The challenges of owning a ‘balanced’ portfolio consisting of equities and bonds is front of mind given the broad market volatility that has occurred in 2022. ‘Balanced’ portfolios can differ in the proportion of growth assets they hold, anywhere from 50% – 70% growth and 30% to 50% defensive assets. For the purposes of Lonsec’s analysis in this thought piece, we have used 60% growth and 40% defensive assets as the benchmark portfolio, consisting of 30% S&P/ASX 200 TR Index, 15% MSCI AC World Index ex Australia NR Index (AUD Hedged), 15% MSCI AC World Index ex Australia TR Index (AUD), 20% Bloomberg AusBond Composite 0 Year Index AUD, and 20% Bloomberg Global Aggregate TR Index (AUD Hedged). This represents a broad and fairly vanilla exposure to 60% equities and 40% bonds.

The so called ‘death of the 60/40 portfolio’ has been raised many times following the GFC. That being said, this portfolio has performed exceptionally well over this period. The average calendar year return from 2009 to 2021 has been 9.3%, with the highest returning year being 17.8% (2019) and the lowest returning year being -0.5% (2018). With volatility mostly at the lower end of historical norms, risk adjusted returns have also been strong. Those adopting a buy and hold, static approach to portfolio construction have generally been well rewarded.

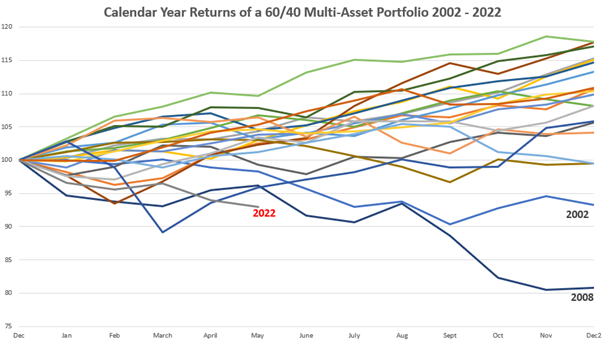

That has all changed this year. ‘Balanced’ portfolio returns have been challenged by the war in Ukraine and central banks that have pivoted more quickly than expected to raising interest rates in response to inflation. Figure 1 shows the extent of the sell-off in 2022. For the calendar year until the end of May, the ‘Balanced’ portfolio is down -7.1%. This is the worst start to a calendar year over the 20-year period assessed. Of course, 2002 and, in particular, 2008 ended with deeper drawdowns and at this stage it is highly uncertain how the rest of 2022 will shape up.

Figure 1

Source: Lonsec iRate, data is calendar year returns for a 60/40 portfolio consisting of 30% S&P/ASX 200 TR Index, 15% MSCI AC World Index ex Australia NR Index (AUD Hedged), 15% MSCI AC World Index ex Australia TR Index (AUD), 20% Bloomberg AusBond Composite 0 Year Index AUD, and 20% Bloomberg Global Aggregate TR Index (AUD Hedged). YTD 2022 as at 31 May 2022.

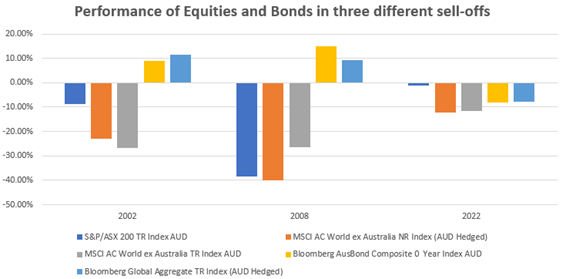

What is different in the 2022 sell-off is the performance of bonds and the breakdown in diversification benefits that they typically offer to a balanced portfolio. While the concept of diversification, the idea of not putting your eggs all in one basket, is fairly well understood, the concept of correlation is less so. If the returns of two asset classes are correlated it means they move up and down together. If assets are negatively correlated it means when the value of one asset rises, the other falls. Ideally, portfolios should be made up of asset class constituents that have a low correlation to each other so that when parts of the portfolio fall in value, other areas of the portfolio rise in value. A negative correlation between risky assets, such as equities, and risk-free assets, such as bonds, has tended to hold for much of recent history, especially in market stress events. However, in 2022, the correlation between equities and bonds has been positive. As depicted in Figure 2, both asset classes have sold off together this year, whereas in 2002 and 2008, bonds offered diversification benefits to falling equity markets.

Figure 2

Source: Lonsec iRate, 2022 correct as at 31 May 2022.

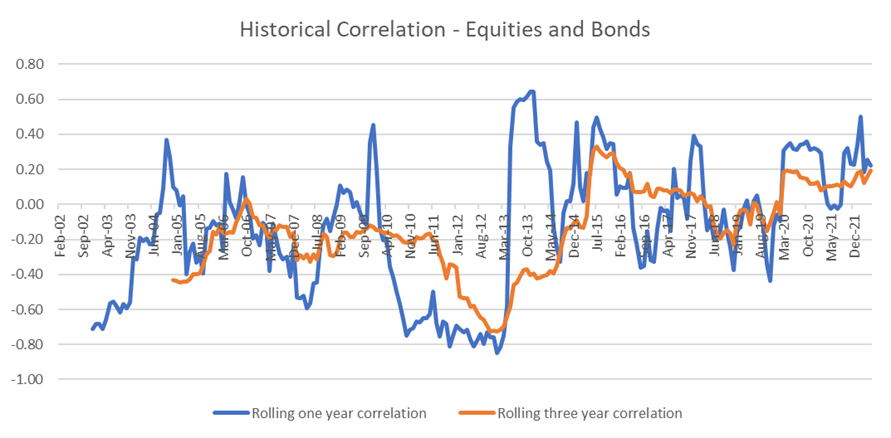

While the negative correlation between equities and bonds is often written about as if a universal law of investing, figure 3 shows that correlations between the two asset classes certainly aren’t static through time and can be highly sensitive to changes in market conditions and regimes. Rolling one-year correlations have been quite volatile over the 20 year period under assessment. A more medium-term representation, as shown by the rolling three year correlation, shows that the two asset classes were generally negatively correlated in the period from 2002 to 2012, but turned more positive in the last several years and spiked early in 2022. The takeaway from this is that positive correlations between equities and bonds are not necessarily anything new, rather the correlations are time varying in nature. Of course, a positive correlation between the two asset classes is less acceptable when markets are falling as they have been this year.

Figure 3

Source: Lonsec iRate, for the period January 2022 to May 2022. Equities consists of 50% S&P/ASX 200 TR Index, 25% MSCI AC World Index ex Australia NR Index (AUD Hedged), 25% MSCI AC World Index ex Australia TR Index (AUD). Bonds consists of 50% Bloomberg AusBond Composite 0 Year Index AUD, and 50% Bloomberg Global Aggregate TR Index (AUD Hedged).

What does the future state hold? ‘Regime change’ has become the topic de jour, a term used to describe a structural shift in the economic environment. For much of the last 20-30 years, the environment has been dominated by low inflation (and falling interest rates) and moderate growth, an environment which, all else equal, is favourable for both equities and bonds. Importantly, bonds have been a great diversifier while delivering positive returns.

Conversely, a backdrop of higher inflation (and rising interest rates) and low growth is less favourable for equities and bonds. It is this environment that is dominating markets this year. The duration of these changes is never certain and one can never be certain how long a certain regime will persist. High valuations in both equity and bond markets at the start of this year had certainly made markets more susceptible to a correction when sentiment turned. That being said, markets can be fast moving and naturally reset themselves after periods of extreme market performance. 10 year bond yields in the US and Australia have already priced in a number of rate rises and some multi-asset managers, after a period of little exposure to bonds, are now talking about them offering better value in some circumstances.

While stress in financial markets can be worrying, it is important to focus on your long-term investment strategy and ensure portfolio asset allocations are aligned with your goals and objectives. Figure 5 shows that the variance of shorter-term returns can be wide, however the range of potential outcomes tends to narrow over longer-term time horizons. This highlights the time diversification inherent in many multi-asset portfolios.

Figure 4

| Rolling one-year returns | Rolling three year returns p.a. | Rolling five year returns p.a. | Rolling 10 year returns p.a. | |

| Average annualised return | 8.07% | 7.77% | 7.51% | 7.60% |

| Best annualised return | 24.62% | 15.82% | 12.94% | 10.00% |

| Worst annualised return | -20.26% | -4.21% | 1.29% | 5.31% |

Source: Lonsec iRate using monthly time series of 60/40 Balanced portfolio from 2002 to May 2022 consisting of 30% S&P/ASX 200 TR Index, 15% MSCI AC World Index ex Australia NR Index (AUD Hedged), 15% MSCI AC World Index ex Australia TR Index (AUD), 20% Bloomberg AusBond Composite 0 Year Index AUD, and 20% Bloomberg Global Aggregate TR Index (AUD Hedged).

Note, the average annualised return of the ‘Balanced’ portfolio is between 7.5% and 8.1% p.a. over each rolling timeframe. For those investors with shorter term time horizons, the range of potential outcomes has been exceptionally wide. An investor withdrawing in November 2008 after one year invested experienced a loss of -20.3%. Somewhat unsurprisingly the strongest 12-month return was in the aftermath of the financial crisis in February 2010 with a return of 24.6%. While an obvious lesson here is that investors tend to be well rewarded for investing at the bottom of the cycle (notwithstanding the difficulties of picking the bottom), a major takeaway is that those invested over longer time horizons have a much narrower range of potential outcomes (somewhat easier than picking when to invest). Rolling 10-year periods over the 20 year time period assessed were in the range of 5.3% and 7.6% p.a. The 5.3% p.a. return was for the 10-year period ending December 2011 and included the drawdowns of 2002 and 2008, highlighting that staying the course can be a valuable strategy in itself when correctly aligned to your risk profile and overall objectives.

The multi-asset universe is exceptionally broad consisting of static asset allocation approaches as referenced in the analysis above, in addition to those taking active asset allocation and/or active security selection decisions. If the forward-looking environment continues to be challenged, multi-asset managers will have to lean on these asset allocation and security selection levers to enhance the risk and return profile of their portfolios. Many multi-asset funds have the flexibility in their mandates to tilt portfolios away from their reference asset class benchmark, in addition to introducing other asset classes within their portfolios to support diversification benefits. Forward looking scenario testing and testing of correlation assumptions may also be part of their investment process. Theoretically, this increases the level of diversification and potential return sources available and allows active managers to be more dynamic in responding to changing market conditions or regimes. Funds with greater asset allocation tools can be useful for investors who require greater certainty in outcomes, are close to or in retirement, or have a specific goal suited to the fund in question.

Key takeaways for multi-asset investors

- Investing in the right asset allocation for your risk profile and goals is highly important. This may well be a static asset allocation approach, as is the one described in our analysis, or one that is much more dynamic and tactical in its approach.

- Return outcomes over shorter term time horizons can be wide. Investors who are willing to invest over the longer term have tended to be well rewarded for taking risk.

- The correlation between equities and bonds is time varying and dependent on market regimes. To date, 2022 has been an exceptionally unusual year in the last 20 years with both equities and bonds selling off together.

IMPORTANT NOTICE: This document is published by Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL No. 421445 (Lonsec). Please read the following before making any investment decision about any financial product mentioned in this document.

Disclosure as at the date of publication: Lonsec receives fees from fund managers or product issuers for researching their financial product(s) using comprehensive and objective criteria. Lonsec receives subscriptions for providing research content to subscribers including fund managers and product issuers. Lonsec receives fees for providing investment consulting advice to clients, which includes model portfolios, approved product lists and other advice. Lonsec’s fees are not linked to the product rating outcome or the inclusion of products in model portfolios, or in approved product lists. Lonsec and its representatives, Authorised Representatives and their respective associates may have positions in the financial product(s) mentioned in this document, which may change during the life of this document, but Lonsec considers such holdings not to be sufficiently material to compromise any recommendation or advice.

Warnings: Past performance is not a reliable indicator of future performance. The information contained in this document is obtained from various sources deemed to be reliable. It is not guaranteed as accurate or complete and should not be relied upon as such. Opinions expressed are subject to change. This document is but one tool to help make investment decisions. The changing character of markets requires constant analysis and may result in changes. Any express or implied rating or advice presented in this document is limited to “General Advice” (as defined in the Corporations Act 2001 (Cth)) and based solely on consideration of the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (‘financial circumstances’) of any particular person. It does not constitute a recommendation to purchase, redeem or sell the relevant financial product(s).

Before making an investment decision based on the rating(s) or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances, or should seek independent financial advice on its appropriateness. If our advice relates to the acquisition or possible acquisition of particular financial product(s), the reader should obtain and consider the Investment Statement or Product Disclosure Statement for each financial product before making any decision about whether to acquire a financial product. Where Lonsec’s research process relies upon the participation of the fund manager(s) or product issuer(s) and they are no longer an active participant in Lonsec’s research process, Lonsec reserves the right to withdraw the document at any time and discontinue future coverage of the financial product(s).

Disclaimer: This document is for the exclusive use of the person to whom it is provided by Lonsec and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by Lonsec. Financial conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, Lonsec, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from, this document or any loss or damage suffered by the reader or any other person as a consequence of relying upon it.

Copyright © 2022 Lonsec Research Pty Ltd (ABN 11 151 658 561, AFSL No. 421445) (Lonsec). This document is subject to copyright of Lonsec. Except for the temporary copy held in a computer’s cache and a single permanent copy for your personal reference or other than as permitted under the Copyright Act 1968 (Cth), no part of this document may, in any form or by any means (electronic, mechanical, micro-copying, photocopying, recording or otherwise), be reproduced, stored or transmitted without the prior written permission of Lonsec.

This document may also contain third party supplied material that is subject to copyright. Any such material is the intellectual property of that third party or its content providers. The same restrictions applying above to Lonsec copyrighted material, applies to such third party content.