After a decade of record-low bond yields, fixed income has been making a comeback this year. In Australia, when advisers and investors think of fixed income, they mostly think of term deposits and government bonds, but corporate bonds also make up a significant portion of the global bond market. The global bond market is massive – bigger than the global share market – with different grades of issuers, companies, terms, and structures.

Bond fundamentals

Before we look at the outlook for the corporate bond market, here are some bond fundamentals for you and your clients:

- Bonds are credit instruments – companies and governments issue bonds as a way of raising money, borrowing funds from investors in the form of bonds.

- Bonds are usually issued for a fixed term – between one and thirty years. Maturity is the term for which the bond is issued.

- When you purchase a bond, the bond issuer is legally obliged to pay you regular interest, referred to as coupons. Coupons are usually set at a fixed rate, paid to the bond holder at regular intervals. This is why they are also called fixed income.

- Bonds are issued with a face value that is to be repaid to the bondholder at maturity. The full face value is referred to as Par and is usually $100.

- As interest rates go up, bond prices decline. This is because interest rates are used to discount the bond cash flows to arrive at the bond’s price. So, if the denominator goes up and the coupon which is the numerator remains fixed, the prices will decline.

- Duration and Maturity are not the same thing. When we talk about Duration, we talk about the sensitivity of the bond prices to interest rates. Generally, bonds with long maturities and low coupons have the longest durations. These bonds are more sensitive to a change in market interest rates and thus are more volatile in a changing rate environment.

- Corporate Bonds carry a rating from one of three big ratings agencies – S&P Global, Moody’s, and Fitch. Investment-grade bonds (with a rating of BBB-/Baa3 and above) have relatively lower risk and lower returns as they have a stronger payment capacity compared to High Yield or below-Investment grade bonds.

- It is important to remember that, unlike government bonds, corporate bonds do not carry the guarantee of a government and therefore investors’ money is at risk. However, corporate bonds have a lower risk than shares in the same company as they sit higher on the capital preservation ladder. This means that if your bond issuer becomes insolvent, you will have priority over hybrid and equity investors when the proceeds of asset sales are applied.

Outlook for the corporate bond market

We see two major factors impacting the short to mid-term outlook for corporate bonds – ongoing stress from higher interest rates and the cost of refinancing.

Ongoing stress from higher interest rates

Central banks are close to the end of their current hiking cycle but this “higher for longer” mantra may be a cause of ongoing stress for some corporate bonds. While in most cases, a pause in rate rises is good for risk assets with an initial rally as they have a stronger payment capacity, this time, the current economic landscape is not conducive to a sustained rally.

We are faced with credit tightening, banking client concerns, sticky inflation, and yield curves that have flattened locally and deeply inverted in the USA. An inverted yield curve is unusual and does not happen often which means that the yield on shorter maturity bonds is higher than longer maturity bonds.

In addition, lower-quality corporate bond issuers such as high-yield corporate bonds are at a higher risk of default because higher interest rates will mean they will need operational revenues and minimal cost increases in order to cover interest costs. With corporate debt maturities coming up within the next year, many of these issuers are going to find it difficult to roll over or even refinance their debt obligations.

Cost of refinancing

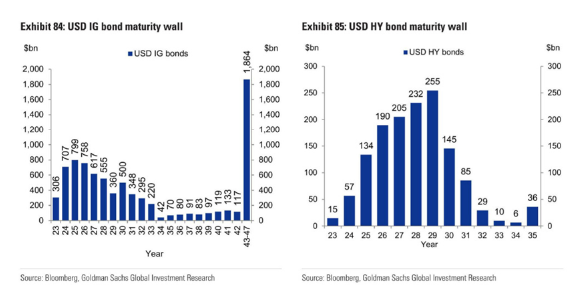

The bond maturity wall for US Corporate Bonds has been pushed out by several years, especially for high-yield bonds, making refinancing manageable for now. However, if the US Federal Reserve keeps rates higher for an extended period of time, there is a lot of debt that will need to be refinanced at higher levels than most of these companies have ever seen, or at least experienced in decades. It is worth noting that Australian companies do issue a lot of debt in the US market. This may have an effect here whereby the cost of refinancing may see Australian corporates return to Australia to refinance their debt thereby pushing up domestic corporate credit yields.

USD bond maturity wall

Allied to the bonds maturity wall, the global tightening of bank lending standards will have a knock-on effect for lower grade bonds wanting to refinance. We expect lending standards to remain tight into the next year so if these lower-grade borrowers can’t raise funds in the corporate bond market to refinance their bonds, turning to banks will not be much of an option.

Major US investment banks expect High Yield defaults to revert to the long-run average. of around 4% to 5%, lower than previous crisis/recession levels and higher than current levels of less than around 1%. This may also cause, a longer period of defaults, particularly if the US Federal Reserve decided to hold rates higher for longer.

In summary, the outlook for corporate bonds in a higher for longer rate cycle and the credit-tightening environment now has elevated risks but you are now being compensated with much higher running yields. For example, in a two-year US high-yield corporate bond the yield is now approximately 8.88%*, made up of 4.98% government bond yield plus 3.90% spread. The long-term high yield spread average is 5.4% and for recessionary periods 8% above government bond yields. Given current corporate credit fundamentals, spreads are expected to at least move back toward their historical long-term average.

*as at 6 July 2023

IMPORTANT NOTICE: This document is published by Lonsec Investment Solutions Pty Ltd ACN 608 837 583, a Corporate Authorised Representative (CAR 1236821) (LIS) of Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec Research). LIS creates the model portfolios it distributes using the investment research provided by Lonsec Research but LIS has not had any involvement in the investment research process for Lonsec Research. LIS and Lonsec Research are owned by Lonsec Holdings Pty Ltd ACN 151 235 406. Please read the following before making any investment decision about any financial product mentioned in this document.

DISCLOSURE AT THE DATE OF PUBLICATION: Lonsec Research receives a fee from the relevant fund manager or product issuer(s) for researching financial products (using objective criteria) which may be referred to in this document. Lonsec Research may also receive a fee from the fund manager or product issuer(s) for subscribing to research content and other Lonsec Research services. LIS receives a fee for providing the model portfolios to financial services organisations and professionals. LIS’ and Lonsec Research’s fees are not linked to the financial product rating(s) outcome or the inclusion of the financial product(s) in model portfolios. LIS and Lonsec Research and their representatives and/or their associates may hold any financial product(s) referred to in this document, but details of these holdings are not known to the Lonsec Research analyst(s).

WARNINGS: Past performance is not a reliable indicator of future performance. Any express or implied rating or advice presented in this document is limited to general advice and based solely on consideration of the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (“financial circumstances”) of any particular person. Before making an investment decision based on the rating or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances or should seek independent financial advice on its appropriateness. If the financial advice relates to the acquisition or possible acquisition of a particular financial product, the reader should obtain and consider the Investment Statement or the Product Disclosure Statement for each financial product before making any decision about whether to acquire the financial product.

DISCLAIMER: No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by LIS. The information contained in this document is current as at the date of publication. Financial conclusions, ratings and advice are reasonably held at the time of publication but subject to change without notice. LIS assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, LIS and Lonsec Research, their directors, officers, employees and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from, this document or any loss or damage suffered by the reader or any other person as a consequence of relying upon it.

Copyright © 2023 Lonsec Investment Solutions Pty Ltd ACN 608 837 583 (LIS). This document may also contain third party supplied material that is subject to copyright. The same restrictions that apply to LIS copyrighted material, apply to such third-party content.