Ten years since the collapse of US investment bank Lehman Brothers, Australia’s superannuation funds have accumulated over $1 trillion in retirement savings, providing a windfall for members prepared to take a long-term view.

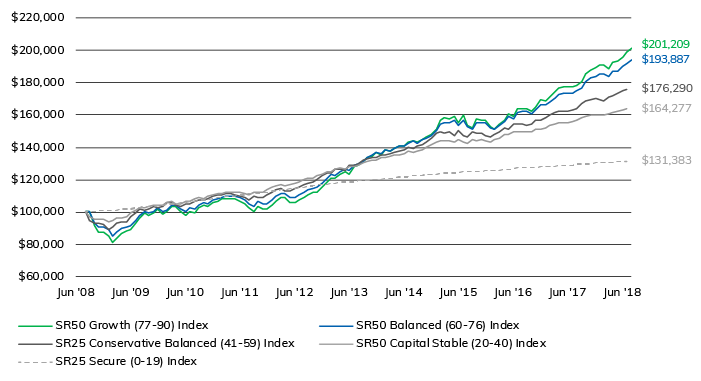

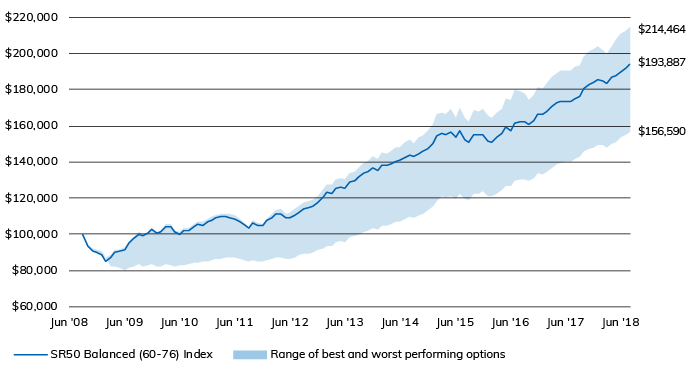

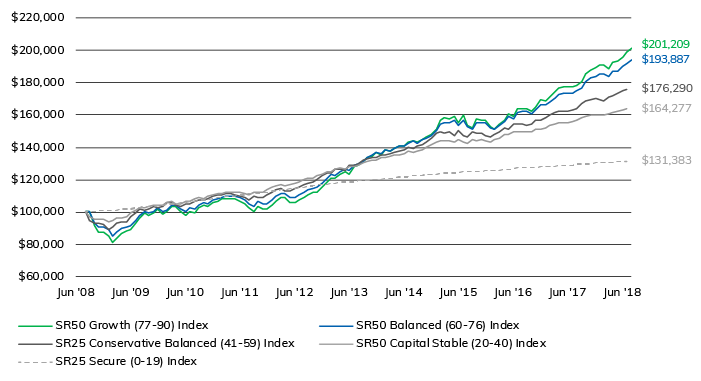

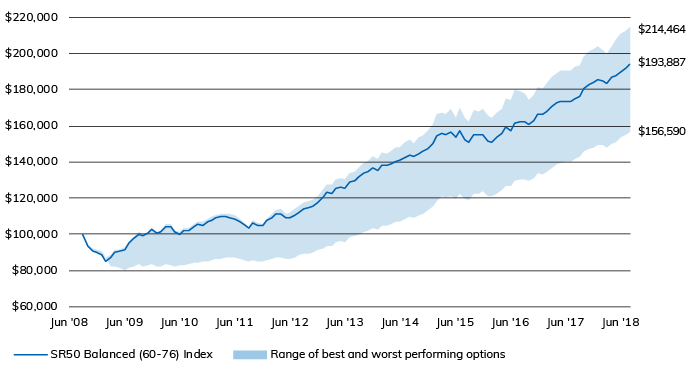

According to data from leading superannuation research house SuperRatings, members with a balance of $100,000 at the end of August 2008, just days before the Global Financial Crisis (GFC) hit, would today have a nest egg worth $193,887 if they remained in a balanced option. In contrast, members who panicked and shifted their savings to a capital stable option would have a far smaller balance of $164,277 (see chart below).

Growth of $100,000 invested over 10 years to 31 August 2018*

Select index

SR50 Balanced (60-76) Index

SR50 Growth (77-90) Index

SR25 Conservative Balanced (41-59) Index

SR50 Capital Stable (20-40) Index

SR25 Secure (0-19) Index

Source: SuperRatings

Interim results only

Source: SuperRatings

*Interim results

Investors who had stuck it out with their growth option would have fared even better, with $100,000 growing to $201,209 over the decade. The results show the importance of taking a long-term view, even in the face of severe crises such as the GFC.

“The failure of Lehman Brothers ushered in a period of intense crisis for the global financial markets, including in Australia,” said SuperRatings Executive Director Kirby Rappell. “We hoped then that the market crash would prove cyclical and that we would see a relatively quick recovery, but of course that did not happen.”

“But even in the face of the Great Recession, Australia’s superannuation funds have shown us that taking a long-term view and sticking with your investment strategy pays off. Super funds held their nerve and refrained from making rash decisions, and members continue to reap the benefits. After 10 years the GFC looks more like a speed hump.”

Interim results only. Median Balanced Option refers to ‘Balanced’ options with exposure to growth style assets of between 60% and 76%. Approximately 60% to 70% of Australians in our major funds are invested in their fund’s default investment option, which in most cases is the balanced investment option. Returns are net of investment fees, tax and implicit asset-based administration fees

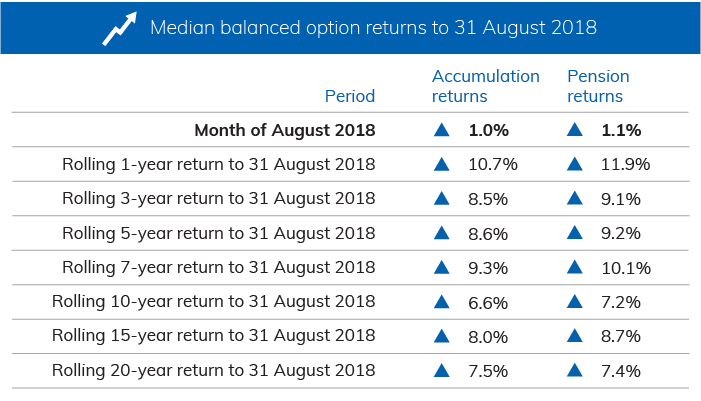

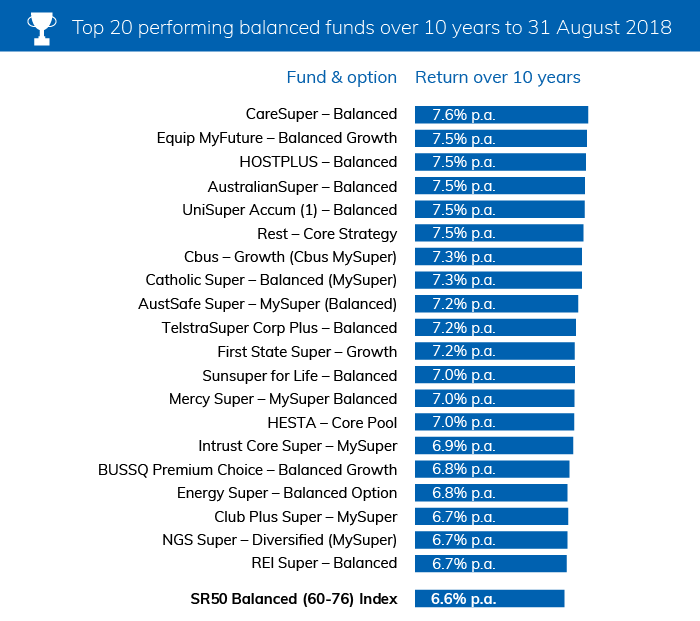

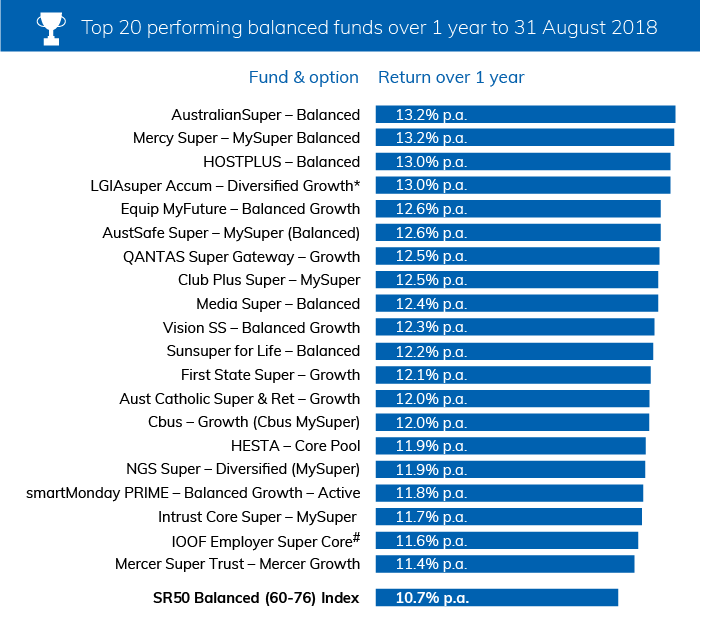

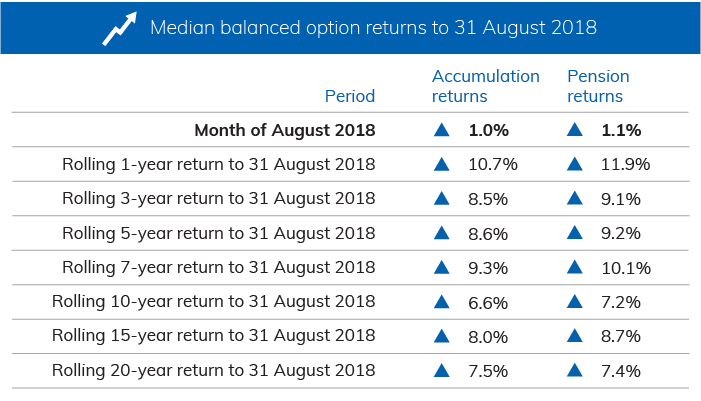

According to SuperRatings’ data, the median balanced option grew at an estimated 1.0% in August, while the median growth option delivered 1.3%. Over ten years, results remain diminished by the GFC, with the median balanced option returning only 6.6% p.a. However, over the past seven years the median balanced option has returned a very healthy 9.3% p.a., with super funds riding the global share market rally which began in 2009.

“The lesson of the GFC is useful to bear in mind when confronting the risks and uncertainties in today’s market,” said Mr Rappell. “There are some significant risks, including the threat of tariffs on global trade and investment, central bank tightening, and the currency and bond crisis that has engulfed emerging markets. Funds need to maintain discipline and stick to their long-term return objectives in the interest of their members.”

Best and worst performing options over 10 years to 31 August 2018*

Source: SuperRatings

*Interim results

Australia’s top super funds take a long-term view

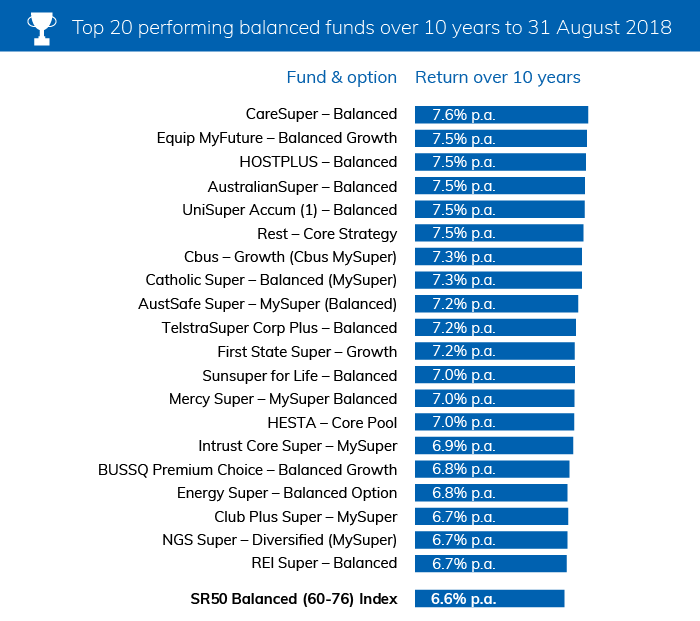

While the GFC continues to cast a shadow over long-term returns, Australia’s top performing funds have nevertheless delivered some impressive results. A comparison of balanced option returns shows that CareSuper remains ahead of the pack with an annual return of 7.6% over the past decade, followed closely by Equip MyFuture and HOSTPLUS.

Source: SuperRatings

*Interim results.

Source: SuperRatings

# IOOF Employer Super Core – IOOF MultiMix Balanced Growth Trust

*Interim results

Release ends

Warnings: Past performance is not a reliable indicator of future performance. Any express or implied rating or advice presented in this document is limited to “General Advice” (as defined in the Corporations Act 2001(Cth)) and based solely on consideration of the merits of the superannuation or pension financial product(s) alone, without taking into account the objectives, financial situation or particular needs (‘financial circumstances’) of any particular person. Before making an investment decision based on the rating(s) or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances, or should seek independent financial advice on its appropriateness. If SuperRatings advice relates to the acquisition or possible acquisition of particular financial product(s), the reader should obtain and consider the Product Disclosure Statement for each superannuation or pension financial product before making any decision about whether to acquire a financial product. SuperRatings research process relies upon the participation of the superannuation fund or product issuer(s). Should the superannuation fund or product issuer(s) no longer be an active participant in SuperRatings research process, SuperRatings reserves the right to withdraw the rating and document at any time and discontinue future coverage of the superannuation and pension financial product(s). Copyright © 2018 SuperRatings Pty Ltd (ABN 95 100 192 283 AFSL No. 311880 (SuperRatings)). This media release is subject to the copyright of SuperRatings. Except for the temporary copy held in a computer’s cache and a single permanent copy for your personal reference or other than as permitted under the Copyright Act 1968 (Cth.), no part of this media release may, in any form or by any means (electronic, mechanical, micro-copying, photocopying, recording or otherwise), be reproduced, stored or transmitted without the prior written permission of SuperRatings. This media release may also contain third party supplied material that is subject to copyright. Any such material is the intellectual property of that third party or its content providers. The same restrictions applying above to SuperRatings copyrighted material, applies to such third party content.

// GLOBAL PARAMETERS

var chartHeight = 376;

var chartWidth = 700;

var startAmt = 100000;

var numAxes = 8;

// DATA

// SR50 Balanced (60-76) Index

var balancedPrices = [

100000,

93352.9,

90449.62481,

90338.1908722341,

88669.7348250148,

85423.9791817451,

87337.4763154162,

90005.6362168522,

90914.6931426424,

91396.5410162984,

94705.0958010884,

97655.1595352923,

100145.366103442,

99093.1387417934,

100391.258859311,

102592.337209801,

100366.083492349,

101206.047245096,

104141.022615204,

104055.418694614,

101429.892370112,

100179.667516758,

102184.1624841,

101782.885278025,

104062.821908253,

105455.078402564,

105268.001093478,

107042.714323912,

108102.437195719,

109280.753761153,

109652.30832394,

109811.30417101,

109531.285345374,

108808.378862095,

107304.320641084,

105333.998705472,

103425.767984924,

106297.798136097,

105222.914801345,

105108.221824212,

107509.839584673,

109439.641205218,

111072.371212359,

111405.588325996,

108960.90409577,

109234.069082338,

110408.335324973,

112219.032024303,

113877.180441494,

114846.389124231,

115459.094610209,

117670.829026562,

120684.849641249,

123038.204209253,

122809.722264036,

125288.513698214,

126153.004442731,

125390.787989888,

129204.298025025,

129774.088979315,

131505.14555221,

133828.315453536,

134878.867729846,

136821.123425156,

135663.479899855,

138501.69556284,

138010.014543592,

139007.274908684,

140471.994564397,

140724.844154613,

142441.687253299,

143675.802031662,

142817.626466127,

144567.999296096,

145646.332002845,

147346.024697318,

150189.360935903,

154641.424162126,

155570.973762764,

155103.016273686,

156605.188986296,

153441.764168773,

157001.613097489,

152421.091035369,

150902.367284293,

155411.631823482,

154909.030606165,

155160.60287187,

151661.731277109,

150911.005707287,

153491.28208287,

155594.41962997,

159149.752118515,

157558.25459733,

161735.754159723,

162199.774038407,

162272.763936725,

161039.490930806,

162917.37243455,

166420.095941892,

166237.033836356,

168065.641208556,

170569.819262564,

172943.81000706,

173762.698947444,

173797.451487233,

173884.350212977,

174922.265899398,

176557.789085557,

180563.53220433,

182827.618334641,

183906.301282815,

185451.114213591,

185092.266307587,

183759.601990173,

186736.507542413,

187423.884626677,

189935.364680675,

191929.686009822,

193887.368807122

];

// SR50 Growth (77-90) Index

var growthPrices = [

100000,

91467.9,

87758.876655,

87399.0652607145,

85267.3146599404,

81293.8577967872,

83676.6620626689,

86973.522547938,

88265.0793577749,

89103.5976116738,

93041.9766261098,

96428.7045753001,

99234.7798784414,

97715.6938680622,

99147.2287832293,

101814.289237498,

98983.8519966957,

99960.5256643471,

103639.073008795,

103421.430955477,

99863.7337306082,

98116.1183903226,

100500.340067207,

99706.3873806765,

102383.503881848,

103987.853387676,

103748.681324885,

105737.232299839,

106889.768131907,

108204.512279929,

108496.664463085,

108540.06312887,

107975.6548006,

106939.088514514,

104933.980604867,

102296.150200422,

100011.058797245,

103564.951771605,

102045.653929116,

101802.887318418,

104521.02440982,

106726.418024867,

108617.716878686,

108834.952312443,

105492.957431785,

105762.386445066,

107065.590570842,

109014.184319231,

110758.411268339,

111815.821820718,

112491.972095268,

114955.546284154,

118580.324569586,

121165.375645203,

120807.93778705,

123655.743304504,

124635.962381679,

123676.26547134,

128294.213547774,

128862.043736937,

130885.048961563,

133555.103960379,

134789.954451596,

136919.635731932,

135303.984030295,

138668.994113128,

137934.048444329,

139037.520831883,

140658.281212221,

140735.643266887,

142826.83419019,

144131.98580102,

143087.893695877,

144975.938453194,

146237.664045553,

148297.421543634,

151518.441539562,

157068.259016273,

158041.925153915,

157520.544842832,

159372.828929639,

155456.082285864,

159762.215765183,

153920.670107944,

151996.661731595,

157386.159363274,

156794.859562546,

157026.131980401,

152516.184443792,

151326.55820513,

154306.93476898,

156808.558795455,

161078.612660014,

158775.188498976,

163828.050097767,

164174.054939574,

164131.698033399,

162359.075694639,

164891.877275475,

169483.95116572,

169009.396102456,

171189.617312177,

174082.721844753,

176799.456801862,

177555.981677517,

177413.936892175,

177344.745456787,

178490.392512438,

180457.535128318,

185340.35511382,

188141.2185603,

189495.835333934,

191211.530627048,

190663.900803332,

188528.465114334,

192449.857188713,

193315.881546062,

196058.260641674,

198626.62385608,

201208.769966209

];

// SR25 Conservative Balanced (41-59) Index

var australianPrices = [

100000,

94930,

92794.075,

92929.36876135,

91913.6507607884,

89271.1333014158,

90756.8727729512,

92821.5916285359,

93582.7286798899,

94200.3746891771,

96922.7655176944,

99547.143239617,

101556.800967338,

100845.903360567,

102065.130332196,

103626.726826279,

102424.656795094,

103155.559145984,

105509.981627932,

105642.396654875,

103782.139692179,

103089.497691874,

104649.241791952,

104795.75073046,

106432.450765369,

107553.716634182,

107294.189515943,

108543.308470288,

109465.926592286,

110516.799487571,

110848.349886034,

111191.979770681,

111193.536458398,

110648.688129752,

109871.823690393,

108730.035698602,

107232.170726818,

109466.460236082,

108820.608120689,

109001.032688953,

110886.750554472,

112405.788150318,

113820.97702313,

114242.114638116,

112859.67080888,

113198.249821307,

114240.352909162,

115725.477496981,

117113.95177599,

118031.071132347,

118537.660489647,

120158.662996843,

122370.904141278,

124181.993522569,

124107.484326456,

126341.915474269,

126733.575412239,

125760.515020224,

128581.323372128,

128847.229548861,

130048.858811634,

131848.865066446,

132527.754872673,

133880.598194413,

133336.775204548,

135439.496149523,

135073.80950992,

136006.088943157,

137243.74435254,

137611.145856171,

138810.7022146,

139902.170766113,

139219.448172775,

140668.722628253,

141737.804920228,

143189.483518221,

145529.056489425,

148526.955053107,

149239.587383452,

148657.552992657,

149580.121766529,

147306.503915678,

150215.807368012,

147303.273078954,

146187.598088654,

149286.775168133,

148759.942138565,

148878.950092276,

146844.072602415,

146256.696312005,

147807.017292912,

149203.941413348,

151815.010388081,

151179.664569607,

154211.723922215,

154515.675230066,

154490.952722029,

153548.557910425,

154439.139546305,

156925.609693001,

156800.069205246,

158273.989855776,

159983.348946218,

161747.325351699,

162476.158799734,

162313.682640934,

162318.065110365,

163064.565891808,

164048.497482399,

166894.738913719,

168563.686302856,

169128.37465197,

170117.944772059,

169790.637846318,

168924.705593301,

171061.603119057,

171708.044917244,

173330.685941711,

174735.011159211,

176290.152758528

];

// SR50 Capital Stable (20-40) Index

var internationalPrices = [

100000,

96633.6,

95482.3072896,

95701.9165963661,

95292.1209895004,

93600.6858419368,

94570.5761486309,

95931.1630276813,

96463.5809824849,

97090.5942588711,

99037.1635831672,

100894.110400352,

102435.671513159,

102189.825901527,

103197.724154394,

104229.701395938,

103781.513679935,

104396.522930002,

105868.513903315,

106196.494559388,

105324.408946066,

105250.681859804,

106349.393727738,

106907.728044809,

107893.310389654,

108659.352893421,

108535.589890475,

109403.874609599,

110235.344056632,

111040.062068245,

111450.910297898,

111885.56884806,

112204.442719277,

112041.746277334,

111827.634500198,

111477.725831847,

110871.06404787,

112279.126561278,

112071.410177139,

112507.704176959,

113959.053560842,

115098.64409645,

116105.757232294,

116745.383848887,

116292.645250321,

116649.082208013,

117626.601516916,

118690.651754238,

119818.212945903,

120561.085866168,

121012.828254908,

122209.161075037,

123633.753265688,

124898.65019535,

125044.282021477,

126707.370972363,

127030.474768342,

126297.00080703,

128146.620383849,

128304.368873542,

129229.956590595,

130422.749089927,

130918.355536468,

131985.732889157,

131960.391628442,

133345.975740541,

133345.975740541,

134119.382399836,

135125.277767835,

135564.164670025,

136445.33174038,

137251.041424307,

136959.931965446,

137968.367944508,

138803.076570572,

139843.128023315,

141529.216617892,

143435.473636519,

144067.737204308,

143788.245794132,

144333.490822183,

143063.356102948,

144839.916859035,

143246.677773585,

142705.92156499,

144668.841516116,

144379.503833084,

144534.567420201,

143652.906558938,

143574.184766143,

144860.753035833,

145909.400027059,

147628.358668778,

147730.074607901,

149680.850243098,

149980.211943584,

149990.860538632,

149420.895268585,

149719.737059123,

151276.822324538,

151428.099146862,

152351.810551658,

153433.508406575,

154586.254355233,

155281.583327323,

155272.421713907,

155398.813465182,

155934.473175196,

156473.850517909,

158255.305306056,

159374.012059264,

159654.350946477,

160276.364297764,

160200.713853816,

160016.803434311,

161074.194471405,

161513.604873923,

162562.958764789,

163395.118550706,

164277.45219088

];

// SR25 Secure (0-19) Index

var cashPrices = [

100000,

99940,

100319.772,

100712.423587608,

100903.777192424,

100918.509143895,

101126.401272731,

101328.654075276,

101514.592155505,

101778.530095109,

102171.496999806,

102590.400137505,

102949.466537987,

103162.160135854,

103496.096048214,

103734.137069125,

104024.592652918,

104368.081857858,

104691.622911617,

105010.618286629,

105285.011032212,

105623.502342681,

105993.18460088,

106413.553571007,

106743.435587077,

107117.037611632,

107405.825145033,

107737.172115605,

108178.894521279,

108579.156431008,

109013.473056732,

109446.256544767,

109873.096945292,

110147.779687655,

110455.532584103,

110748.23974545,

111030.204763842,

111407.374369425,

111697.033542786,

112061.94775137,

112484.757480236,

112862.143841582,

113297.904578954,

113649.128083149,

113993.257642985,

114317.112487949,

114676.411172498,

115080.53084547,

115506.328809598,

115910.600960432,

116232.716520501,

116633.254461631,

116957.728175543,

117261.818268799,

117536.679970821,

117881.062443136,

118146.294833633,

118237.031188065,

118554.852327899,

118783.663192892,

119089.887476603,

119399.521184042,

119593.784205008,

119868.012752191,

120130.643568131,

120370.904855267,

120613.69297036,

120875.424684106,

121141.350618411,

121414.039798653,

121733.844379482,

122017.971172264,

122172.201887826,

122431.695644636,

122703.12671388,

122975.159545804,

123296.124712219,

123548.881767879,

123792.643711607,

123954.069319007,

124160.328890354,

124223.774818417,

124467.129193286,

124546.290287453,

124616.036210014,

124891.936114183,

125019.200997083,

125157.222194984,

125319.926583838,

125474.947333022,

125725.897227688,

125980.869347265,

126245.303192025,

126525.567765112,

126816.576570971,

127043.451426457,

127199.58782826,

127326.787416088,

127385.103084725,

127597.836206876,

127814.752528428,

128032.037607726,

128236.888867899,

128451.813893641,

128670.181977261,

128790.359927227,

128991.272888714,

129197.658925336,

129332.928874231,

129645.138564533,

129862.294171629,

130007.869803395,

130171.939735087,

130243.92481776,

130348.119957615,

130553.418246548,

130719.090534303,

130934.384876413,

131160.508559094,

131383.481423645

];

// Dates

var dates = [“Sep 2008″,”Oct 2008″,”Nov 2008″,”Dec 2008″,”Jan 2009″,”Feb 2009″,”Mar 2009″,”Apr 2009″,”May 2009″,”Jun 2009″,”Jul 2009″,”Aug 2009″,”Sep 2009″,”Oct 2009″,”Nov 2009″,”Dec 2009″,”Jan 2010″,”Feb 2010″,”Mar 2010″,”Apr 2010″,”May 2010″,”Jun 2010″,”Jul 2010″,”Aug 2010″,”Sep 2010″,”Oct 2010″,”Nov 2010″,”Dec 2010″,”Jan 2011″,”Feb 2011″,”Mar 2011″,”Apr 2011″,”May 2011″,”Jun 2011″,”Jul 2011″,”Aug 2011″,”Sep 2011″,”Oct 2011″,”Nov 2011″,”Dec 2011″,”Jan 2012″,”Feb 2012″,”Mar 2012″,”Apr 2012″,”May 2012″,”Jun 2012″,”Jul 2012″,”Aug 2012″,”Sep 2012″,”Oct 2012″,”Nov 2012″,”Dec 2012″,”Jan 2013″,”Feb 2013″,”Mar 2013″,”Apr 2013″,”May 2013″,”Jun 2013″,”Jul 2013″,”Aug 2013″,”Sep 2013″,”Oct 2013″,”Nov 2013″,”Dec 2013″,”Jan 2014″,”Feb 2014″,”Mar 2014″,”Apr 2014″,”May 2014″,”Jun 2014″,”Jul 2014″,”Aug 2014″,”Sep 2014″,”Oct 2014″,”Nov 2014″,”Dec 2014″,”Jan 2015″,”Feb 2015″,”Mar 2015″,”Apr 2015″,”May 2015″,”Jun 2015″,”Jul 2015″,”Aug 2015″,”Sep 2015″,”Oct 2015″,”Nov 2015″,”Dec 2015″,”Jan 2016″,”Feb 2016″,”Mar 2016″,”Apr 2016″,”May 2016″,”Jun 2016″,”Jul 2016″,”Aug 2016″,”Sep 2016″,”Oct 2016″,”Nov 2016″,”Dec 2016″,”Jan 2017″,”Feb 2017″,”Mar 2017″,”Apr 2017″,”May 2017″,”Jun 2017″,”Jul 2017″,”Aug 2017″,”Sep 2017″,”Oct 2017″,”Nov 2017″,”Dec 2017″,”Jan 2018″,”Feb 2018″,”Mar 2018″,”Apr 2018″,”May 2018″,”Jun 2018″,”Jul 2018″,”Aug 2018”];

// All prices

var allPrices = balancedPrices.concat(growthPrices, australianPrices, internationalPrices, cashPrices);

// FUNCTIONS

var balancedPoints = calcpoints(balancedPrices, chartHeight, chartWidth);

createchart(balancedPoints, balancedPrices);

createaxes(balancedPrices);

function removeChart(){

var lines = document.getElementsByClassName(“line”);

while(lines.length > 0){

lines[0].parentNode.removeChild(lines[0]);

};

var labels = document.getElementsByClassName(“price-label”);

while(labels.length > 0){

labels[0].parentNode.removeChild(labels[0]);

};

var polyline = document.getElementById(“polyline-id”);

polyline.setAttribute(“points”, “”);

var polylineFill = document.getElementById(“polyline-fill”);

polylineFill.setAttribute(“points”, “”);

};

function report(portfolio){

if(portfolio == “balanced”){

removeChart();

createaxes(balancedPrices);

var balancedPoints = calcpoints(balancedPrices, chartHeight, chartWidth);

createchart(balancedPoints, balancedPrices);

} else if(portfolio == “growth”){

removeChart();

createaxes(growthPrices);

var growthPoints = calcpoints(growthPrices, chartHeight, chartWidth);

createchart(growthPoints, growthPrices);

} else if(portfolio == “australian”){

removeChart();

createaxes(australianPrices);

var australianPoints = calcpoints(australianPrices, chartHeight, chartWidth);

createchart(australianPoints, australianPrices);

} else if(portfolio == “international”){

removeChart();

createaxes(internationalPrices);

var internationalPoints = calcpoints(internationalPrices, chartHeight, chartWidth);

createchart(internationalPoints, internationalPrices);

} else if(portfolio == “cash”){

removeChart();

createaxes(cashPrices);

var cashPoints = calcpoints(cashPrices, chartHeight, chartWidth);

createchart(cashPoints, cashPrices);

};

};

function numberWithCommas(num){

var parts = num.toString().split(“.”);

parts[0] = parts[0].replace(/B(?=(d{3})+(?!d))/g, “,”);

return parts.join(“.”);

};

function dataconvert(prices, dates){

var data = [];

for(var i = 0; i < prices.length; i++){

var datum = {

price: prices[i],

date: dates[i]

};

data.push(datum);

};

return data;

};

function calcdollar(data, startAmt){

var oneData = [];

for(var i = 0; i < data.length; i++){

oneData.push(data[i] + 1);

};

var dollarAmts = [];

var start = startAmt;

var accum = start;

for(var i = 0; i < oneData.length; i++){

accum = oneData[i] * accum;

dollarAmts.push(accum);

};

return dollarAmts;

};

function calcpoints(prices, chartHeight, chartWidth){

var points = [];

var xPoint = 0;

var step = chartWidth / prices.length;

var max = Math.max.apply(null, allPrices);

var min = Math.min.apply(null, allPrices);

var range = max – min;

var firstInterval = range / numAxes;

var interval = 20000;

var minAxis = 60000 // startAmt – (interval * Math.ceil((startAmt – min) / interval));

var maxAxis = 220000 // minAxis + (numAxes * interval);

var axisRange = maxAxis – minAxis;

for(var i = 0; i < prices.length; i++){

if(prices[i] === maxAxis){

var yPoint = 0;

} else if(prices[i] === minAxis){

var yPoint = chartHeight;

} else {

var yPoint = ((maxAxis – prices[i]) / axisRange) * chartHeight;

}

var xandy = {

x: xPoint,

y: yPoint

};

points.push(xandy);

var xPoint = xPoint + step;

};

return points;

};

function createaxes(prices){

var max = Math.max.apply(null, allPrices);

var min = Math.min.apply(null, allPrices);

var range = max – min;

var firstInterval = range / numAxes;

var interval = 20000;

var minAxis = 60000 // startAmt – (interval * Math.ceil((startAmt – min) / interval));

var maxAxis = 220000 // minAxis + (numAxes * interval);

var axisRange = maxAxis – minAxis;

var step = chartHeight / numAxes;

var accum = step;

var d = “”;

// DRAW AXES

for(var i = 1; i minAxis; i = i – interval){

accum = accum + step;

var div = document.createElement(“div”);

div.style.position = “absolute”;

div.className = “price-label”;

div.style.left = chartWidth + 5 + “px”;

div.style.top = accum – 12 + “px”;

var commaNum = numberWithCommas(priceLabel);

div.innerHTML = “$” + commaNum;

document.getElementById(“main-chart”).appendChild(div);

priceLabel = priceLabel – interval;

};

};

function createchart(points, prices){

// DRAW CHART LINE

var pairs = [];

for(var i = 0; i < points.length; i++){

var xPoint = points[i].x;

var yPoint = points[i].y;

pairs.push(xPoint);

pairs.push(yPoint);

var chart = document.getElementById(“chart”);

var point = chart.createSVGPoint();

point.x = xPoint;

point.y = yPoint;

var polyline = document.getElementById(“polyline-id”);

polyline.points.appendItem(point);

};

// DRAW CHART FILL

for(var i = 0; i < points.length; i++){

var xPoint = points[i].x;

var yPoint = points[i].y;

pairs.push(xPoint);

pairs.push(yPoint);

var chart = document.getElementById(“chart”);

var point = chart.createSVGPoint();

point.x = xPoint;

point.y = yPoint;

var polyline = document.getElementById(“polyline-fill”);

polyline.points.appendItem(point);

};

var num = points.length – 1;

var chart = document.getElementById(“chart”);

var point = chart.createSVGPoint();

point.x = points[num].x;

point.y = chartHeight;

var polyline = document.getElementById(“polyline-fill”);

polyline.points.appendItem(point);

var chart = document.getElementById(“chart”);

var point = chart.createSVGPoint();

point.x = 0;

point.y = chartHeight;

var polyline = document.getElementById(“polyline-fill”);

polyline.points.appendItem(point);

var chart = document.getElementById(“chart”);

var point = chart.createSVGPoint();

point.x = 0;

point.y = points[0].y;

var polyline = document.getElementById(“polyline-fill”);

polyline.points.appendItem(point);

var left = 0;

var step = chartWidth / points.length;

// CREATE INTERACTIVE ELEMENTS

for(var i = 0; i < points.length; i++){

var top = points[i].y;

var div = document.createElement(“div”);

div.id = left;

div.className = “line”;

div.style.position = “absolute”;

div.style.height = chartHeight + “px”;

div.style.width = step + “px”;

div.style.left = left – (step / 2) + “px”;

div.style.top = “0px”;

document.getElementById(“chart-container”).appendChild(div);

var div = document.createElement(“div”);

div.className = “cursor”;

div.style.height = chartHeight – points[i].y + “px”;

div.style.top = chartHeight – (chartHeight – points[i].y) + “px”;

div.style.left = “2px”;

div.style.position = “absolute”;

div.style.zIndex = “2”;

document.getElementById(left).appendChild(div);

var div = document.createElement(“div”);

div.className = “dot”;

div.style.position = “absolute”;

div.style.top = points[i].y – 7 + “px”;

div.style.left = 0 – (step / 2) + “px”;

div.style.zIndex = “3”;

document.getElementById(left).appendChild(div);

var div = document.createElement(“div”);

div.className = “label-chart”;

div.style.position = “absolute”;

div.style.top = chartHeight + “px”;

div.style.left = “-50px”;

div.style.zIndex = “3”;

var num = Math.round(prices[i]);

var commaNum = numberWithCommas(num);

div.innerHTML = dates[i] + “: $” + commaNum;

document.getElementById(left).appendChild(div);

var left = left + step;

};

};