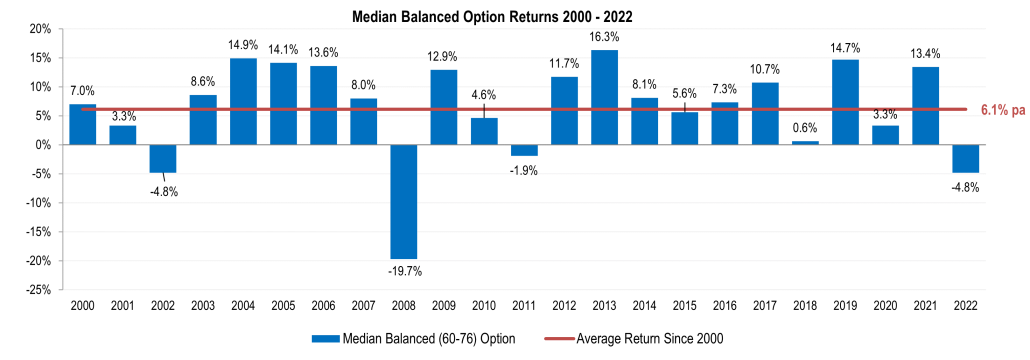

Super funds experienced a turbulent 2022 with heightened inflation driving ongoing interest rate rises and throwing international markets into periods of significant uncertainty. The median Balanced growth option reported a -4.8% return for the 2022 calendar year, making last year the fourth time since 2000 that members have seen balances fall over the year to December.

This year’s return has been driven by declines in property and international shares and was further impacted by fixed interest failing to act as a safety net. However, superannuation has provided strong returns over the long term with an average 6.1% return since 2000.

The Perpetual Balanced Growth Fund provided members with the highest return of 1.7% over the year, while First Super also provided a slight positive return of 0.1% to its members.

Top 20 balanced options over 12 months

| Rank | Option Name | 1 Year % | 10 Year % PA |

|---|---|---|---|

| 1 | Perpetual WealthFocus – Perpetual Balanced Growth Fund | 1.7 | 6.9 |

| 2 | First Super – Balanced | 0.1 | 7.6 |

| 3 | CareSuper – Balanced | -2.0 | 8.3 |

| 4 | Brighter Super – Balanced | -2.2 | 7.4 |

| 5 | Qantas Super Gateway – Growth | -2.2 | 7.7 |

| 6 | Hostplus – Balanced | -2.5 | 9.1 |

| 7 | Australian Retirement Trust – Super Savings – Balanced | -2.6 | 8.6 |

| 8 | Mercer Super Trust – Mercer Select Growth | -3.4 | – |

| 9 | Plum – Pre-mixed Moderate | -3.6 | 7.4 |

| 10 | ESSSuper – Basic Growth | -3.6 | – |

| 11 | TelstraSuper – Balanced | -3.7 | 7.9 |

| 12 | HESTA – Balanced Growth | -3.7 | 8.1 |

| 13 | CSC PSSap – MySuper Balanced | -3.9 | 7.5 |

| 14 | Equip MyFuture – Balanced Growth | -3.9 | 7.9 |

| 15 | Rest – Core Strategy | -4.0 | 7.5 |

| 16 | Catholic Super – Balanced Growth (MySuper) | -4.1 | 7.6 |

| 17 | legalsuper – MySuper Balanced | -4.3 | 7.7 |

| 18 | Commonwealth Bank Group Super – Balanced | -4.3 | 6.1 |

| 19 | Commonwealth Bank Group Super – Growth | -4.4 | 7.2 |

| 20 | Spirit Super – Balanced (MySuper) | -4.4 | 7.7 |

| SR50 Balanced (60-76) Index | -4.8 | 7.5 |

While it has been a challenging year for many funds, we urge members to remember that superannuation is a long-term investment, therefore while it is interesting to see which funds performed well over the year, this needs to be considered in relation to performance over longer time periods.

The top 10 super funds all delivered 8% p.a. or higher over the last decade with the Hostplus – Balanced option the top performer over the long-term, with an average annual return of 9.1%.

Top 20 balanced options over 10 years

| Rank | Option Name | 1 Year % | 10 Year % pa |

|---|---|---|---|

| 1 | Hostplus – Balanced | -2.5 | 9.1 |

| 2 | AustralianSuper – Balanced | -4.8 | 8.8 |

| 3 | Australian Retirement Trust – Super Savings – Balanced | -2.6 | 8.6 |

| 4 | UniSuper – Balanced | -5.4 | 8.4 |

| 5 | Cbus – Growth (MySuper) | -4.8 | 8.4 |

| 6 | CareSuper – Balanced | -2.0 | 8.3 |

| 7 | HESTA – Balanced Growth | -3.7 | 8.1 |

| 8 | Hostplus – Indexed Balanced | -6.3 | 8.0 |

| 9 | Vision Super – Balanced Growth | -5.3 | 8.0 |

| 10 | Aware Super – Growth | -6.7 | 8.0 |

| 11 | Equip MyFuture – Balanced Growth | -3.9 | 7.9 |

| 12 | TelstraSuper – Balanced | -3.7 | 7.9 |

| 13 | IOOF Employer Super Core – IOOF MultiMix Balanced Growth Trust | -5.2 | 7.9 |

| 14 | Prime Super – MySuper | -5.6 | 7.8 |

| 15 | Spirit Super – Balanced (MySuper) | -4.4 | 7.7 |

| 16 | BUSSQ Premium Choice – Balanced Growth | -6.1 | 7.7 |

| 17 | Qantas Super Gateway – Growth | -2.2 | 7.7 |

| 18 | legalsuper – MySuper Balanced | -4.3 | 7.7 |

| 19 | First Super – Balanced | 0.1 | 7.6 |

| 20 | Catholic Super – Balanced Growth (MySuper) | -4.1 | 7.6 |

| SR50 Balanced (60-76) Index | -4.8 | 7.5 |

We expect more ups and downs for markets over the coming months, with the path of inflation and the related interest rate movements remaining the key driver for whether funds can provide a positive return to members or not. It’s a good time for members to consider the level of ups and downs they are willing to tolerate and do a health check on their fund across performance, fees and insurance.

For members seeking a less bumpy ride there is a silver lining with cash returns expected to rise to around 4-5%, however while a significant improvement on the last few years, expected cash returns remain lower than inflation.

2022 was another eventful year for Australia’s superannuation members, with funds needing to adjust their strategies to increasingly consider risk as greater uncertainty led to a lot more ups and downs across investment markets.

We continue to see funds merging and investment menus consolidating but there remains a large number of products across the market – in our latest review we rated over 450 superannuation products. Our product ratings are accessible on our website here.

SuperRatings Executive Director Kirby Rappell said, “While members may be disappointed with this year’s performance, if we look at the long term, funds continue to perform well against objectives. With more uncertainty ahead, it remains important to set your strategy and try to ignore the current market noise to increase the odds of long term success.”

Release ends

We welcome media enquiries regarding our research or information held in our database. We are also able to provide commentary and customised tables or charts for your use.

For more information contact:

Kirby Rappell

Executive Director

Tel: 1300 826 395

Mob: +61 408 250 725

Kirby.Rappell@superratings.com.au