Prolonged QE lulled markets into a false sense of stability

The recovery from the Global Financial Crisis (GFC) has been largely assisted by ultra-loose monetary policy and unprecedented levels of Quantitative Easing (QE), which has been highly supportive of global equity markets. QE provides additional liquidity within the financial system via a central bank purchasing securities in efforts to increase the money supply and encourage lending and investment. Following the GFC, a number of central banks adopted this unconventional monetary policy in attempts to spur economic growth, despite the long-term efficacy of this experiment remaining unclear. However, prolonged bouts of QE depress interest rates to an abnormally low level, and as such capital is shifted into higher-yielding financial assets. This change in investor behavior consequently distorts capital markets by artificially inflating the value of financial assets while decreasing volatility.

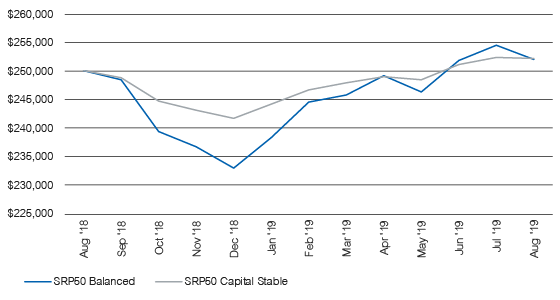

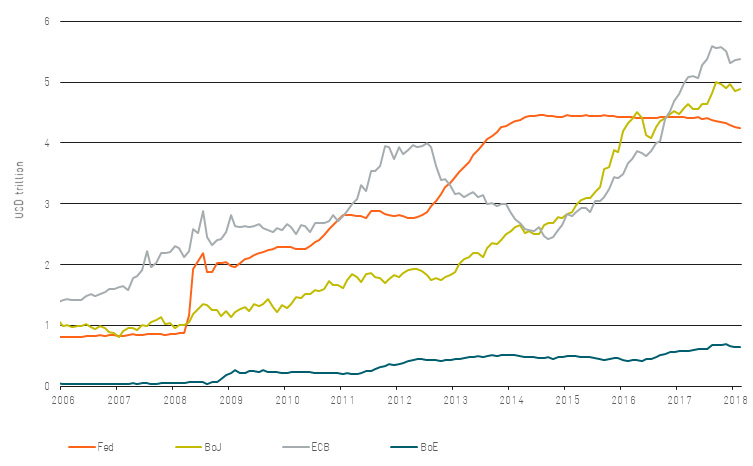

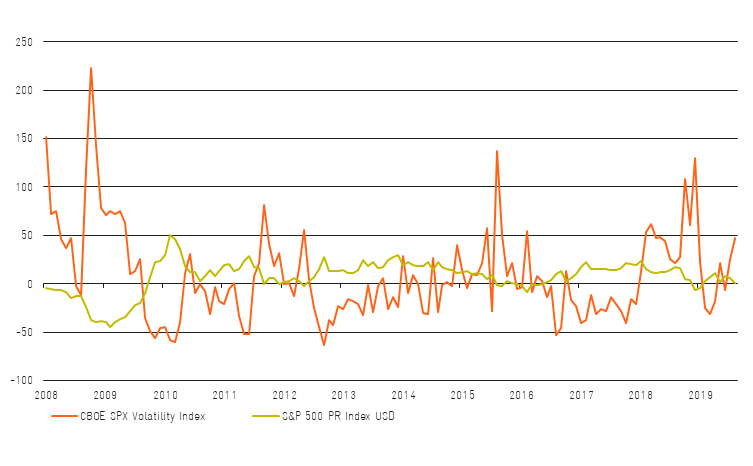

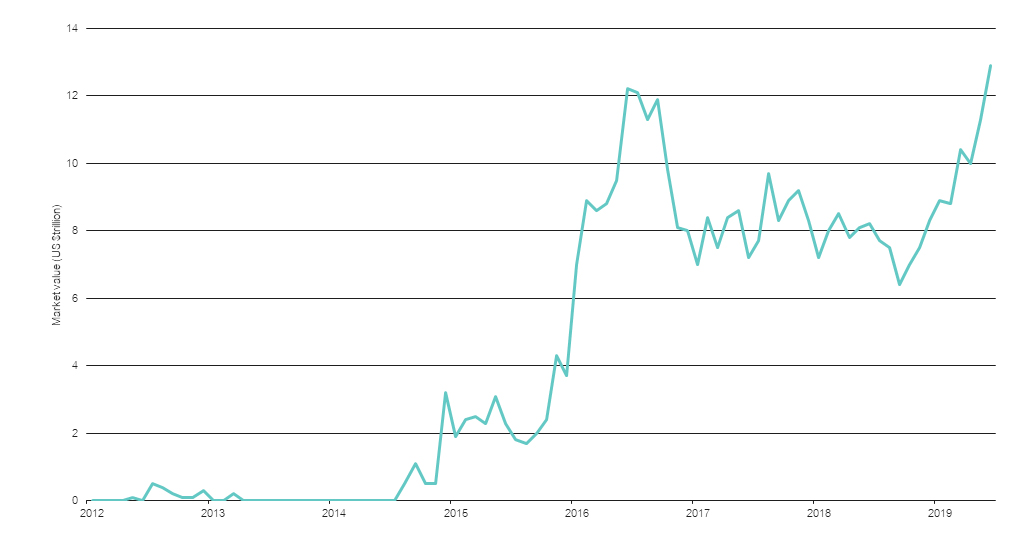

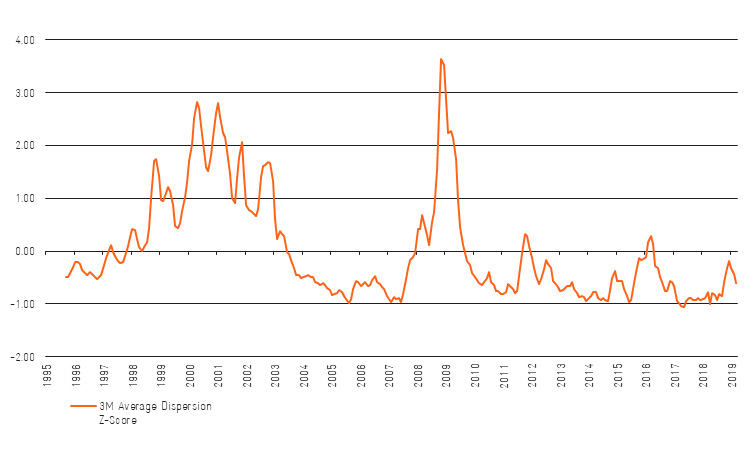

As the Chart 1 below shows, central bank balance sheets were relatively static until ‘QE1’ was initiated. The years that followed involved significant central bank market intervention which has resulted in periods of unusually depressed volatility. This is outlined in Chart 2, which illustrates the uncharacteristically subdued dispersion of returns during the GFC recovery, which is attributable to the excessively accommodative monetary policy adopted during this period. Conversely, in the pre-GFC period, it is believed that market euphoria contributed to atypically low dispersion of returns.

Chart 1: Global central bank balance sheets, 2006-18

Source: AQR, Bloomberg

Under normal market conditions, the appeal of Alternative strategies within a well-diversified portfolio relates to their ability to dampen volatility and enhance risk-adjusted returns when blended with other asset classes. Unfortunately for investors in this asset class, prolonged quantitative easing has largely stifled volatility and asset class dispersion of returns which hedge funds have attributed to their ongoing underperformance. As such, protracted periods of loose monetary policy across the last decade has heightened correlation and lowered the dispersion of returns amongst asset classes and the underlying securities which has seen Alternative strategies become a less attractive value proposition to investors.

Chart 2: Historical dispersion of returns

Source: AQR, Bloomberg

However, in 2018 inflation finally reached the 2% p.a. target after years of chronically undershooting the US Fed’s target band of 2–3%. The combination of robust economic growth and an uptick in inflation emboldened the Fed’s hawkish stance and led to four interest rate hikes last year. Consequently, the process for central banks to unwind their inflated balance sheets and normalize monetary policy to counter runaway inflation is Quantitative Tightening (QT). Similar to QE, QT remains largely untested as it involves draining liquidity from the financial system, which is broadly negative for financial assets. The market volatility observed throughout 2018 was largely attributable to the regime change from QE to QT, which saw an increase in risk premia manifest into deteriorating P/E multiples and equities derating significantly. Similarly, the initiation of QT resulted in poor returns for fixed income securities due to bond yields spiking and credit spreads widening. Overall, the elevated levels of volatility throughout 2018 culminated in disappointing returns across traditional assets class.

Geopolitical factors are creating a powder keg environment

The abrupt market dislocation which followed the brief tightening phase in 2018 has resulted in global central banks abandoning any prospect of a return to normalized monetary policy. Most notably was the dovish ‘Powell-Put’ which sidelined the Fed governor’s previously hawkish rhetoric, replacing it with a more accommodative monetary policy stance which has been replicated by central banks globally. This about-face from Powell in conjunction with additional easing and fiscal stimulus in China led to a significant reversal and market rally for the remainder of the 2019 financial year.

Trump’s adversarial negotiating techniques continue to weigh on markets with pressure mounting for a permanent truce as the 2020 election looms, the Chinese economy reports the slowest economic growth in decades, and the German economy teeters on the brink of recession. Trump’s modus operandi has typically been to threaten international trading partners with economic penalties for not kowtowing to his demands, and this approach has been mostly successful, with the exception of China. However, there is a limit to the resilience of the US economy as the sugar hit from Trump’s hallmark tax cuts fade. Consequently, the US Fed was forced to cut interest rates by 0.25% in July for the first time in 11-years, citing the trade wars and a global economic slowdown. Meanwhile, markets continue to grapple with the increasingly hostile US-Iran relationship, the perilous Italian sovereign debt challenge, and the North Korean nuclear program.

The US-China trade war re-escalation in early August quickly dispelled any hopes of a prolonged market recovery in 2019, with Trump abruptly announcing further tariffs on virtually all remaining Chinese imports. The US Treasury department subsequently labelled China as a ‘currency manipulator’ after the country allowed the Yuan to breach the psychologically critical level of US$1/¥7, resulting in additional tit-for-tat countermeasures by both sides. As such, August was a tumultuous month for markets with severe selloffs followed by relief-rallies, new tariffs precipitating reversals and bravado foreshadowing olive branches. Trump’s public rhetoric continues to be equally volatile, oscillating from heaping praise on the ‘strongman Xi Jinping’ to declaring him as America’s greatest enemy, with the unpredictability of such events (i.e. Tweets) whipsawing markets.

Trump’s public optimism has never faltered, despite his economic credibility starting to weaken in the face of a synchronized global slowdown and fears of an imminent recession. This was highlighted when the yields on the 10-year and 2-year Treasury notes inverted in August for the first time since the GFC, which historically has been a precursor to every recession in the last 50 years (albeit the timing is notoriously unreliable). However, critics will argue that protracted periods of QE have distorted the yield curve such that its predictive qualities are now weak or non-existent. Despite this, it does clearly indicate that investors are preparing for a global slowdown, which again sparked a savage wave of panic selling and a thirst for safe-haven assets.

The global economic outlook continues to deteriorate with Brexit uncertainties similarly contributing to the powerful recessionary forces that are gathering pace. The UK prime minister Boris Johnson has steadfastly committed to leaving the European Union on 31 October. Johnson’s unwavering commitment to Brexit highlights the increased probability of a ‘no deal’ Brexit, which has further exacerbated the pessimistic outlook held by markets. The potential for a disorderly Brexit has thrust the pound into a downward trajectory while simultaneously crimping corporate sector activity, leaving the economy hinging on a recession. As Chart 3 shows, this heightened uncertainty and volatility has led to significant underperformance of the FTSE 100 Index versus the MSCI AC World Index since the Brexit referendum was held.

Chart 3: MSCI AC World Index vs FTSE 100 Index

Source: Lonsec

How Alternatives can help mitigate the effects of volatility

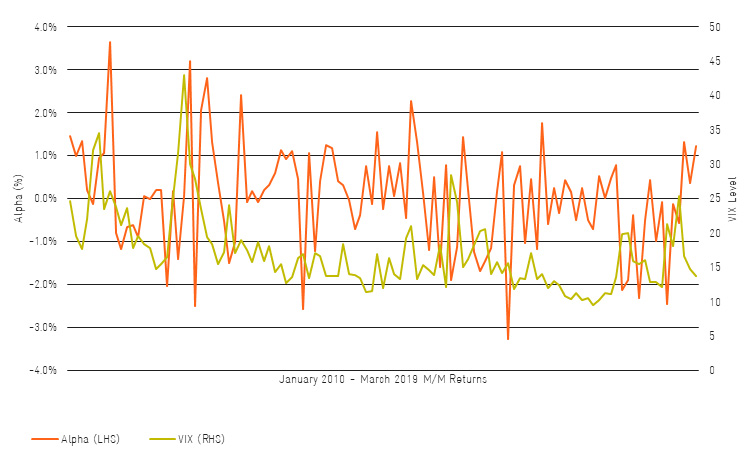

The ongoing trade dispute, diverging monetary policy, populism, Brexit uncertainties and concerns over the longest economic expansion on record running out of steam have all culminated into the elevated levels of volatility observed throughout 2018-19. However, this potentially paves the way for Alternative strategies to deliver alpha to patient investors. Increased volatility and dispersion of returns amongst asset classes may support Alternative assets, as risks within global financial markets remain tilted to the downside amid a synchronised global slowdown. That said, Alternative strategies failed to protect and generate alpha during the 2018 correction where the environment was more conducive to performance.

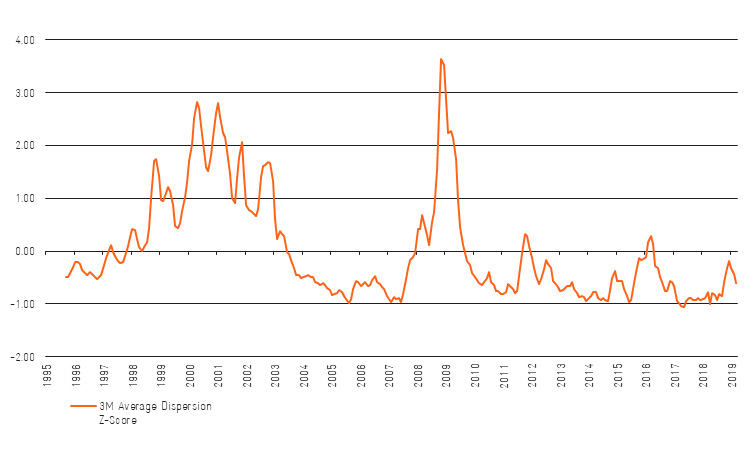

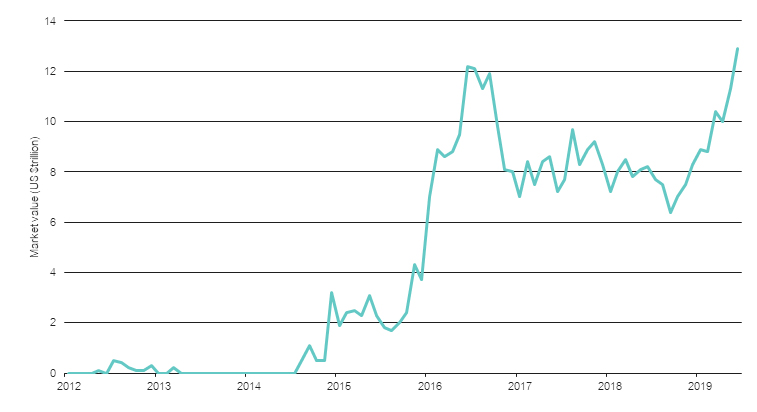

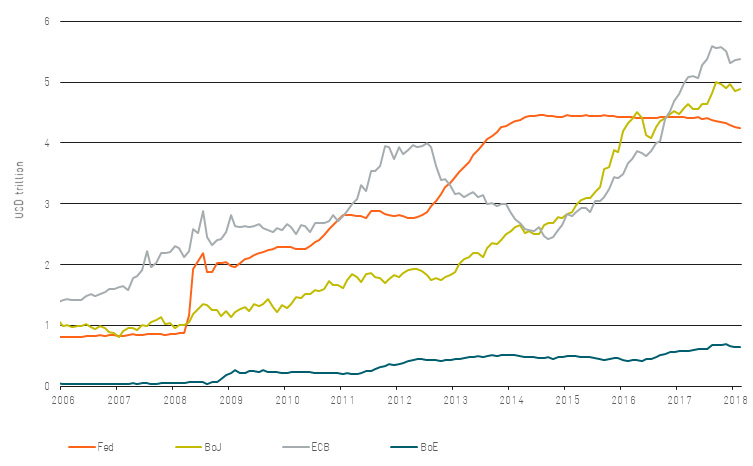

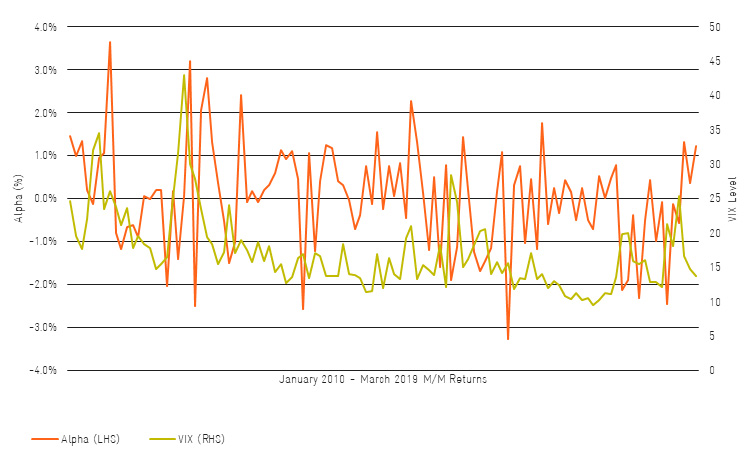

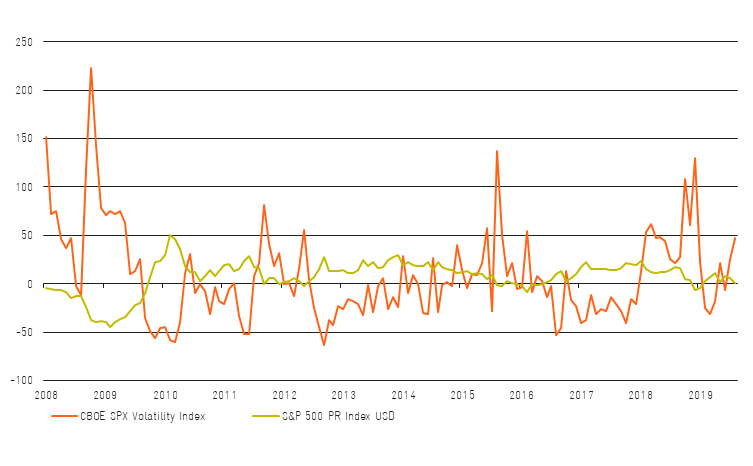

This historical relationship is best illustrated through contrasting the below two charts. Chart 4 highlights the historically positive correlation between volatility and Alternative assets. This is captured via a composite of the excess returns (bank bill rate plus 3%) generated among Lonsec’s Alternative asset peer group against the VIX, which is a measure of implied volatility. The results generally illustrate a stronger correlation during periods of heightened volatility, and therefore, greater excess returns for Alternative strategies when markets are distressed. Conversely, Chart 5 elucidates the typically negative correlation between volatility and broader equity market returns.

Chart 4: Post-GFC volatility positively correlated with Alternative assets excess returns

Source: Lonsec

In an increasingly volatile and late-cycle environment, Lonsec remains overweight Alternative assets in efforts to leverage the more prominent market dislocations occurring. Despite their generally tepid returns in a strong bull market, Lonsec emphasises the importance of Alternative investment strategies in client portfolios, as skewed valuations create an attractive opportunity set for contrarian investors. Alternative strategies may provide a degree of insulation from market turbulence through their broad-based diversification via uncorrelated and unconventional investment strategies.

Chart 5: Volatility and S&P 500 Returns Offer a Negative Correlation

Source: Lonsec

While the current economic expansion may continue beyond the consensus expectations, Lonsec highlights the importance of including uncorrelated and diversified return drivers into balanced portfolios. In this respect, Alternative strategies continue to offer a compelling late-cycle solution in the face of a sustained bull-market, a gradual economic softening, or a severe equity market deterioration.