The performance of the Lonsec Alternatives universe generally performed well in the December 2020 quarter and into January 2021. The vaccine breakthroughs played a significant role in buoying investor sentiment, and while there have been logistical hiccups in some countries that have delayed the rollout, overall developments are positive for markets.

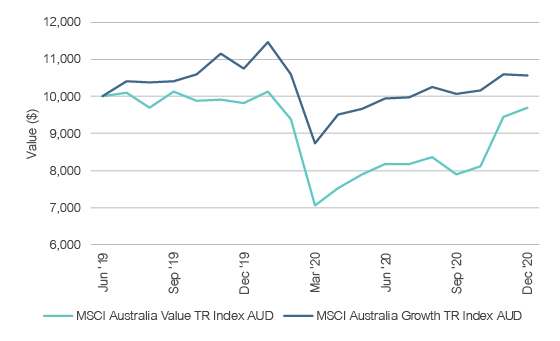

A key catalyst for stronger performance outcomes has been the return of the value risk premia after a long period of headwinds. Value has benefited from the vaccine narrative and the return to more normal operating conditions, while fiscal and monetary measures helped to plug the liquidity gap, patch up balance sheets, and prevent a complete collapse in confidence.

Risk premia strategies have benefitted from the factor rotation in the market, with risk premia such as value, carry, trend and volatility becoming more favourable, and to a lesser extent equity long/short.

Private equity and debt markets were up in the December quarter, underpinned by the risk-on mood, strong returns, excess liquidity and the chase for yield. However, given the strong rally and sentiment in public markets, stress and forced selling hasn’t yet materialised across the sectors, with the exception being real estate. Managers with excess capital are well placed to buy attractively priced businesses if forced selling becomes more widespread.

Managed Futures strategies performed relatively well over the December quarter as buoyant market conditions and improving market sentiment reversed trends seen in the previous quarter. US dollar weakness trends underpinned the advance, with continued strength in all major currencies against the US dollar, and a continuation of the upwards momentum in stock markets. Additionally, strong trends across agricultural and energy markets aided commodities indices.

Equity market neutral strategies have been mixed. Factor rotation leadership and the buoyant sentiment driven by vaccine developments, political changes, and fiscal stimulus led to a decrease in stock dispersion, which tends to be unfavourable for these strategies. Notably, factor correlations have risen to the highest level in two decades, and equity issuance slowed further within the Australian market over the quarter. Equity issuance had allowed for strong alpha capture in previous quarters as many offers were priced at attractive discounts to market prices.

Global macro strategies performed well through the quarter, buoyed by the positive market sentiment, with discretionary managers finding attractive trading opportunities around political events, as well as significant policy changes being made by monetary and fiscal authorities. Lonsec continues to believe the qualitatively driven strategies appear better placed to adapt and react to changing market conditions and significant central bank intervention compared to their systematic global macro peers.

These strategies tend to be better placed to balance the portfolio across asset classes using a combination of directional and spread trades in addition to dedicated hedges. Nonetheless, quantitative macro strategies were favourably positioned for the December quarter, most notably benefiting from a return to fundamentals and the value risk premia.

Within private debt, despite risk appetite continuing to return, the market is still less favourable for debt exposed to leisure, retail and energy sectors. Nonetheless, newly priced issues tend to require a greater level of asset security and financial covenants, which are favourable for the lender.