Following Lonsec’s Asset Allocation Investment Committee meeting in June, we asked Chief Investment Officer Lukasz de Pourbaix to give us an update on his views of the current market drivers and challenges, and how these impacted Lonsec’s latest dynamic asset allocation views.

The main topic of discussion at this meeting was inflation – is it transitory or are we seeing a structural shift up in inflation? Lonsec’s current view is that whilst inflation will continue to rise in the short-term, after that, it’s still questionable whether we will see a structural rise in inflation. One of the other matters we’re focused on is wage growth. We have not seen a material rise in wages, which is important in the context of looking at inflation.

As part of our dynamic asset allocation process, we also look at a number of key factors: valuation (are assets cheap or expensive), where we are in the business cycle, and policy (such as monetary policy) and liquidity. In this video, Lukasz looks into each of these factors and explains how these were considered to determine Lonsec’s current asset allocation

Transcript

Inflation and its implication for asset allocation

Hello, my name is Lukasz de Pourbaix, I’m the CIO of Lonsec Investment Solutions. Today, I’ll be providing an update on our latest takeouts from our asset allocation Investment Committee, which is responsible for our dynamic asset allocation views. Now we hold that committee every quarter.

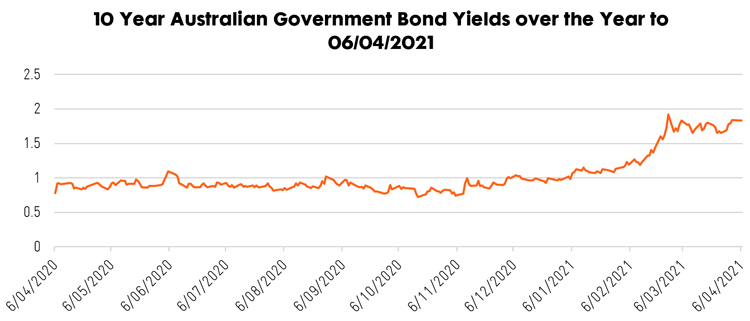

The main topic, really this investment committee was inflation, and whether inflation is transitory in nature, or whether we are seeing a structural shift up in inflation. And certainly, we’ve seen CPI numbers go up, most recently in the US announced the significant jump in CPI to levels we haven’t seen since 2008. And so, as part of that discussion, part of the narrative was, is this driven by supply/demand issues as a result of COVID? Or is there genuinely an inflation increase? And it’s fair to say that the market at the moment does believe that it’s transitory in nature, we are seeing significant disruptions to supply chains, which has impacted a range of assets. If you look at things like some of the commodities, Lumber (LBS), the one that suddenly is sort of focused on, through the microchips to make computers, mobile phones, etc. We’ve seen prices certainly spike up in a lot of these areas. And our view would be that once we get spending come back to pre-COVID levels, inflation will continue to rise in the short term, but after that, it’s still questionable whether we will see structural rise inflation.

Our base case at the moment is that it is likely to be transitory in nature, but that it will rise in the shorter term. One of the other aspects that we’re certainly focused on in that context is wage growth. Today, we haven’t seen a material rise in wage growth. It is a lagging indicator. However, it is important in the context of looking at inflation and while we have seen pockets of rises in wage growth, if anyone’s been out to try to hire staff in places like cafes, restaurants, fruit pickers, we all know that there’s shortages there, but across the board, we haven’t seen wage growth right rise and certainly that would be an area that we would be keen to focus on.

What changes were made in June to Lonsec’s Asset Allocation positions?

As part of our dynamic asset allocation process, we look at a couple of key factors that we think determine the direction of where different asset prices will go into the future. And those are valuation – so are assets cheap or expensive. Where are we in the business cycle, and then policy and liquidity.

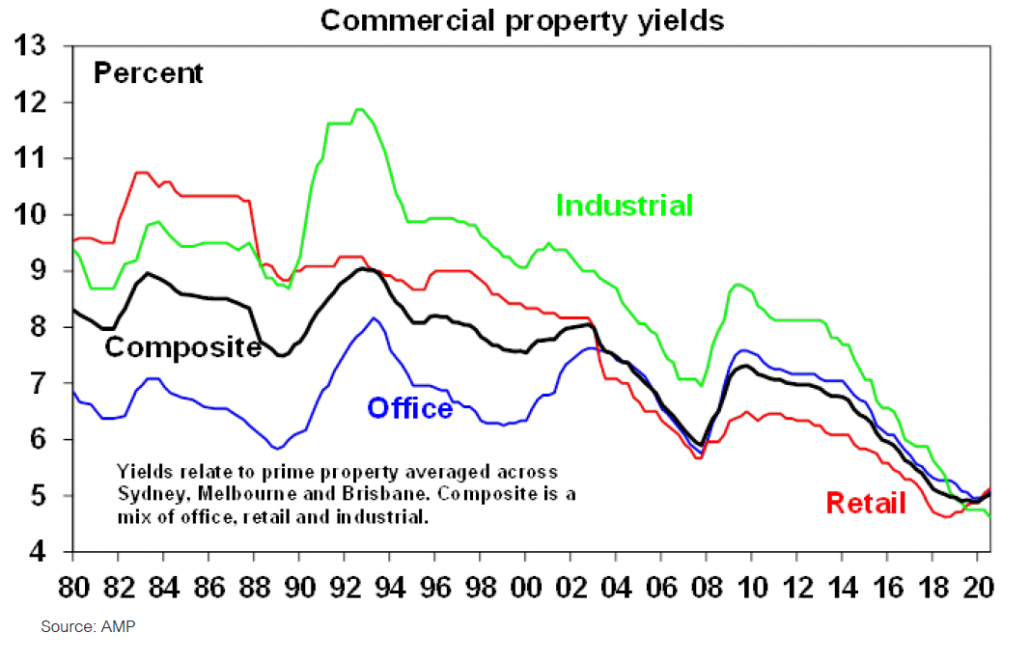

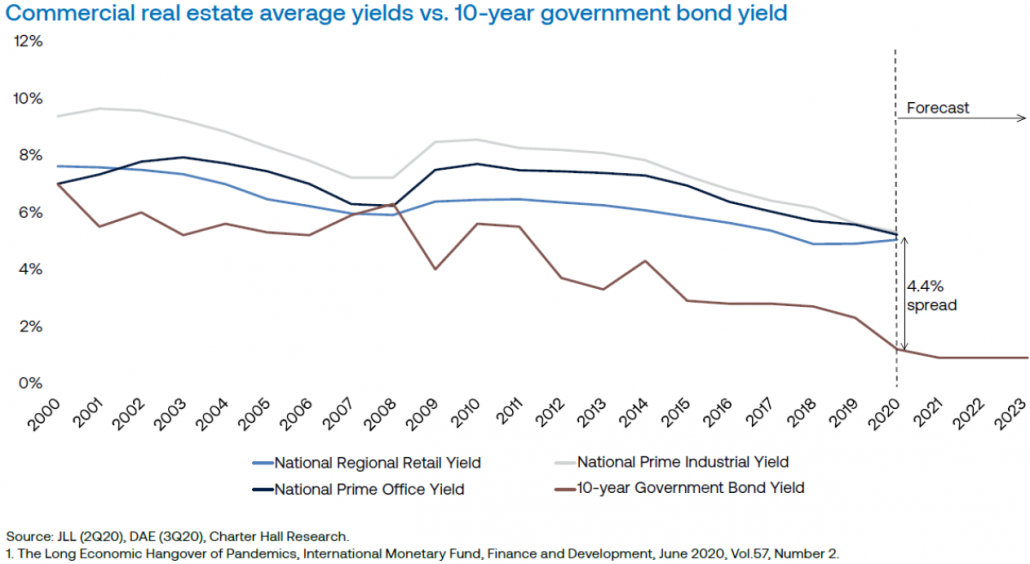

If we take those three metrics in isolation, from a valuation perspective, it’s probably fair to say that most assets from an absolute perspective look pretty expensive. However, we are in the game of allocating capital. And so we have to look at things from a relative perspective. If we look at asset classes, from a relative perspective, we’ve continued to think that risk assets such as equities are favorable compared to things like bonds and cash, where know there’s you’re getting little reward for that risk. From an equity perspective, we probably have a bias towards emerging markets and Australian equities over some developed markets, particularly the US, from a pure valuation perspective. So overall picture is that from a relative perspective, risk assets are still looking attractive, you’re still being rewarded for risk from a valuation perspective. If you look at other indicators, and one of those is cyclical indicators – so where are we in the cycle? Cyclical indicators continue to look positive. A lot of economic data that’s been coming out, whether it’s looking at PMIs, whether it’s looking at job growth, all of them pointing in the right direction.

From our economic perspective, we’ve clearly seen a recovery and continue to see a recovery, those indicators are looking positive. Finally, from a policy perspective, if we think about monetary policy, and my earlier reference to inflation, the two are obviously related. Policy, however, does remain supportive of risk assets, interest rates remain low. Central Banks, in our view, aren’t going to pull the trigger anytime soon. They will want to see evidence of growth, and more evidence that if this inflationary environment is transitory, they’ll probably be a bit more standoffish in pulling the trigger on rates. But as it is at the moment, that environment in terms of policy does remain supportive of risk assets. We are also seeing material fiscal support. So net net if you think about those longer-term indicators, such as valuation, which is very much longer term indicator is supportive of risk assets. The policy settings continue to be supportive of risk assets. And then obviously, liquidity is there supporting markets as well, all things pointing to risk assets from an overall directional perspective, we do like risk assets over some of the more defensive assets. Having said that, we do think we’re in an environment where we are seeing a lot more dispersion between returns within asset classes. We do think that being selective within asset classes, be it equities or bonds, is becoming much more important. And we do think that dispersion between winners and losers will be wider going forward than it has been in the past.

Overall, the outcome of our dynamic asset allocation committee has been to make no change at this point. From our last quarter, we do remain positive on risk assets, underweight, Fixed Income, underweight Cash, we continue to have a neutral position to Alternatives. We are looking at if there are others? Potentially at some point, do we review that allocation to alternatives? Do we potentially increase that? From a portfolio perspective, we already have some exposure. Some of you will note will have we’ve had exposure to Gold, which has seen a significant increase in price over recent months. And if we do see that inflationary environment be more than just transitory those type of assets can contribute to helping protect the portfolio in that environment. So overall, there are some risks out there. Some inflation is probably the number one risk at the moment. But net net, we think that the environment is still conducive to risk assets.

IMPORTANT NOTICE: This document is published by Lonsec Investment Solutions Pty Ltd ACN 608 837 583, a Corporate Authorised Representative (CAR 1236821) (LIS) of Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec Research). LIS creates the model portfolios it distributes using the investment research provided by Lonsec Research but LIS has not had any involvement in the investment research process for Lonsec Research. LIS and Lonsec Research are owned by Lonsec Holdings Pty Ltd ACN 151 235 406. Please read the following before making any investment decision about any financial product mentioned in this document.

DISCLOSURE AT THE DATE OF PUBLICATION: Lonsec Research receives a fee from the relevant fund manager or product issuer(s) for researching financial products (using objective criteria) which may be referred to in this document. Lonsec Research may also receive a fee from the fund manager or product issuer(s) for subscribing to research content and other Lonsec Research services. LIS receives a fee for providing the model portfolios to financial services organisations and professionals. LIS’ and Lonsec Research’s fees are not linked to the financial product rating(s) outcome or the inclusion of the financial product(s) in model portfolios. LIS and Lonsec Research and their representatives and/or their associates may hold any financial product(s) referred to in this document, but details of these holdings are not known to the Lonsec Research analyst(s).

WARNINGS: Past performance is not a reliable indicator of future performance. Any express or implied rating or advice presented in this document is limited to general advice and based solely on consideration of the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (“financial circumstances”) of any particular person. Before making an investment decision based on the rating or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances or should seek independent financial advice on its appropriateness. If the financial advice relates to the acquisition or possible acquisition of a particular financial product, the reader should obtain and consider the Investment Statement or the Product Disclosure Statement for each financial product before making any decision about whether to acquire the financial product.

DISCLAIMER: No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document, which is drawn from public information not verified by LIS. The information contained in this document is current as at the date of publication. Financial conclusions, ratings and advice are reasonably held at the time of publication but subject to change without notice. LIS assumes no obligation to update this document following publication. Except for any liability which cannot be excluded, LIS and Lonsec Research, their directors, officers, employees and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from, this document or any loss or damage suffered by the reader or any other person as a consequence of relying upon it.

Copyright © 2021 Lonsec Investment Solutions Pty Ltd ACN 608 837 583 (LIS). This document may also contain third party supplied material that is subject to copyright. The same restrictions that apply to LIS copyrighted material, apply to such third-party content.