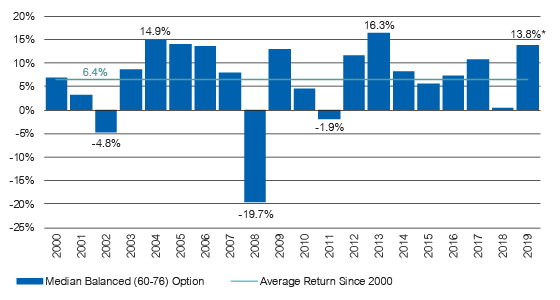

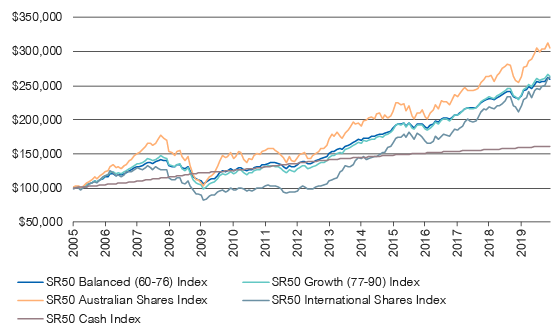

November was the strongest month for superannuation in 2020 and the 8th consecutive month of positive returns for members.

As COVID-19 restrictions ease nation-wide and investors look forward to the approval and distribution of a vaccine, share markets globally have pushed to record highs, delivering windfall gains for super members.

According to estimates from leading superannuation research house SuperRatings, the median balanced option returned 4.9% in November as members enjoyed an early Christmas gift that has put them back into the black over the course of a volatile and uncertain year.

Since the start of 2020 the median balanced option has delivered 2.3% and is on track to finish the year in positive territory. Super has bounced back strongly in the second half of the year, returning 7.5% from the start of July to the end of November, reversing the large falls back in February and March.

According to SuperRatings data, the median growth option returned an estimated 6.2% in November and 2.4% over the calendar year, while the median capital stable option returned an estimated 2.0% in November and 1.7% over the calendar year.

“We’ve had a watershed month for super and hopefully this strong performance can continue through to the new year,” said SuperRatings Executive Director Kirby Rappell.

“Given the world is battling a pandemic that has resulted in large sections of the economy being placed in lockdown, the results are remarkable. This is the year super proved its worth once again and reminded us why it is so critical to our economic success.”

Accumulation returns to end of November 2020

| CYTD | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a.) | 7 yrs (p.a.) | 10 yrs (p.a) | |

|---|---|---|---|---|---|---|

| SR50 Growth (77-90) Index | 2.4% | 2.4% | 6.6% | 7.9% | 8.0% | 8.4% |

| SR50 Balanced (60-76) Index | 2.3% | 2.2% | 5.8% | 7.1% | 7.3% | 7.9% |

| SR50 Capital Stable (20-40) Index | 1.7% | 1.5% | 3.8% | 4.3% | 4.6% | 5.1% |

Source: SuperRatings estimates

Pension returns had a similarly strong month. The median balanced pension option rose an estimated 5.4% in November and 2.6% over the calendar year. The median pension growth option rose an estimated 6.8% in November and 2.6% over the calendar year, and the median capital stable pension option returned an estimated 2.3% in November and 2.0% over the calendar year.

Pension returns to end of November 2020

| CYTD | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a.) | 7 yrs (p.a.) | 10 yrs (p.a) | |

|---|---|---|---|---|---|---|

| SRP50 Growth (77-90) Index | 2.6% | 2.6% | 7.3% | 8.7% | 8.9% | 9.3% |

| SRP50 Balanced (60-76) Index | 2.6% | 2.4% | 6.6% | 7.8% | 7.9% | 8.5% |

| SRP50 Capital Stable (20-40) Index | 2.0% | 1.7% | 4.4% | 5.0% | 5.2% | 5.9% |

Source: SuperRatings estimates

The global recovery is underway and is looking sufficiently V-shaped, but recent economic news has been mixed. Infection rates have risen in the US and Europe, causing a loss of momentum, but news of successful vaccine trials have boosted confidence.

The UK has begun rolling out the Pfizer-BioNTech vaccine, while Australia and the US are preparing to do the same once the vaccine is approved. Meanwhile, China has ramped up its trade conflict with Australia, putting tariffs of up to 200% on Australian wine and suspending the importation of Australian beef, barley and timber.

“Australia’s success in containing the coronavirus has put us in an enviable position, but there are still significant risks at play. The pandemic is not yet defeated and there are geopolitical issues weighing on the outlook. Members should be optimistic but prepare themselves for potential surprises as we head into 2021.”

Release ends

Warnings: Past performance is not a reliable indicator of future performance. Any express or implied rating or advice presented in this document is limited to “General Advice” (as defined in the Corporations Act 2001(Cth)) and based solely on consideration of the merits of the superannuation or pension financial product(s) alone, without taking into account the objectives, financial situation or particular needs (‘financial circumstances’) of any particular person. Before making an investment decision based on the rating(s) or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances, or should seek independent financial advice on its appropriateness. If SuperRatings advice relates to the acquisition or possible acquisition of particular financial product(s), the reader should obtain and consider the Product Disclosure Statement for each superannuation or pension financial product before making any decision about whether to acquire a financial product. SuperRatings research process relies upon the participation of the superannuation fund or product issuer(s). Should the superannuation fund or product issuer(s) no longer be an active participant in SuperRatings research process, SuperRatings reserves the right to withdraw the rating and document at any time and discontinue future coverage of the superannuation and pension financial product(s).

Copyright © 2020 SuperRatings Pty Ltd (ABN 95 100 192 283 AFSL No. 311880 (SuperRatings)). This media release is subject to the copyright of SuperRatings. Except for the temporary copy held in a computer’s cache and a single permanent copy for your personal reference or other than as permitted under the Copyright Act 1968 (Cth.), no part of this media release may, in any form or by any means (electronic, mechanical, micro-copying, photocopying, recording or otherwise), be reproduced, stored or transmitted without the prior written permission of SuperRatings. This media release may also contain third party supplied material that is subject to copyright. Any such material is the intellectual property of that third party or its content providers. The same restrictions applying above to SuperRatings copyrighted material, applies to such third party content.