After several weeks of diplomatic tensions, over the last few days the word has watched in shock as Russia invades Ukraine. By way of background, the Ukraine was part of the former Soviet Union and gained independence from the USSR in 1991 following the gradual collapse of communism in central and eastern Europe in 1989. The recent tensions can be traced back to 1994 when the Budapest Memorandum was signed by the US, UK, Russia and the Ukraine when the Ukraine essentially agreed to give up their nuclear weapons and in return recognition of their sovereignty and ‘assurances’ of assistance should they face aggression. The west also opened the door for former Soviet states such as the Ukraine and Georgia to become members of NATO which was deemed to be unpalatable to the Russian government. Roll forward and we have seen Russian annex the Ukrainian region of Crimea in 2014 as well as making incursions into the eastern Ukrainian regions of Donetsk and Luhansk. The situation is complex and the coming days and weeks will provide us greater clarity on the direction tensions may take.

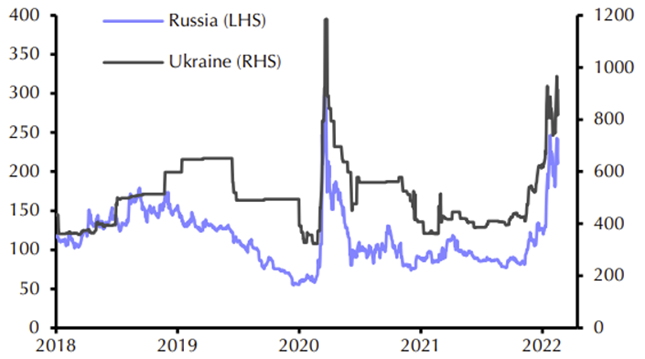

From a market perspective, we have seen markets price in the risk of a conflict with five-year credit default swaps blowing out for Russia and the Ukraine debt reflecting the additional risk for swapping out sovereign default risk. Equity markets are likely to be volatile until there is more clarity on the situation.

Russia & Ukraine 5yr Credit Default Swaps (bp)

Source: Capital Economics

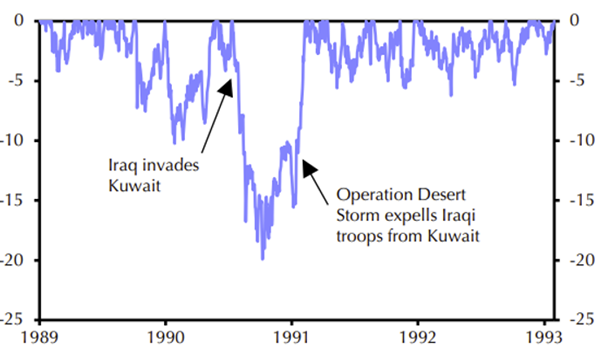

Geopolitical risks are difficult to predict and even more difficult to manage for within a portfolio context. In recent years we have seen growing tensions between China and the US, North Korea agitate, and ongoing conflicts in the Middle East, such as the Syrian conflict. Typically, markets tend to react sharply and quickly to geopolitical events. If we look at how markets reacted during the Gulf War in the early 90s when Iraq invaded Kuwait, the S&P 500 feel sharply but also recovered quickly. The chart below shows the drawdown from previous peak in the market. While every conflict is different, markets like certainty and a clear direction. Until that time, expect markets to be volatile.

S&P 500, Drawdown from previous peak (%)

Source: Capital Economics

As we see the Russia/Ukraine conflict escalate our expectation is that energy prices will increase given Russia is a large oil and gas producer and Europe relies heavily on Russian energy. A significant development has been the move to block Russian banks from the SWIFT global payments system and freeze the Bank of Russia’s reserves which are expected to severely restrict movement of capital from Russia. We also saw the decision by Germany to suspend the Nord Stream 2 gas pipeline project, a gas pipe connecting Russian gas to Germany. This is significant because Germany essentially shut down its nuclear power stations opting for gas via the new pipeline. It will be interesting to observe whether this will be a catalyst for Europe to rethink their energy sources to reduce their reliance on Russian gas.

We are monitoring the developments in the conflict and are assessing what our potential exposure is to Russia and Ukraine within the portfolios. Our portfolios remain diversified, and we hold assets such as gold and alternative assets within the portfolios which have been included to assist in managing risk. Coupled with this, we continue to assess the impact growing inflation may have on our portfolios having recently held interim investment committee meetings as new information comes to hand.

IMPORTANT NOTICE: This document is published by Lonsec Investment Solutions Pty Ltd ACN 608 837 583, a Corporate Authorised Representative (CAR 1236821) (LIS) of Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec Research). LIS creates the model portfolios it distributes using the investment research provided by Lonsec Research but LIS has not had any involvement in the investment research process for Lonsec Research. LIS and Lonsec Research are owned by Lonsec Holdings Pty Ltd ACN 151 235 406. Please read the following before making any investment decision about any financial product mentioned in this document.

DISCLOSURE AT THE DATE OF PUBLICATION: Lonsec Research receives a fee from the relevant fund manager or product issuer(s) for researching financial products (using objective criteria) which may be referred to in this document. Lonsec Research may also receive a fee from the fund manager or product issuer(s) for subscribing to research content and other Lonsec Research services. LIS receives a fee for providing the model portfolios to financial services organisations and professionals. LIS’ and Lonsec Research’s fees are not linked to the financial product rating(s) outcome or the inclusion of the financial product(s) in model portfolios. LIS and Lonsec Research and their representatives and/or their associates may hold any financial product(s) referred to in this document, but details of these holdings are not known to the Lonsec Research analyst(s).

WARNINGS: Past performance is not a reliable indicator of future performance. Any express or implied rating or advice presented in this document is limited to general advice and based solely on consideration of the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (“financial circumstances”) of any particular person. Before making an investment decision based on the rating or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances or should seek independent financial advice on its appropriateness. If the financial advice relates to the acquisition or possible acquisition of a particular financial product, the reader should obtain and consider the Investment Statement or the Product Disclosure Statement for each financial product before making any decision about whether to acquire the financial product.

DISCLAIMER: No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by LIS. The information contained in this document is current as at the date of publication. Financial conclusions, ratings and advice are reasonably held at the time of publication but subject to change without notice. LIS assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, LIS and Lonsec Research, their directors, officers, employees and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from, this document or any loss or damage suffered by the reader or any other person as a consequence of relying upon it.

Copyright © 2022 Lonsec Investment Solutions Pty Ltd ACN 608 837 583 (LIS). This document may also contain third party supplied material that is subject to copyright. The same restrictions that apply to LIS copyrighted material, apply to such third-party content.