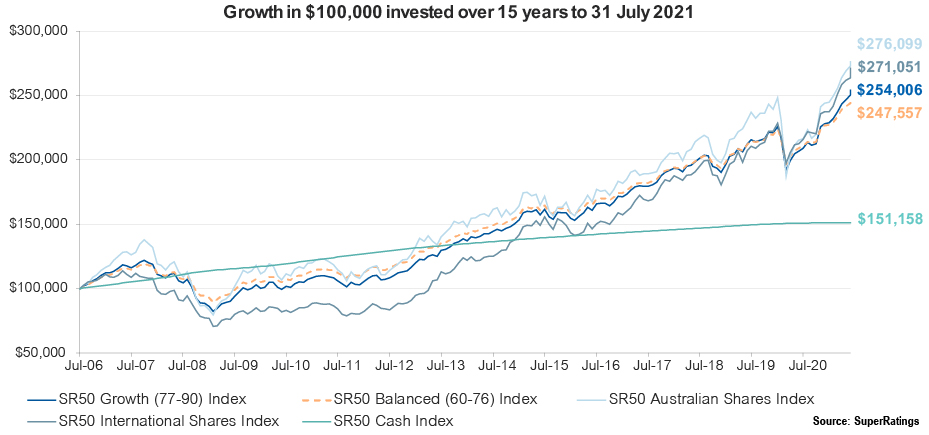

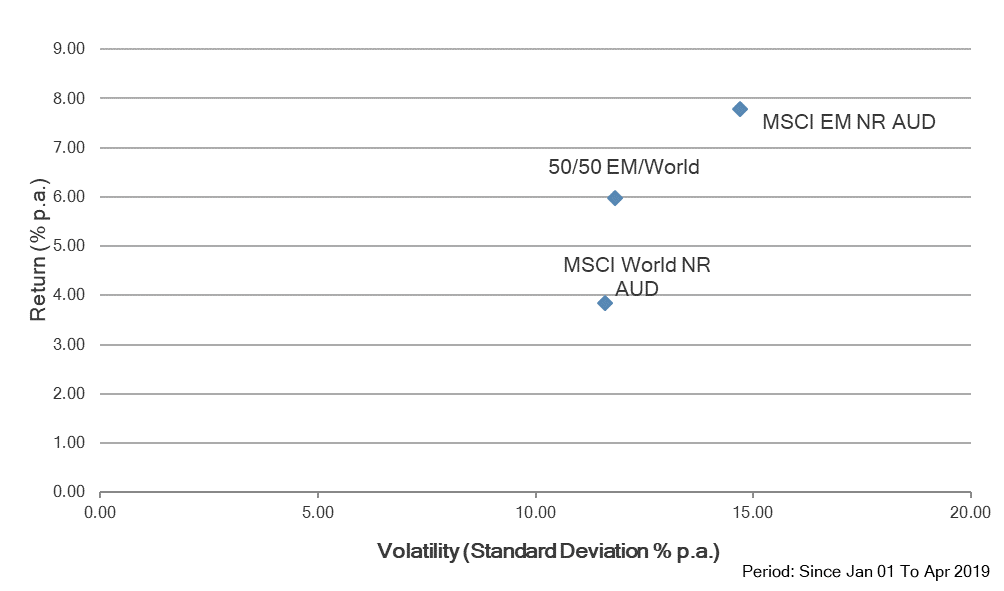

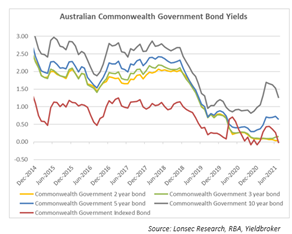

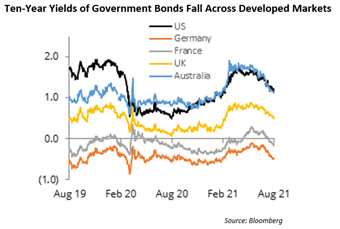

According to a report in Bloomberg recently, while Vanguard data show a portfolio with 60 equities/fixed income mix returned an average 9.1% a year from 1926 to 2020, JP Morgan Asset Management recently estimated it will return just 3.7% over the next decade. Why? In a world where 85% of developed-market government bonds are yielding below 1%, the likely returns from the fixed income component of the portfolio has plunged, as shown in Figures 1 and 2.

Figure 1

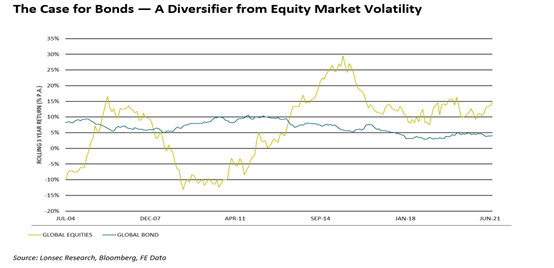

Figure 2

So, this raises a question that we are getting asked by our clients – why even bother having fixed income within my portfolio?

When answering this question, it is important to think about what the reasons were for including fixed income in your portfolio in the first place.

At Lonsec, we believe that fixed income generally can play three roles in a portfolio:

1. As a diversifier to equities – bonds dampen overall portfolio volatility when held in a portfolio with riskier assets such as equities;

2. As a defensive asset that “will not go down” – so may be suitable for the risk averse investor with a primary objective being the preservation of capital; and

3. As a provider of a steady income stream – regular income payments from bonds provide a stable income stream for retirees

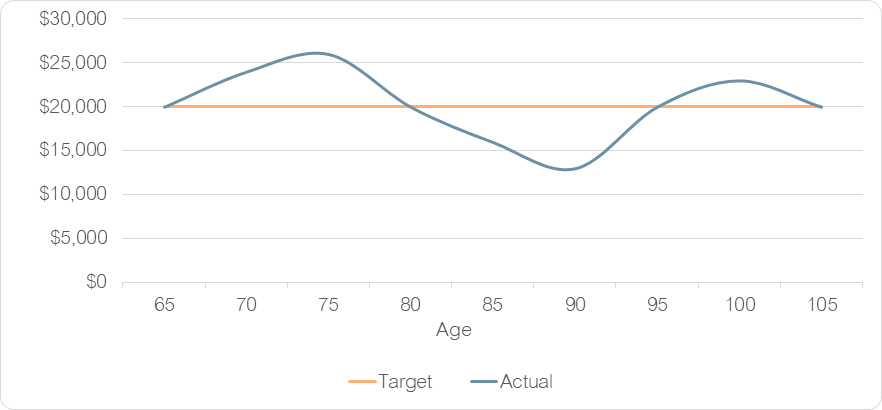

Figure 3 shows the rolling three year returns for global equities and global bonds and serves to highlight the relatively low volatility of global bonds compared to global equities.

Figure 3

However, when faced with the prospect of challenging returns, the reasons for inclusion tend to fall by the wayside and we start to focus on where to find better returns. As a result, we have seen many investors move out of fixed interest securities, especially longer term government bonds, in favour of equities or a taking a bar bell approach by investing in the extremes of lower quality investment grade bonds and short duration cash like securities. This is a dangerous proposition especially for those in retirement.

Becoming a victim of short-termism and negative momentum can shift your portfolio greatly to one that effectively eradicates each of those objectives we listed above. Why?

1. When we increase our allocation to equities or riskier assets, we are reducing our diversification. This will significantly increase the volatility of the portfolio.

2. Whilst the short duration assets will act has a buffer during times of market volatility, we have seen time and time again, that lower quality investment bonds will typically have their correlation to equities rise to 1 during periods of market stress and produce a very significant negative return that effectively wipes out any ‘buffering’ that the short duration assets may have provided.

3. During periods of economic stress, the stability of income from equities can change quickly. We saw this last year when many banks cut their dividends for a short period of time to ensure their books were able to withstand the changing economic landscape.

4. For retirees, unless the income provided through dividends and higher yielding fixed income securities is sufficient enough to live on, the impact of falling markets when in drawdown can be catastrophic to the long term viability of a retirement portfolio.

The question around the validity of longer duration bonds in portfolios is a valid one. Fund managers have been able to lean on these as performance enhancers as dovish central banks have overseen 20 years of falling interest rates. This, coupled with the relentless demand for safe haven assets from investors, especially during times of equity market stress, has seen abnormally high returns being achieved in this end of the market.

A fact that we all quickly forget about volatility is that with riskier assets not only do you have a greater probability of producing higher returns, you also have a greater probability of producing lower returns.

Whilst historically it has been easy to forget about fixed interest as the asset class has taken a backseat to the action packed excitement of the sharemarket, we cannot do this anymore, especially if you are approaching or in retirement. This is the stage where preservation of capital with a guaranteed income stream becomes the most important goal.

For those especially, bond investors now have three choices:

1. Take on more risk to generate higher yields;

2. Lower return expectations for the short to medium term; or

3. Accept low rates as something they cannot change.

IMPORTANT NOTICE: This document is published by Lonsec Investment Solutions Pty Ltd ACN 608 837 583, a Corporate Authorised Representative (CAR 1236821) (LIS) of Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec Research). LIS creates the model portfolios it distributes using the investment research provided by Lonsec Research but LIS has not had any involvement in the investment research process for Lonsec Research. LIS and Lonsec Research are owned by Lonsec Holdings Pty Ltd ACN 151 235 406. Please read the following before making any investment decision about any financial product mentioned in this document.

DISCLOSURE AT THE DATE OF PUBLICATION: Lonsec Research receives a fee from the relevant fund manager or product issuer(s) for researching financial products (using objective criteria) which may be referred to in this document. Lonsec Research may also receive a fee from the fund manager or product issuer(s) for subscribing to research content and other Lonsec Research services. LIS receives a fee for providing the model portfolios to financial services organisations and professionals. LIS’ and Lonsec Research’s fees are not linked to the financial product rating(s) outcome or the inclusion of the financial product(s) in model portfolios. LIS and Lonsec Research and their representatives and/or their associates may hold any financial product(s) referred to in this document, but details of these holdings are not known to the Lonsec Research analyst(s).

WARNINGS: Past performance is not a reliable indicator of future performance. Any express or implied rating or advice presented in this document is limited to general advice and based solely on consideration of the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (“financial circumstances”) of any particular person. Before making an investment decision based on the rating or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances or should seek independent financial advice on its appropriateness. If the financial advice relates to the acquisition or possible acquisition of a particular financial product, the reader should obtain and consider the Investment Statement or the Product Disclosure Statement for each financial product before making any decision about whether to acquire the financial product.

DISCLAIMER: No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by LIS. The information contained in this document is current as at the date of publication. Financial conclusions, ratings and advice are reasonably held at the time of publication but subject to change without notice. LIS assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, LIS and Lonsec Research, their directors, officers, employees and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from, this document or any loss or damage suffered by the reader or any other person as a consequence of relying upon it.

Copyright © 2021 Lonsec Investment Solutions Pty Ltd ACN 608 837 583 (LIS). This document may also contain third party supplied material that is subject to copyright. The same restrictions that apply to LIS copyrighted material, apply to such third-party content.