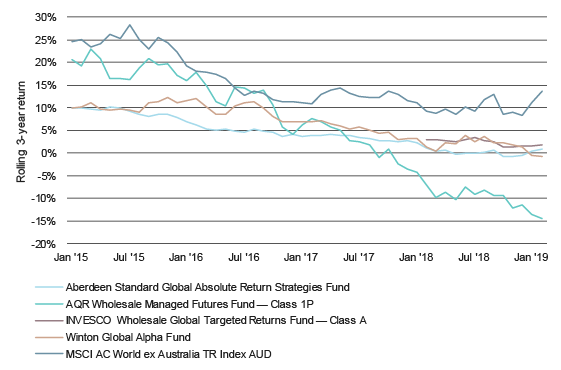

1. Challenging macroeconomic conditions provide opportunities for skilled investors. The proliferation of passive investment products has led to price distortions and programmatic trading, which during periods of heightened volatility can suffer without clear trends. However, increased volatility provides opportunities for active managers to protect capital on the downside through a range of options depending on their mandates (e.g. by increasing cash allocations or shorting). Similarly, volatility can expose mispricing that can be exploited by active managers.

2. Populism tends to be intertwined with economic rationalism which can favour small-cap stocks, as these domestically focused companies should, prima facie, perform proportionally better than larger and more globally exposed peers.

IMPORTANT NOTICE: This document is published by Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL 421 445 (Lonsec).

Please read the following before making any investment decision about any financial product mentioned in this document.

Warnings: Lonsec reserves the right to withdraw this document at any time and assumes no obligation to update this document after the date of publication. Past performance is not a reliable indicator of future performance. Any express or implied recommendation, rating, or advice presented in this document is a “class service” (as defined in the Financial Advisers Act 2008 (NZ)) or limited to “general advice” (as defined in the Corporations Act (C’th)) and based solely on consideration of data or the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (“financial circumstances”) of any particular person.

Warnings and Disclosure in relation to particular products: If our general advice relates to the acquisition or possible acquisition or disposal or possible disposal of particular classes of assets or financial product(s), before making any decision the reader should obtain and consider more information, including the Investment Statement or Product Disclosure Statement and, where relevant, refer to Lonsec’s full research report for each financial product, including the disclosure notice. The reader must also consider whether it is personally appropriate in light of his or her financial circumstances or should seek further advice on its appropriateness. It is not a “personalised service” (as defined in the Financial Advisers Act 2008 (NZ)) and does not constitute a recommendation to purchase, hold, redeem or sell any financial product(s), and the reader should seek independent financial advice before investing in any financial product. Lonsec may receive a fee from Fund Manager or Product Issuer (s) for reviewing and rating individual financial product(s), using comprehensive and objective criteria. Lonsec may also receive fees from the Fund Manager or Financial Product Issuer (s) for subscribing to investment research content and services provided by Lonsec.

Disclaimer: This document is for the exclusive use of the person to whom it is provided by Lonsec and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by Lonsec. Conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error, inaccuracy, misstatement or omission, or any loss suffered through relying on the information.

Copyright © 2019 Lonsec Research Pty Ltd, ABN 11 151 658 561, AFSL 421 445. All rights reserved. Read our Privacy Policy here.

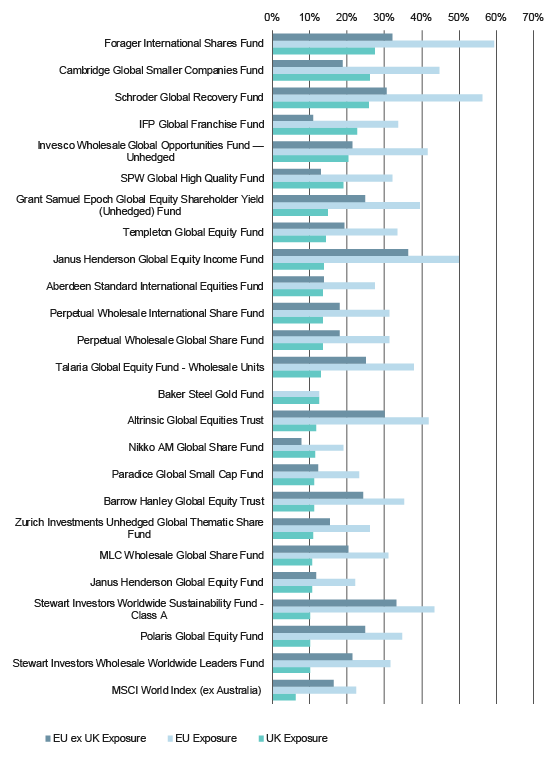

10% UK exposure” width=”561″ height=”301″ class=”alignnone size-full wp-image-5666″ style=”margin: 0;” />

10% UK exposure” width=”561″ height=”301″ class=”alignnone size-full wp-image-5666″ style=”margin: 0;” />