The yield curve is one of the most watched barometers of perceived economic health in financial markets. Investors turn to it for a gauge of central bank policy changes, inflation expectations and, more importantly, recessions. Given the yield curve’s undefeated record of recession prediction, ignoring it is to any investor’s detriment.

News headlines in 2019 flashed their warning bells when the yield curve inverted (which happens when short term rates are higher than long term rates). Today the signal is much more positive, with the Australian yield curve at its steepest level (as measured by the spread between the 10-year rate and 2-year rate) since May 2014. Headlines have been quite lazy in picking up on the curve’s resurgence given it is the ‘norm’ for it to be upwardly sloping. But why is the Reserve Bank of Australia (RBA), and its chair Philip Lowe, vehemently against its rise?

Firstly, a steepening yield curve can be driven by multiple factors with varying interpretations. Typically, the basic premise of steepening is that long-term rates rise faster than short-term rates, or short-term rates fall faster than long-term rates. At a more rudimentary level, the ‘short end’ of the curve reflects current and perceived central bank policy, while the ‘long end’ reflects expectations relating to inflation and the state of the future economy.

Australian government bond spread continues to widen

For context, the spread between the Australian 10-year yield and the 2-year yield is currently 116bps versus 29bps this time last year. The RBA, with its sizable quantitative easing (QE) programs and revisions to the overnight cash rate, has done the job of running a steam roller over the short end. But the long end has potentially gotten away from them.

When we think about buying a property, there is one word we think about, and that is location, location, location. With a government bond, that word is inflation, inflation, inflation. Which is what the RBA wants, right? Well, yes and no. The RBA does want inflation, but unfortunately for them inflation expectations are reflected in nominal yields, generally at the long-end of the curve (10-years and longer), and eventually across the whole curve when the market anticipates a rate hike. However, we can dig into this a little further.

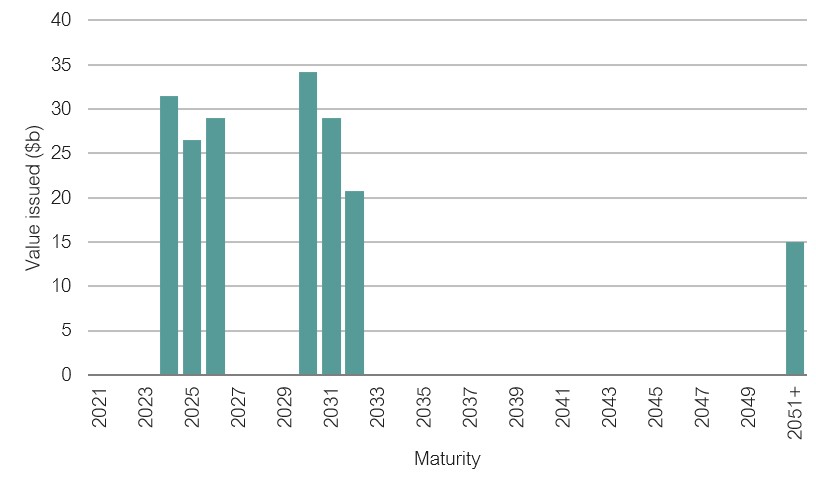

Many chalk up the rise in long-dated yields to a rise in inflation expectations, but it is also important to note that there has been around $186 billion of government bond issuance since January 2020, with around $34 billion of that issuance around the 10-year tenor. This has had the knock-on effect of repricing other yields around that maturity, from both a liquidity and supply standpoint. So, inflation ‘expectations’ may be driven more by liquidity than a standard interpretation of the curve tells us. However, the raft of fiscal and monetary measures taken has indeed stoked the fire—so why is this a potential issue?

The RBA is dealing with the problem of high domestic and attractive AAA-rated Australian government bonds (AGBs) when compared to other sovereign issuers, many of which are lower quality relative to AAA-rated AGBs. When considering global rates, Australian yields continue to be some of the highest and safest in the world, hence a strengthening Australian dollar. While the rise in the dollar is not entirely attributable to capital flows and is in part due to the rise in commodity exports, this is still bad news from an economic growth perspective.

Australian government bond issuance over the past 12 months

In Australia, there is a reliance on resource exports as an important source of income. A higher dollar weakens our export trade to some extent, and the RBA knows this. It is therefore reasonable to believe that the RBA is fighting a battle with a stubbornly high Australian dollar, partially stoked by ‘high’ relative rates and, thus, inflation may be the only road out.

Thankfully, imported inflation from a weak dollar is one avenue by which the RBA could boost CPI prints in the future, ultimately pushing them closer toward their target 2–3% inflation band. But then again, they have not hit their target in nearly five years. Furthermore, other major central banks have extended their own QE programs alongside additional government fiscal stimulus in response to the global economic fallout from the pandemic. This has provided further downward pressure on their own respective currencies compared to the Australian dollar.

Ultimately, a competitive currency devaluation exercise is taking place in order to stoke imported inflation. One could question whether the RBA’s inflation targeting mandate is even valid anymore, although that is a whole other discussion.

So where are the positives with a steeper curve? Thankfully for fixed income managers they now have term premia (the excess yield above a shorter-dated bond) available to them. For much of 2019, managers were only afforded extra yield in the range of 20-40bps for taking on nearly eight more years of duration risk. For strategies that rely on yield curve roll down, the increase in the slope of the curve is indeed welcome after a historically ‘tight’ 2019.

For long duration biased strategies, their returns typically favour decreases in long-term rates, although managers that have shown to persistently add value from duration will benefit from a correct call on directionality. All in all, market dislocation and the flood of liquidity have provided yet another peculiar but interesting time for active investors—retail and institutional alike.

by Joshua Nappa – Investment Analyst, Fixed Income

Issued by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Warning: Past performance is not a reliable indicator of future performance. Any advice is General Advice without considering the objectives, financial situation and needs of any person. Before making a decision read the PDS and consider your financial circumstances or seek personal advice. Disclaimer: Lonsec gives no warranty of accuracy or completeness of information in this document, which is compiled from information from public and third-party sources. Opinions are reasonably held by Lonsec at compilation. Lonsec assumes no obligation to update this document after publication. Except for liability which can’t be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error, inaccuracy, misstatement or omission, or any loss suffered through relying on the document or any information. ©2021 Lonsec. All rights reserved. This report may also contain third party material that is subject to copyright. To the extent that copyright subsists in a third party it remains with the original owner and permission may be required to reuse the material. Any unauthorised reproduction of this information is prohibited.